When a family loses its breadwinner, financial uncertainty often deepens the emotional toll — especially in regions where conventional life insurance is misunderstood, inaccessible, or incompatible with religious values. That gap is exactly what Takadao, a Saudi-founded Web3 fintech, aims to bridge.

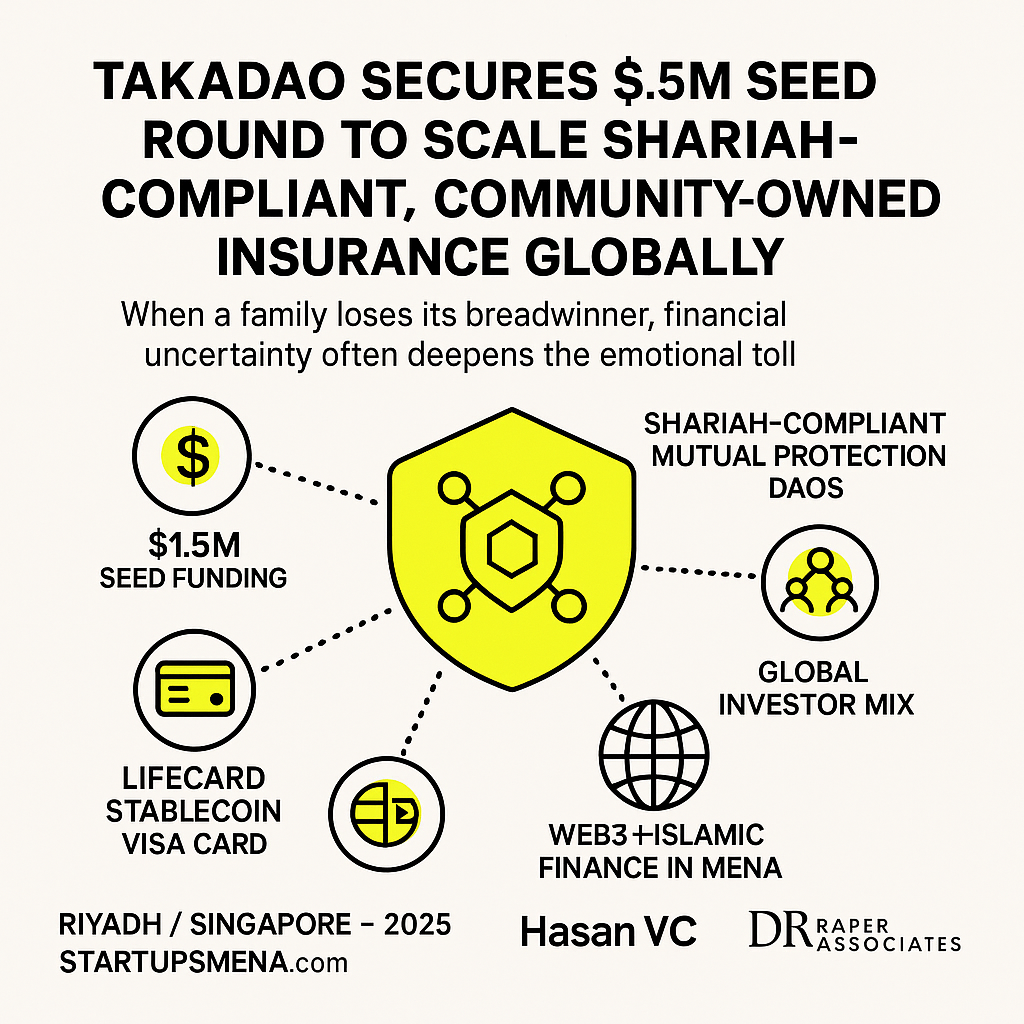

The company has raised $1.5 million in seed funding, bringing its total capital to approximately $3.1 million, as it accelerates its mission to build community-owned, Shariah-compliant protection products powered by blockchain. The round comes alongside the launch of LifeCard, a new product allowing users to spend stablecoins anywhere Visa is accepted.

A Global Round Backing a Saudi-Born Vision

Takadao is headquartered in Riyadh with operations in Singapore, supported by a distributed team across more than 20 countries. Its latest seed round attracted a global roster of investors, including:

- Hasan VC (Malaysia)

- Syla Invest (France)

- Wahed Ventures (UK)

- Ice Blue Fund (Japan)

- Istari Ventures (US)

- Adverse (Saudi Arabia)

- Draper Associates (US)

The global mix reflects a rising appetite for Shariah-compliant, blockchain-enabled financial products — particularly those originating from the GCC.

Reinventing Insurance Through Shariah-Compliant DAOs

At the heart of Takadao’s mission is a simple but radical idea: people can insure one another directly through mutual protection DAOs (tDAOs), eliminating the opacity, fees, and profit-first incentives of traditional insurance companies.

Takadao’s model is built on three pillars:

1. Shariah-Compliant Mutual Protection

Drawing on the Islamic concept of takaful, community members contribute to a shared fund that supports beneficiaries in times of need.

2. Community Governance

There is no central insurer. Members vote on rules, payouts, and surplus distribution.

3. On-Chain Transparency

Smart contracts manage the fund, enforce rules, automate payouts, and provide full transparency into how money moves.

Its flagship product, The LifeDAO (TLD), offers a blockchain-based, ethical alternative to life insurance — designed for millions of underinsured Muslims globally.

LifeCard: Turning Stablecoins Into Everyday Money

In parallel with the funding announcement, Takadao introduced LifeCard, a prepaid Visa card enabling users to spend stablecoins like USDC at any Visa-accepting merchant worldwide.

LifeCard aims to solve one of the biggest frictions in crypto adoption: real-world usability. For users, it offers:

- Everyday spending using stablecoins

- Seamless linking between mutual protection pools and financial transactions

- A bridge between blockchain-native assets and traditional payment rails

This dual offering — mutual protection plus spendability — positions Takadao as one of the first Islamic fintechs merging Web3 infrastructure with daily financial behavior.

A Turning Point for Web3 and Islamic Finance in MENA

The Islamic finance market is valued in the trillions, yet Shariah-compliant insurance options remain limited. Takadao’s approach hits a sweet spot:

- A religiously aligned, ethical model

- Delivered in a digital-first, globally accessible format

- Built using transparent, programmable blockchain rails

For the MENA region, Takadao’s rise reflects a broader trend: Saudi Arabia’s increasing position as a hub for Web3, fintech, and Islamic digital finance. The company’s seed round is more than capital — it signals global validation that faith-aligned financial products can sit at the frontier of innovation, not behind it.

What Comes Next

With its new funding, Takadao plans to:

- Scale The LifeDAO globally

- Introduce more tDAOs, including HealthDAO, HouseDAO, AgriDAO, and TravelDAO

- Expand partnerships across blockchain ecosystems and Islamic finance institutions

- Grow LifeCard’s footprint to integrate crypto spending into everyday transactions

If successful, Takadao won’t just build a product — it could redefine how communities pool risk, build wealth, and support one another across borders.

Editor’s Note — The Startups MENA Team

At Startups MENA, we focus on the narratives shaping how the region builds its next-generation financial and innovation infrastructure. Takadao’s $1.5M seed round marks more than a funding milestone — it represents a pivotal moment in the evolution of Islamic finance, community ownership, and Web3.

By blending takaful principles with decentralized governance and real-world financial tools like Visa-enabled stablecoin spending, Takadao challenges the notion that Shariah-compliant finance must be traditional or conservative. Instead, it shows that ethical, faith-aligned financial systems can thrive at the cutting edge of technology.

As Saudi Arabia and the wider MENA region accelerate toward ambitious 2030 visions, the shift is no longer about integrating into global financial systems — but about designing new ones. Takadao is part of a growing wave of ventures building those systems from the ground up, rooted in regional values yet ready for global impact.

— The Startups MENA Editorial Team