When the founders of ifood.jo and POSRocket decided to return to restaurant tech, they didn’t come back with another delivery app or POS system.

They came back with capital.

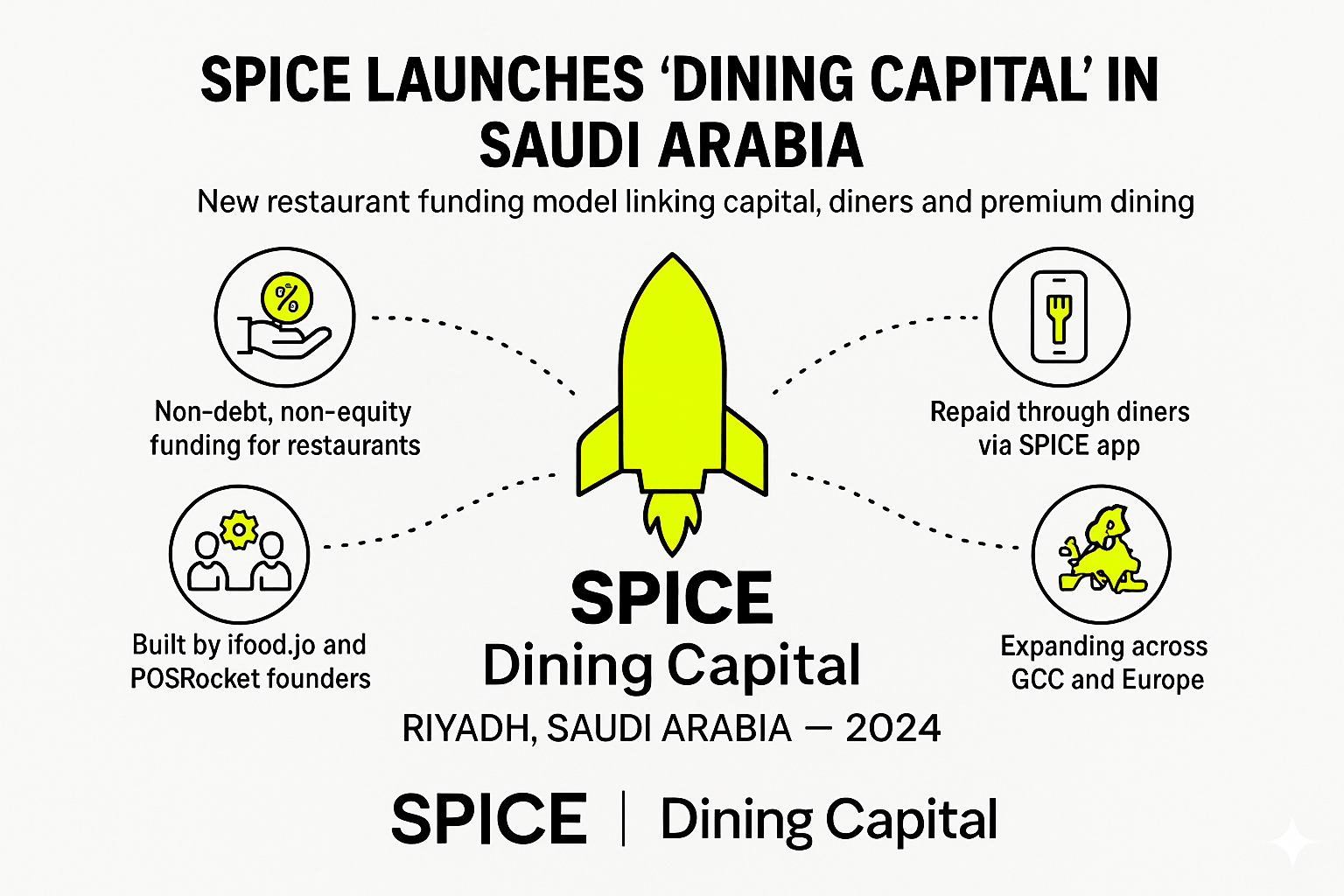

SPICE, a new premium dining and restaurant-tech platform founded by Zeid Husban, Wadi Hawi, and Yousef Sawalha, has officially launched in Saudi Arabia with a bold promise: to change how restaurants across the GCC access growth funding and how diners discover premium places to eat.

At the heart of the launch is a new model the company calls “Dining Capital” — upfront, non-debt, non-equity funding that restaurants repay through diners, not bank loans or ownership dilution.

A Third Act for MENA’s Restaurant-Tech Veterans

SPICE is the founding team’s third venture in restaurant technology — and arguably its most ambitious.

- In 2016, they exited ifood.jo to Delivery Hero, after building it into a leading online food ordering platform.

- In 2022, they sold POSRocket, a cloud POS for restaurants, to Saudi-headquartered Foodics.

Between these two exits, the team spent more than 15 years building tools, integrations, and infrastructure for thousands of restaurants around the region.

This time, they say they’re going upstream — from tools that help restaurants operate to a model that reshapes how restaurants grow in the first place.

“We’ve spent over 15 years building technology for restaurants,” says Zeid Husban, co-founder and CEO. “This time, we’re transforming the economics of how restaurants grow and redefining how they’re financed. We’re building the top-of-mind destination for dining out—a platform that owns the entire journey from discovery to experience.”

What ‘Dining Capital’ Actually Is

SPICE describes Dining Capital as a new category for the region — a funding model designed specifically for restaurants rather than adapted from generic SME finance.

In simple terms:

- Upfront capital: Restaurants receive funding to expand, refurbish, hire, or launch new concepts.

- Non-dilutive and non-debt: There’s no equity handed over and no traditional bank loan sitting on the balance sheet.

- Repaid through diners: The capital is repaid through diners, not through fixed loan instalments or equity dividends.

Paired with this capital is SPICE’s premium app, which is built to drive high-value guests to partner venues — the same guests whose spending helps restaurants grow and, in turn, underpins SPICE’s model.

SPICE pitches Dining Capital as a first-of-its-kind model in MENA, designed to:

- Align incentives across financiers, operators, and diners

- Deliver better returns than traditional financing or one-off marketing campaigns

- Let restaurants grow faster while staying independent

“Restaurants need a partner who shares their risk and success,” Husban says. “SPICE delivers capital designed to scale naturally and sustainably with their business. Restaurants grow faster, stay independent, and build lasting relationships while diners enjoy premium experiences and earn rewards.”

The App at the Center of the Model

SPICE isn’t just a fund — it’s a consumer-facing app aimed at diners who want more from going out than just a table and a bill.

The app is built to:

- Showcase curated, partner restaurants rather than a long, undifferentiated list

- Simplify reservations at premium and experience-driven venues

- Use AI plus human curation to recommend the right place based on each diner’s preferences and context

- Offer exclusive rewards and experiences to loyal guests

On the product side, CTO Yousef Sawalha is focused on making the app feel “personal, local, and seamlessly aligned with how people dine and connect”, using AI layered with human judgment.

“Dining today is emotion, expression, and culture,” he says. “The app learns your preferences and adapts to context, making every choice feel intuitive and every experience more rewarding.”

To maintain that sense of curation, the SPICE app will launch on an invite-only basis, gradually opening access as the restaurant network in Saudi Arabia scales.

Why Saudi Arabia Is the First Testbed

For its debut, SPICE chose Saudi Arabia — a decision that’s as much about timing as it is about geography.

The founders describe Saudi as one of the region’s most rapidly evolving markets, a country embracing innovation, creativity, and investment at remarkable speed and leading the region’s next wave of hospitality growth.

That confidence is anchored in macro shifts:

- Saudi Arabia has already surpassed its original Vision 2030 goal of attracting 100 million visitors per year, hitting that target years ahead of schedule.

- Tourism revenues are climbing, with the sector contributing a growing share to GDP and a new target of 150 million visitors annually by 2030.

In that context, restaurants aren’t just small businesses — they’re critical infrastructure for a tourism-driven, experience-led economy.

“Saudi is leading the region’s next wave of hospitality growth,” Husban notes. “I came back because I believed in this market and admired its people, their ambition, generosity, and belief that great things can be built here.”

Aligning Diners, Restaurants and Capital

Traditional restaurant economics in MENA often look like this:

- Banks demand collateral and fixed repayments, regardless of seasonality or shocks.

- Equity investors push for rapid scaling and eventual exits, which may not suit every operator.

- Delivery platforms and aggregators generate orders and visibility, but take a cut without directly sharing downside risk.

SPICE is trying to position itself differently: as a “by operators, for operators” partner that shares both the risk and the upside.

Co-founder and COO Wadi Hawi frames it as an answer born from experience:

“Only SPICE could build this, because we’ve lived it,” he says. “We’ve seen the highs, the struggles, and the passion behind every great restaurant. This is our way of giving back to the industry that shaped us.”

That operator-first mindset underpins three key design decisions:

- Specialised capital – tailored to restaurant realities instead of generic SME templates

- Curated demand – not just more customers, but the right guests, at the right price point

- Aligned incentives – SPICE succeeds when restaurants grow sustainably, not just when they sign up

The company has also secured backing from leading regional hospitality and tech investors who share the vision of transforming restaurant economics across MENA, though individual investors and ticket sizes have not yet been disclosed.

From Riyadh to the GCC – and Beyond

SPICE’s Saudi launch is a starting point, not the endgame.

According to the company:

- Founding restaurant partners in Riyadh’s upscale dining scene are expected to be announced as the platform gains momentum in the capital.

- Restaurant partnerships are already opening across Riyadh and the broader Saudi market, as SPICE lines up venues that fit its premium positioning.

- Over the next two years, the company plans to expand into the UAE, the rest of the GCC, and Europe, turning Dining Capital from a Saudi pilot into a cross-border asset class.

If SPICE executes, the impact could be significant:

- For restaurants, a new, non-dilutive way to finance growth while staying independent

- For diners, a curated, loyalty-driven alternative to generic platforms

- For investors, a structured way to participate in the upside of the region’s hospitality boom

In a Saudi market that has already hit major tourism milestones ahead of schedule and is now targeting 150 million annual visitors, SPICE is betting that the next big innovation won’t just be in where people dine, but how those dining experiences are funded.

Editor’s Note — From the Startups MENA Team

At Startups MENA, we pay close attention to sectors where lifestyle, infrastructure, and capital intersect. SPICE’s launch in Saudi Arabia sits at that exact junction: it is as much a hospitality story as it is a financing story.

By framing restaurant growth as “Dining Capital”, SPICE moves beyond traditional bank loans and one-off marketing budgets. It treats restaurants not as risky, isolated ventures but as core assets in a tourism and experience economy that Saudi Arabia is rapidly building under Vision 2030.In a country that has already surpassed its original tourism targets and is now aiming for 150 million visitors a year, the question is no longer whether there will be enough demand. It’s who gets to participate in that demand — and on what terms. Models like SPICE suggest a future in which independent operators and emerging concepts don’t have to trade away ownership or take on heavy debt just to compete.

As Saudi Arabia doubles down on hospitality and entertainment, this kind of sector-native, incentive-aligned capitalcould signal a broader regional shift: from generic funding products to tailored financial architectures that understand how value is really created on the ground — one table, one guest, and one dining experience at a time.

— The Startups MENA Editorial Team