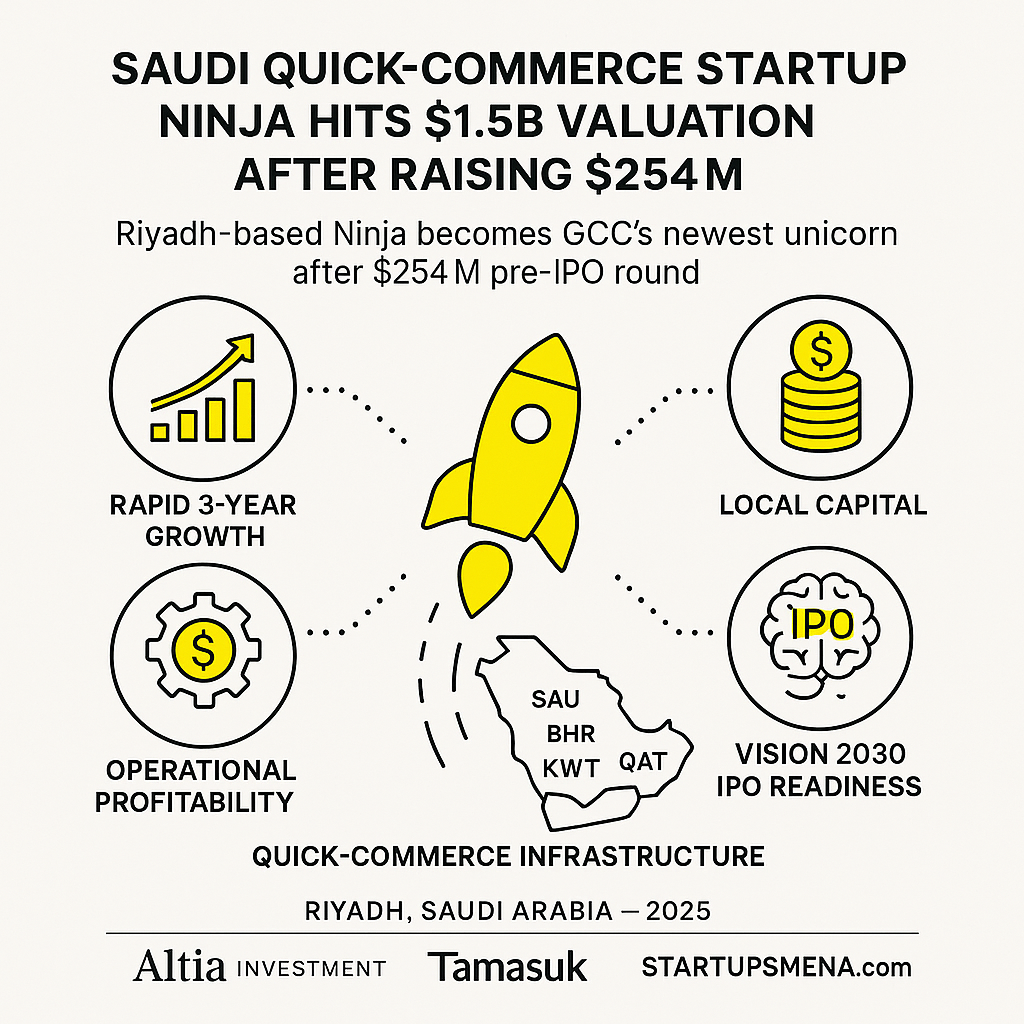

A Three-Year Sprint to Unicorn Status

Saudi Arabia’s quick-commerce startup Ninja has officially entered the region’s unicorn club after raising $254 million in a major pre-IPO funding round. The raise—led by Riyad Capital with participation from vii Ventures, Altia Investment, Tamasuk Al Rajhi, and several regional backers—values the company at approximately $1.5 billion.

Founded in 2022, Ninja’s trajectory has been nothing short of explosive. In just three years, the Riyadh-born company has grown from a fast-delivery newcomer to one of the GCC’s strongest consumer logistics players, supported by significant local demand and a rapidly evolving digital economy.

How Ninja Built a New Quick-Commerce Blueprint

Ninja operates across Saudi Arabia, Bahrain, Kuwait, and Qatar, focusing on ultra-fast delivery of groceries, pharmacy items, beauty essentials, and everyday household products. Rather than competing on marketing, the company has built its model around:

- Micro-fulfilment centers that reduce delivery times

- Localized product selection tailored to consumer habits

- Operational efficiency designed for sustainable margins

- A logistics infrastructure built for speed, density, and scalability

The company reports being operationally profitable with nearly $1 billion in annual GMV, a rare feat in a category where many global players have burned through capital without reaching sustainability.

Why This Funding Round Matters

The new capital injection positions Ninja to:

1. Expand Its Last-Mile Infrastructure

The company plans to deepen its presence across core GCC markets and sharpen delivery speed and reliability.

2. Prepare for a Potential IPO by 2027

As the company’s leadership signals, a listing on the Saudi Exchange (Tadawul) is firmly in view—part of the Kingdom’s broader push to spotlight homegrown tech players on public markets.

3. Strengthen Saudi Arabia’s Vision 2030 Innovation Agenda

Ninja’s momentum aligns with Saudi Arabia’s accelerated investment in consumer technology, AI, fintech, logistics, and digital commerce.

Its growth reflects a shift: local startups are no longer waiting for global capital—they’re being powered by regional institutional investors.

A Landmark Moment for the GCC Startup Ecosystem

Ninja’s rise carries broader significance:

- One of the fastest Saudi startups to reach unicorn status

- A demonstration of how local capital + local problem-solving can outperform global copy-and-paste models

- Validation for q-commerce as a serious, infrastructure-led business, not just a trend

- Evidence that Saudi Arabia is becoming the region’s leading engine for large-scale tech ventures

As global venture funding remains volatile, Ninja’s success shows the GCC’s tech economy is maturing on its own terms—backed by deep-pocketed sovereign funds, institutional investors, and strong consumer markets.

The Road Ahead: Growth With Discipline

Despite its momentum, Ninja faces key challenges:

- Maintaining margin discipline in a category traditionally known for thin unit economics

- Navigating competitive pressure from food delivery and retail giants entering convenience categories

- Scaling sustainably while preparing for public-market scrutiny

- Executing nuanced expansion across markets that vary in regulations and consumer behavior

Still, Ninja’s operational profitability and strong regional adoption give it a strategic edge few global q-commerce players achieved at similar stages.

Lessons for Regional Founders

Ninja’s journey offers several takeaways for MENA’s founder community:

- Build regionally before going global—GCC markets reward localized execution

- Prioritize unit economics early—fast growth only matters if margins follow

- Capitalize on regional investment appetite—local investors increasingly drive scale

- Plan for IPO readiness from day one—governance, metrics, and financial discipline matter

- Use logistics as a competitive moat—speed is valuable only when economically feasible

Editor’s Note — The Startups MENA Team

At Startups MENA, we spotlight the stories that shape how the region builds its next-generation innovation economy. Ninja’s leap to a $1.5 billion valuation is more than a funding success—it is a signal that Saudi Arabia’s startup ecosystem has entered a new era.

A company achieving unicorn status in only three years reflects a powerful convergence: rising consumer demand, strong institutional capital, and a national commitment to diversifying into tech-driven industries. Ninja’s rise shows what becomes possible when founders build for the region’s realities, not Silicon Valley templates.

As the GCC accelerates towards Vision 2030 and broader digital transformation, stories like Ninja’s will set the tone for what regional entrepreneurship can achieve—fast, scalable, and globally competitive.

— The Startups MENA Editorial Team