A school administrator in Riyadh shouldn’t need a spreadsheet, WhatsApp, and a stack of IOUs just to collect monthly tuition.

Yet across Saudi Arabia and the wider MENA region, that’s still how a lot of recurring payments—from school fees and SaaS subscriptions to gym memberships and rent—actually get done. Invoices are manual, reminders are ad hoc, and cash flow visibility is fuzzy at best.

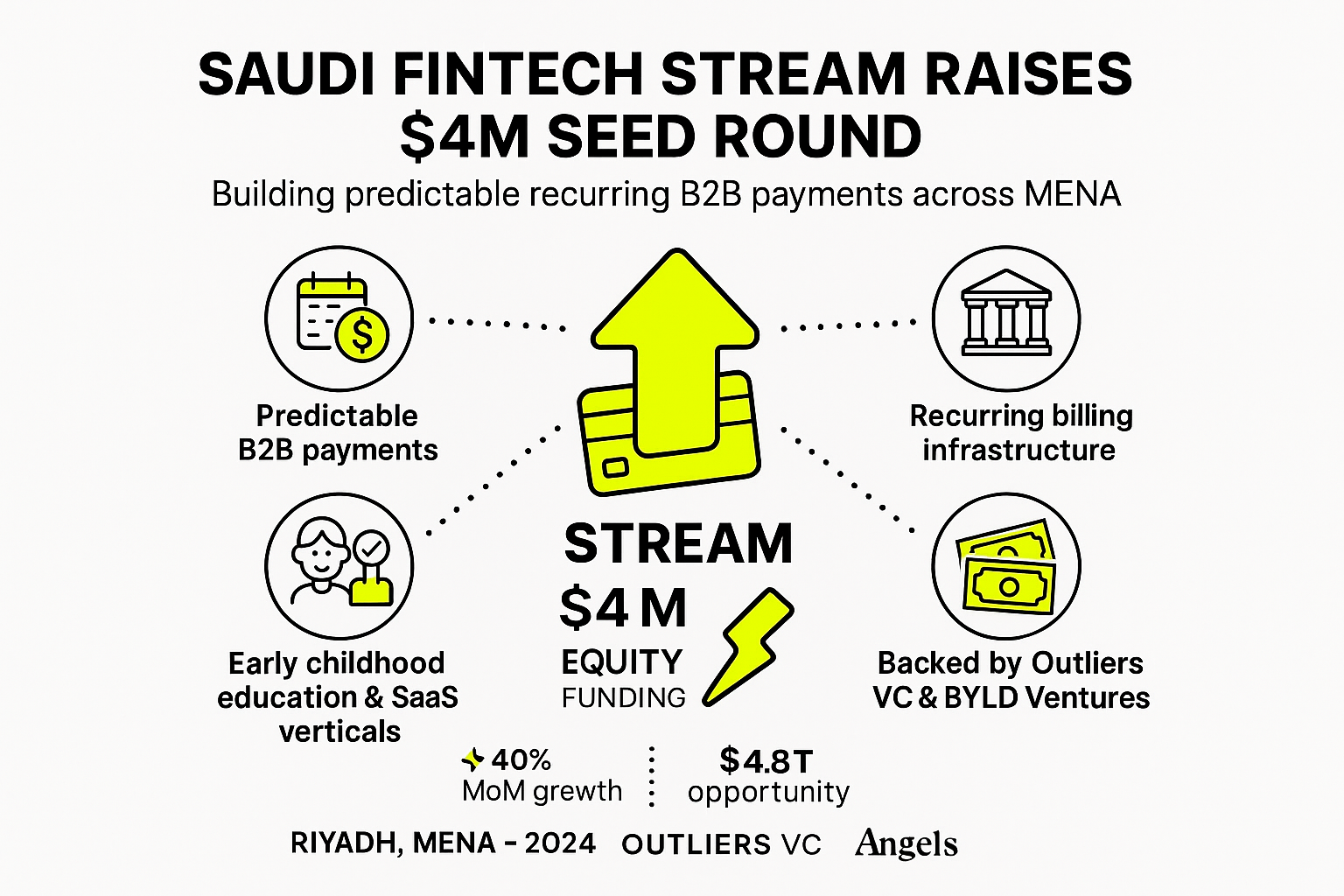

Stream, a Saudi-born fintech founded in 2024 by Ibrahim Aldlaigan, wants to turn that chaos into a predictable, automated workflow. And now it has fresh capital to do it. The startup has secured $4 million in seed funding, led by early-stage investor Outliers VC, with participation from BYLD Ventures and angel investors including Careem co-founder Abdullah Elyas.

A Founder Focused on How Businesses Get Paid

While a lot of fintech innovation in MENA has focused on how consumers spend, Stream is deliberately tackling the other side of the equation: how businesses get paid.

“Most of the world’s innovation in payments has focused on how people spend. We’re focused on how businesses get paid,” says founder and CEO Ibrahim Aldlaigan.

Stream’s platform is designed to manage the entire payment lifecycle for businesses, including:

- Issuing branded, app-free invoices

- Scheduling payments (one-time, recurring, or in parts)

- Collecting via local payment rails

- Providing real-time cash flow visibility

- Automating reconciliation and record-keeping

For many businesses in Saudi Arabia and the region, the default model is still to collect everything upfront, simply because they lack the systems to bill over time.

“Stream gives them structure and control; a business defines how and when payments happen… and we handle the rest. It’s about making payments predictable, flexible, and connected to the real flow of services,” Aldlaigan adds.

The $4.8 Trillion Opportunity in Recurring Payments

The scale of the opportunity is significant.

According to the Saudi Central Bank’s Payments Usage Study 2023, the total value of payment transactions in Saudi Arabia reached approximately $4.8 trillion in 2023, with about 70% of retail transactions now happening digitally. Yet only around 7% of consumer transactions are recurring payments.

That gap—between a largely digitised payments environment and a largely manual recurring payments reality—is what Stream is aiming to close.

Think of all the recurring flows that still run on spreadsheets, transfers, and reminders:

- Tuition fees

- Rent

- Subscriptions and memberships

- SaaS and service retainers

In many cases, the infrastructure for recurring billing exists in mature markets but hasn’t yet been adapted to local regulations, rails, and business practices in MENA. Stream is positioning itself as that locally attuned recurring payments infrastructure.

From Early Childhood Education to Multi-Sector Growth

Stream started by focusing on a niche with a clear, painful recurring payment problem: early childhood education.

By building for nurseries and kindergartens first—where parents pay on a recurring basis, often with complexity around siblings, schedules, and partial terms—the company stress-tested its billing logic in one of the trickiest segments.

From there, Stream has expanded into:

- School networks

- SaaS providers

- Other verticals with recurring or instalment-based payments at their core

Since launch, the company reports:

- 40% month-on-month growth

- Millions in payment volume processed

- Thousands of customers across dozens of merchants using the platform

Those numbers suggest a strong pull from businesses that are eager to modernise how they bill and collect—without forcing customers to download a new app or learn a new system.

Why Investors Are Backing Stream’s Infrastructure Play

For investors like Outliers VC and BYLD Ventures, Stream is not just another payments startup; it’s a regional infrastructure play built on local insight.

“Stream is built on deep local insight and a clear understanding of how businesses actually operate,” says Sarah AlSaleh, General Partner at Outliers VC. “Ibrahim brings the rare combination of investor perspective and relentless product execution… Stream is laying the foundation for the next generation of payment infrastructure in the region.”

Youcef Oudjidane, founder of BYLD, points to culture as a key asset:

“In a short period of time, Ibrahim has built a culture of intensity and technical excellence that attracts top talent and drives the company’s mission to streamline payments and remove friction across MENA. It wouldn’t surprise me if we’re talking about the ‘Stream mafia’ in the years to come.”

The seed round will fuel:

- Product development in engineering and payment capabilities

- Strengthening compliance and internal systems

- Enhancing the overall user experience as Stream scales its infrastructure for a fast-growing subscriber base

In an environment where regulators are pushing for both innovation and stability in digital payments, that focus on compliance and infrastructure maturity is likely to be a competitive differentiator.

What Comes Next for B2B Payments in MENA

If Stream succeeds, its impact may be felt far beyond any single vertical.

The ability for businesses to:

- Offer flexible plans instead of one-time upfront fees

- Smooth out cash flow with predictable recurring revenue

- Reduce reliance on manual follow-ups and reconciliation

…could reshape how services are priced and delivered in sectors from education and healthcare to property management and SaaS.

The broader story here is not just a $4 million seed round. It’s the normalisation of modern, recurring billing and payments as a default expectation in MENA’s B2B economy—just as digital wallets and instant transfers have become the norm on the consumer side.

Stream is betting that the next wave of fintech value creation in the region will come from making payments boring—in the best way possible: predictable, automated, and deeply embedded in how businesses operate every day.

Editor’s Note — From the Startups MENA Team

At Startups MENA, we track the infrastructure stories that quietly underpin the region’s digital economy. Stream’s seed round is more than a funding headline—it’s a signal of how B2B payments in MENA are evolving from one-off transactions to recurring, software-driven relationships.

As Saudi Arabia’s payments landscape becomes overwhelmingly digital, the real bottleneck is no longer rails—it’s workflow. By tackling recurring billing for sectors like education and SaaS, Stream is helping businesses move from manual reminders and lump-sum collections to structured, predictable cash flows.

This matters for founders and operators across the region. When payments become programmable, startups can design better pricing models, smoother customer experiences, and more resilient revenue streams. In that sense, companies like Stream aren’t just solving for collections; they’re helping define the operating system of MENA’s next-generation digital businesses.

— The Startups MENA Editorial Team