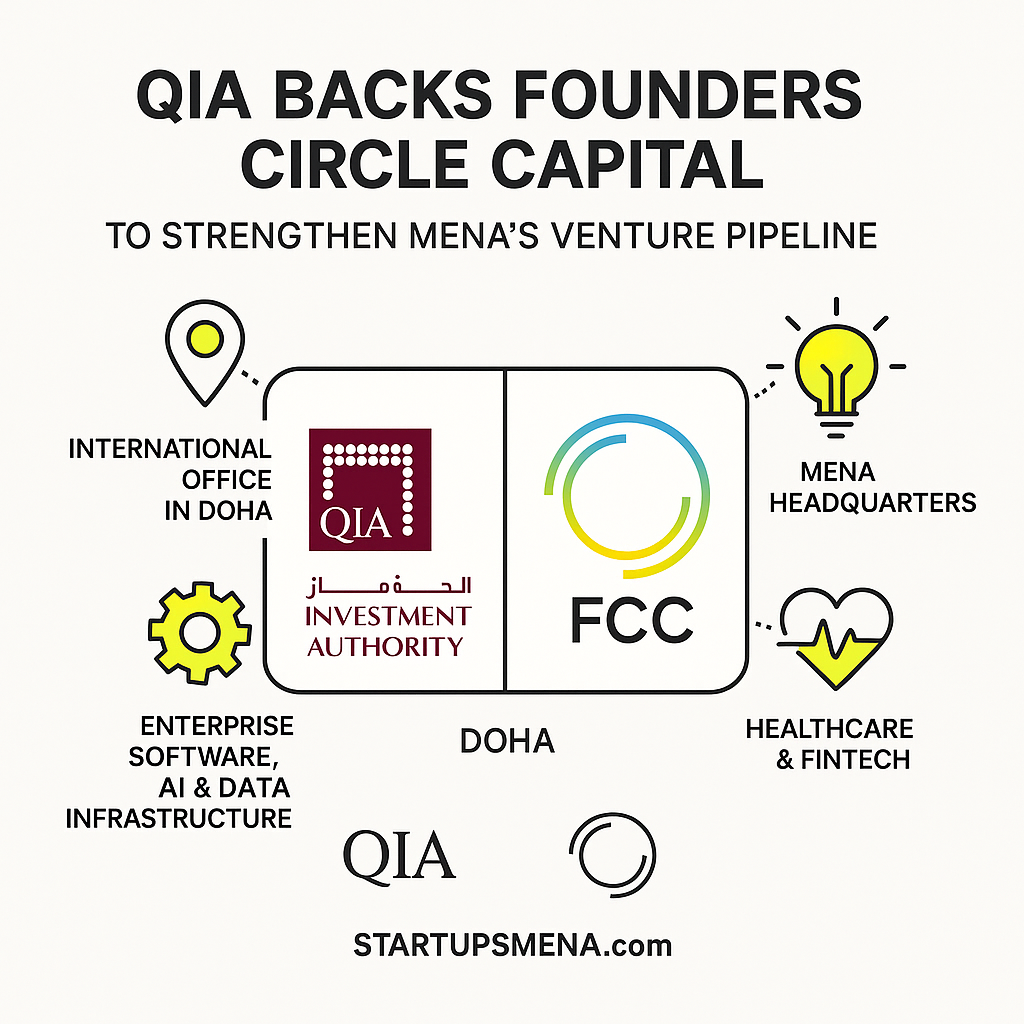

Qatar doubles down on global VC integration through its US$1 billion fund-of-funds strategy

Qatar Investment Authority (QIA) has added Founders Circle Capital (FCC) to its US$1 billion fund-of-funds programme, reinforcing its strategy to position Qatar as a regional and global venture capital hub.

The move is part of QIA’s broader effort to attract top-tier fund managers, institutional capital, and high-growth startups into Qatar and the wider MENA ecosystem.

Key highlights

- Founders Circle Capital will establish its first international office in Doha

- FCC will use Doha as its MENA headquarters

- Focus sectors include:

- Enterprise software

- AI and data infrastructure

- Healthcare and fintech

- The fund-of-funds programme aims to:

- Channel global VC capital into MENA startups

- Build long-term institutional venture infrastructure in Qatar

Strategic significance

By onboarding FCC, QIA is not just deploying capital — it is importing expertise, networks, and deal flow. This signals a shift from passive investment to ecosystem-led capital formation, with Qatar positioning itself as a serious node in the global venture economy.

Editor’s Note — The Startups MENA Team

At Startups MENA, we view Qatar’s fund-of-funds strategy as a structural play, not a headline grab. By anchoring global venture firms in Doha, QIA is building the long-term plumbing required for sustainable startup growth.

This move reflects a growing regional maturity — where the focus is no longer just on funding startups, but on building the institutions that fund them, connect them, and help them scale globally.

— The Startups MENA Editorial Team