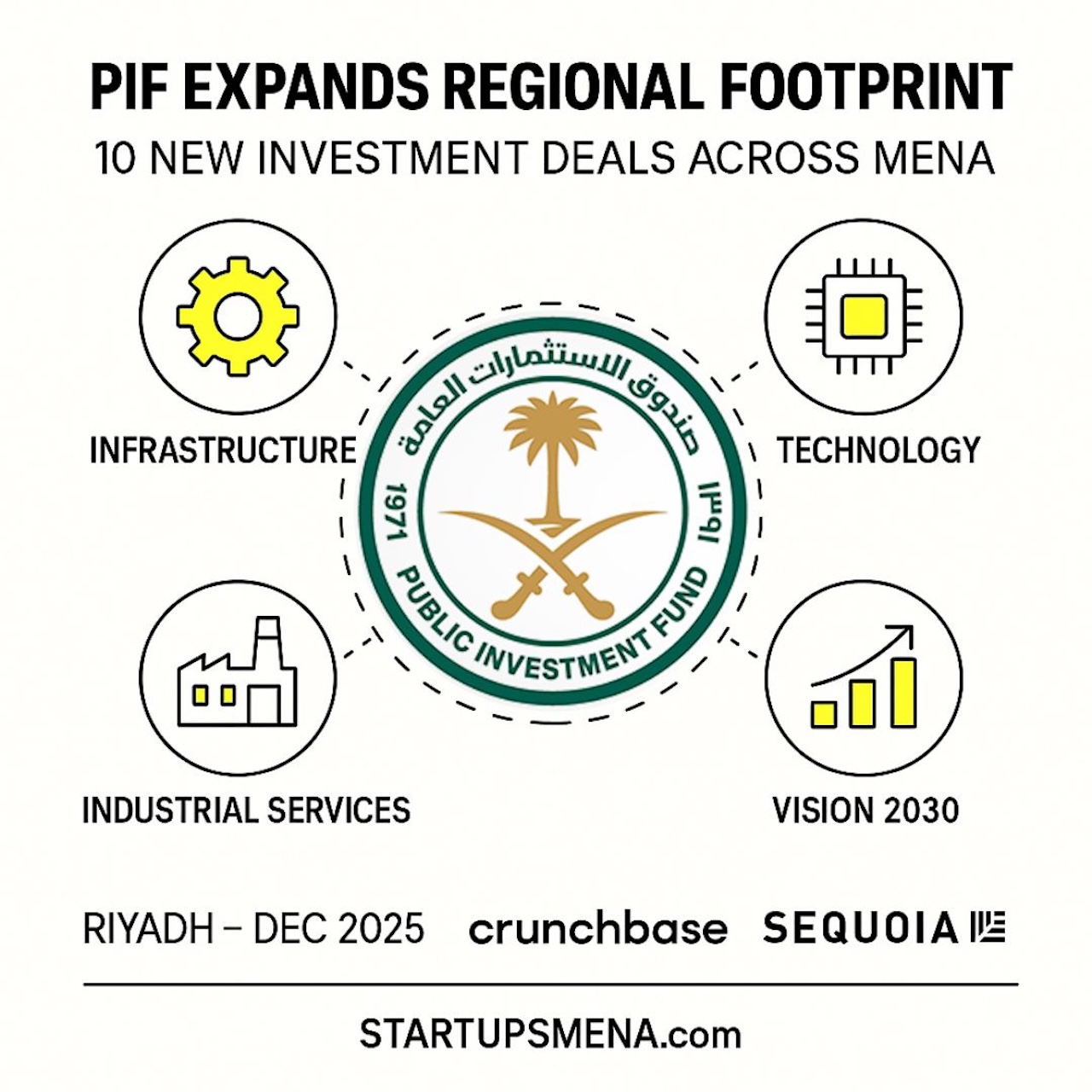

Saudi Arabia’s Public Investment Fund (PIF) has executed more than ten new strategic investment deals across the Middle East and North Africa, marking one of its most active regional deployment phases this year. The transactions span markets such as Bahrain, Egypt, Jordan, and Oman, reinforcing the Kingdom’s ambition to drive economic integration across MENA.

Key Highlights

- Over 10 new cross-border investments executed.

- Sectors involved include infrastructure, technology, industrial services, and strategic development projects.

- Part of Saudi Arabia’s broader Vision 2030 economic diversification strategy.

- Strengthens bilateral economic ties and supports regional capital flows.

Strengthening Regional Economic Connectivity

PIF’s latest investment activity aims to deepen Saudi Arabia’s influence as a strategic economic anchor. While specific deal sizes were not disclosed, the breadth of sectors reflects a deliberate effort to build multi-market supply chains, support emerging tech ecosystems, and create long-term commercial partnerships.

Positioning Saudi Capital as a Regional Catalyst

These deals arrive at a time when several MENA markets—especially Egypt and Jordan—are seeking stronger liquidity channels to accelerate development. PIF’s involvement introduces:

- Long-term funding stability

- Increased investor confidence

- New opportunities for startups and mid-size firms

With more announcements expected in early 2026, PIF is shaping the architecture of a more interconnected MENA investment landscape.

Editor’s Note — The Startups MENA Team

At Startups MENA, we spotlight the developments shaping the region’s economic transformation. PIF’s expanding regional footprint signals more than investment movement—it highlights a shift toward deeper collaboration and shared growth across MENA markets. As the region accelerates toward its long-term goals, sovereign capital is becoming a catalyst for opportunity, scale, and innovation.

— The Startups MENA Editorial Team