A Problem Hiding in Plain Sight

When Tunisian founders Mohamed Anouar Gadhoum and Shaher Abbas launched PAYDAY in 2024, they weren’t chasing a trend — they were solving a chronic and largely ignored problem.

Across Tunisia, thousands of low- and middle-income workers routinely face liquidity gaps, lack access to affordable credit, and have little or no insurance coverage. For many, a single unexpected bill can lead to debt traps or informal lending.

PAYDAY’s mission: give employees control over their financial lives through salary-linked financing and accessible micro-Takaful protection — all delivered digitally.

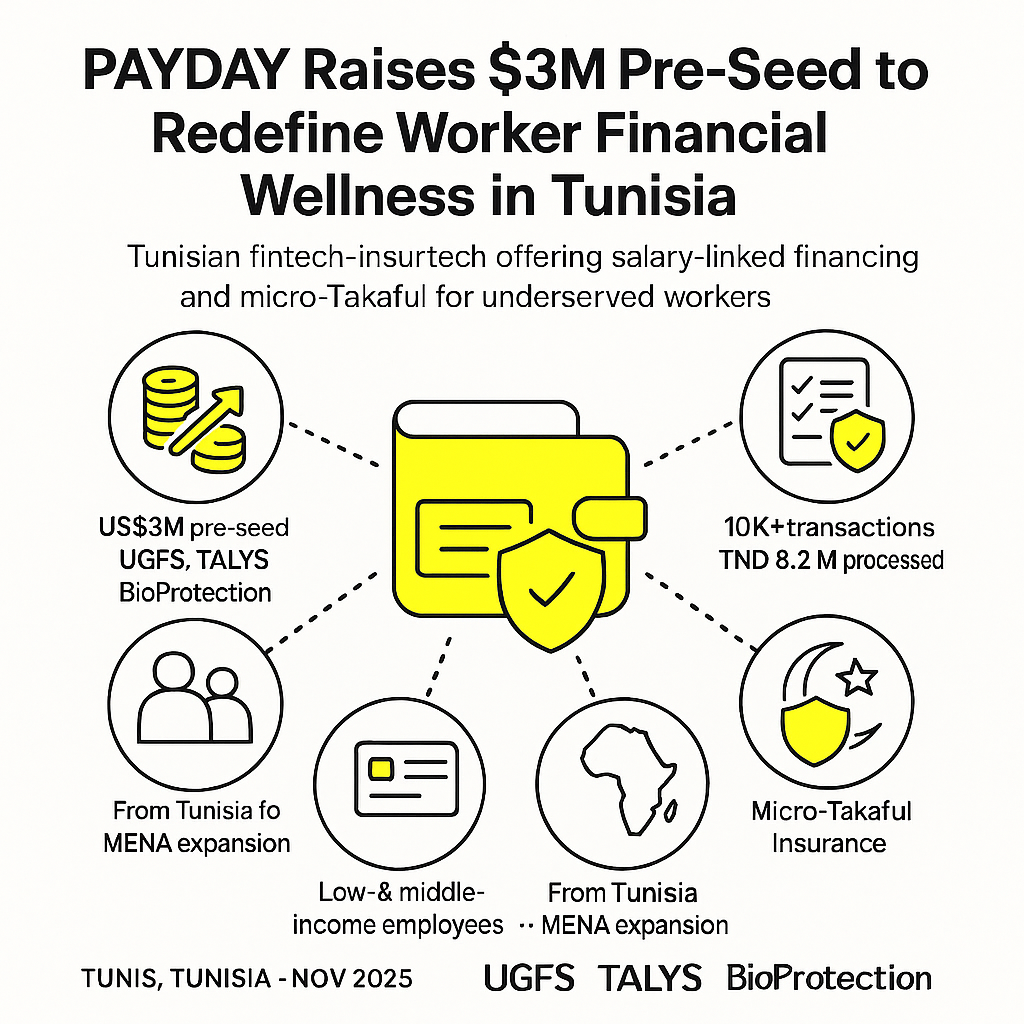

With a US$3 million pre-seed round now secured, the startup is gearing up to scale that mission across the country and beyond.

A Strategic Funding Round Backed by Heavyweights

PAYDAY’s pre-seed round was led by UGFS North Africa, with participation from TALYS Group and BioProtection SA, valuing the company at roughly US$3 million.

Since its launch:

- PAYDAY has processed 10,000+ transactions

- Totaling more than TND 8.2 million (~US$2.8 million) in volume

- Demonstrating early product-market fit in a difficult, underserved segment

“This new round of funding brings together a venture capitalist, a leading technology player, and a strong industrial group,” said co-founder Mohamed Anouar Gadhoum. “This alliance strengthens PAYDAY’s ability to scale an innovative solution serving businesses and their employees.”

Fintech + Insurtech + Payroll: A Hybrid Model Built for Inclusion

PAYDAY combines two essential but often inaccessible services:

1. Salary-Backed Financing

Employees can access earned wages ahead of payday — reducing reliance on high-interest informal loans or family borrowing.

2. Micro-Takaful Insurance

Protection products compliant with Islamic finance principles, designed for workers who typically lack insurance coverage.

By embedding these products directly into employer and payroll systems, PAYDAY becomes a financial wellness layerrather than a standalone app. The result: higher employee satisfaction and reduced turnover for employers, and greater financial security for workers.

Why PAYDAY Matters for Tunisia — and the Region

The MENA region’s fintech boom has largely overlooked the lower-income workforce. Tunisia, in particular, faces:

- Low insurance penetration

- Limited access to affordable credit

- Fragmented employer–finance–insurance linkages

PAYDAY’s model directly addresses this gap — and investors are taking notice.

A US$3 million valuation at pre-seed is a strong signal that North Africa’s fintech and insurtech sectors are maturing, especially solutions focused on inclusion rather than luxury.

If PAYDAY succeeds, its model could scale across francophone Africa, North Africa, and ultimately the wider MENA region.

What’s Next: From Tunisia to Regional Expansion

With new capital in hand, PAYDAY plans to:

- Expand its product stack, strengthening infrastructure and adding financial tools

- Widen its ecosystem, partnering with more employers, MFIs, banks, and insurers

- Move beyond B2B, enabling individuals to access PAYDAY’s services directly

- Position itself as a financial & insurance aggregator across the region

The founders ultimately envision PAYDAY as a platform where workers can manage wages, credit, savings, and protection — all in one place.

Risks and Realities

Scaling PAYDAY won’t be simple.

- Insurance regulations vary sharply across markets

- Payroll integrations are slow and technically complex

- Credit risk increases rapidly at scale

- Competing fintechs may enter the salary-access segment

But if PAYDAY executes, it could become one of the region’s most important worker-centric financial platforms.

Key Lessons for Founders & Investors

- Distribution is everything: Tapping employers through payroll gives PAYDAY a powerful, low-cost channel.

- Solve real problems: Financial inclusion for vulnerable workers is a massive, underserved market.

- Blend adjacent verticals: Fintech + insurtech + HR creates a defensible, high-stickiness model.

- Early traction matters: 10,000+ transactions and millions in volume strengthened investor confidence.

- Strategic capital beats pure capital: Investors who bring networks, compliance expertise, and industry access compound growth.

Editor’s Note — The Startups MENA Team

At Startups MENA, we spotlight the founders and ideas shaping the region’s innovation economy — especially those building for inclusion, resilience, and long-term impact. Tunisia’s PAYDAY is part of a quiet but powerful shift: startups solving everyday challenges for workers who have historically been overlooked by traditional financial systems.

By digitizing access to wages and protection, PAYDAY is not just offering financial tools — it is reinforcing economic dignity. As the MENA region accelerates toward a future defined by self-sustaining ecosystems and empowered workforces, solutions like PAYDAY remind us that innovation is most transformative when it reaches those who need it most.

— The Startups MENA Editorial Team