Riyadh’s newest credit-infrastructure startup aims to make SME lending instant, embedded, and data-driven — transforming a process that has historically been slow, manual, and exclusionary.

A Regional Pain Point Ripe for Reinvention

For decades, SME lending across the Middle East has been defined by manual paperwork, collateral demands, and weeks-long approval cycles. Despite making up the vast majority of the region’s businesses, SMEs account for a very small share of total bank credit — leaving a financing gap measured in the hundreds of billions of dollars.

Orbii, a Riyadh-based startup, believes that the bottleneck isn’t willingness to lend — it’s the infrastructure lenders are forced to use.

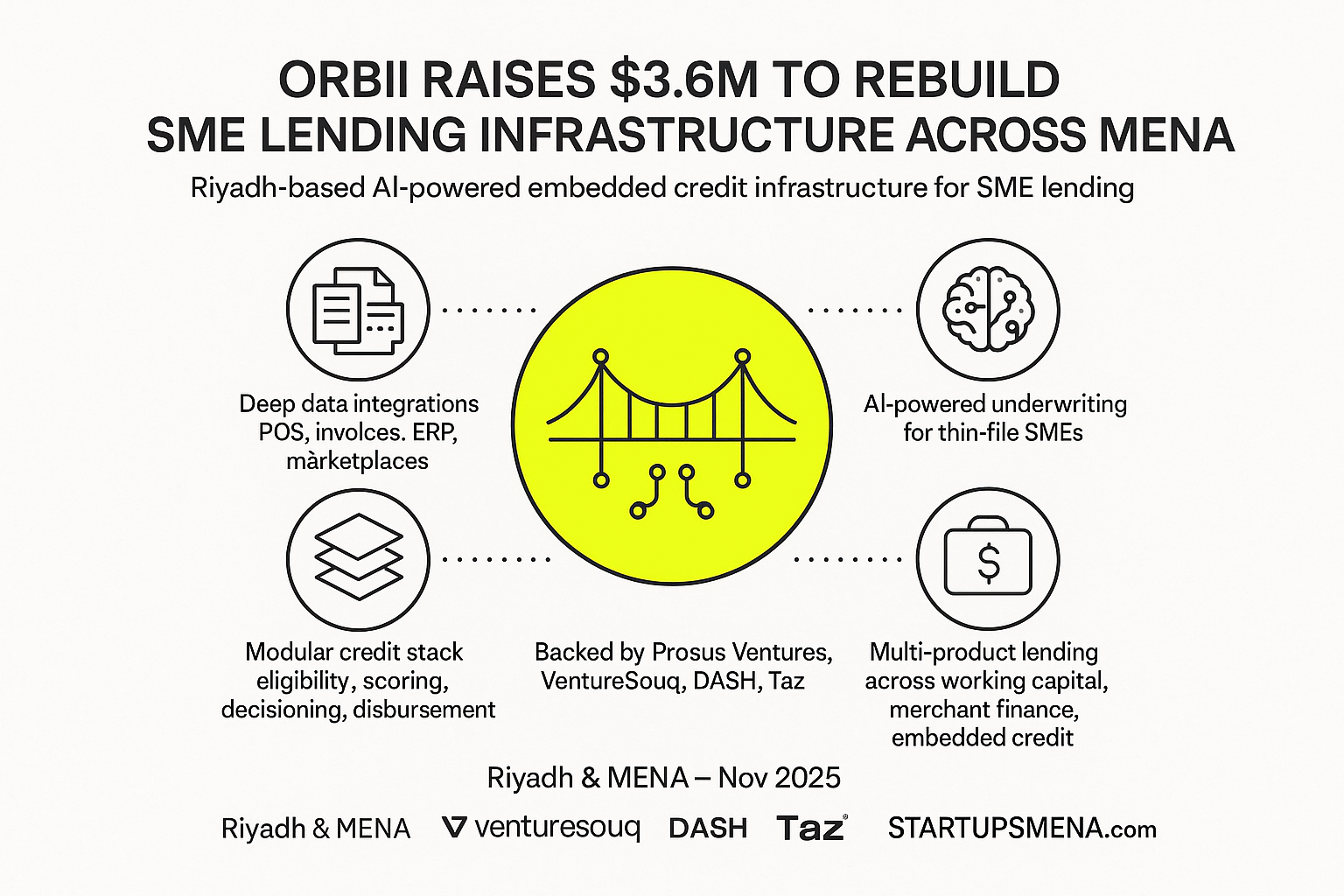

The company has raised $3.6 million in seed funding, led by Prosus Ventures, with participation from VentureSouq, DASH Ventures, Taz Investments, and Sanabil 500. The funding will fuel Orbii’s plans to expand across Saudi Arabia and the UAE, grow its engineering and data teams, and support its goal of powering $1 billion in SME loans by 2026.

A Founding Team Targeting a Structural Problem

Founded in 2024 by Nauman Ali, Guillaume Kieffer, and Nasara Mughal, Orbii positions itself not as a lender, but as the intelligence layer that makes modern SME lending possible.

Their core thesis: credit shouldn’t be a standalone process — it should be a native part of the digital tools SMEs already use.

“Credit decisioning won’t be a process, it’ll be a reflex,” says CEO Nauman Ali. “SMEs should access financing the same way they access payments or payroll — instantly, inside their workflows.”

How Orbii’s “Embedded Credit Infrastructure” Works

Orbii plugs directly into banks, fintechs, POS networks, ERP systems, marketplaces, and B2B platforms. From there, the platform uses AI to analyze real transaction-level data, generate real-time scoring, and automate end-to-end lending workflows.

Its value proposition is built on four pillars:

1. Deep Data Integrations

Orbii connects to the platforms where SME activity actually happens — POS terminals, invoices, payouts, sales, supplier transactions — moving beyond static financial statements.

2. AI-Powered Underwriting

Machine-learning models evaluate thousands of behavioral and financial signals to score thin-file or credit-invisible SMEs that traditional models overlook.

3. Modular Credit Stack

Lenders can adopt only what they need: eligibility checks, scoring, decisioning, disbursement, monitoring, or collections — without rebuilding their entire credit architecture.

4. Multi-Product Capability

From working capital loans to merchant financing and embedded credit inside SaaS tools, Orbii enables banks and fintechs to launch new products in weeks instead of years.

Why Global and Regional Investors Are Backing It

The seed round is a strong validation of two things:

- SME credit in MENA is still largely underserved

- Infrastructure players — not direct lenders — may be best positioned to scale the solution

Prosus Ventures’ participation reflects growing global interest in AI-led embedded finance. Meanwhile, regional investors bring the on-the-ground context needed to navigate regulatory environments and bank partnerships.

Together, this investment syndicate positions Orbii as a credible infrastructure partner for both established financial institutions and emerging fintech platforms.

The Bigger Picture: Unlocking a New Chapter for Regional SMEs

If Orbii succeeds, the downstream impact stretches far beyond the fintech sector:

- Banks gain the ability to modernize credit operations without a multi-year core overhaul.

- Fintechs and B2B platforms can embed lending directly into their products, creating new revenue lines.

- SMEs gain faster, fairer, and more accessible financing at the moment they need it.

- Regional economies move closer to unlocking the full contribution of their SME sectors — a long-standing national priority across the GCC.

SMEs power job creation, diversification, and non-oil growth. Reducing friction in their access to capital is no longer optional — it’s foundational.

Orbii is betting that modern infrastructure is the missing piece.

Editor’s Note — The Startups MENA Team

At Startups MENA, we spotlight the infrastructure plays shaping how the region’s next-generation economy is being built. Orbii’s $3.6 million seed round is more than a funding milestone — it represents a shift in how credit access for SMEs is architected.

For years, small and medium businesses across the Middle East have been underserved not because they lacked potential, but because lenders lacked the tools to understand them. By embedding AI-driven lending directly into the digital platforms SMEs rely on, Orbii reframes the challenge: from “Why can’t SMEs get credit?” to “How fast can we responsibly evaluate them?”

As Saudi Arabia, the UAE, and the broader region push ambitious visions for private-sector expansion, smart credit infrastructure becomes as crucial as logistics, payments, or connectivity. This evolution marks a pivotal chapter in the region’s growth — where technology doesn’t just support SMEs, but empowers them to thrive at scale.

— The Startups MENA Editorial Team