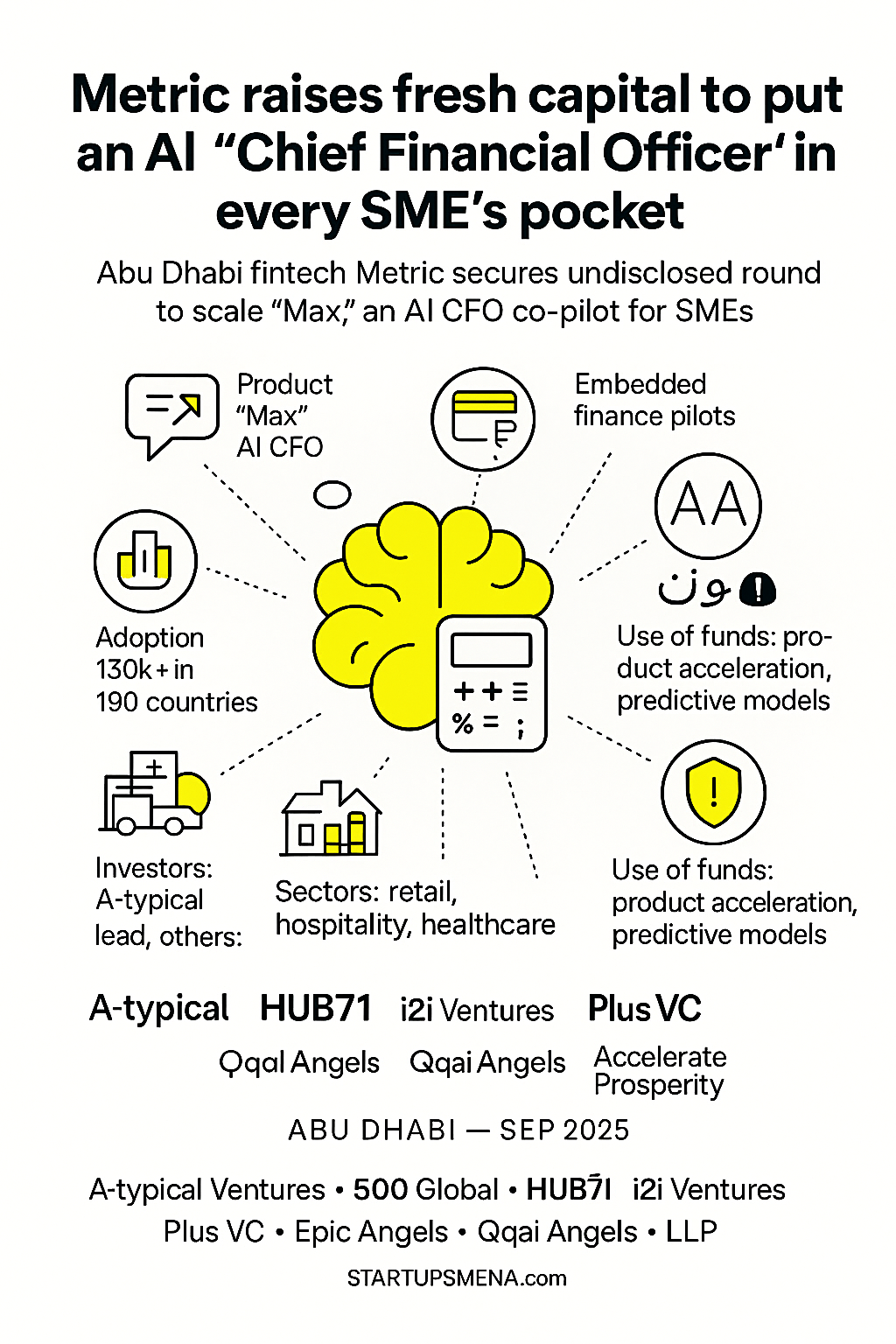

When cafés, clinics, and cloud kitchens across the GCC ask “Can we afford to expand next quarter?”, many still reach for spreadsheets. Metric, an Abu Dhabi–headquartered AI fintech, wants those answers to come from a conversational “business co-pilot” instead—and has now closed a new, undisclosed round of investment to accelerate that vision.

The funding was led by A-typical Ventures, with participation from 500 Global, Hub71, i2i Ventures, Plus VC, Epic Angels, Oqal Angels, Accelerate Prosperity, and regional angels.

What Metric actually does

Founded in 2022 by Meenah Tariq, Omar Parvez Khan, and Dr. Habiba, Metric turns messy financial data into a real-time decision engine for founders. Its tools include visual dashboards, sector benchmarks, forecasting models, and a conversational AI advisor named Max—positioned as a Chief Financial AI for small and medium businesses.

Max analyzes incoming financial data, flags risks, answers strategic questions, and suggests next steps. Metric says the assistant draws on billions in accumulated transactional data and works in both English and Arabic, helping non-technical founders understand their numbers without jargon-heavy reports.

Today, Metric reports adoption from over 130,000 businesses across nearly 190 countries, reflecting a global appetite for CFO-grade insights without CFO-level cost.

Why this funding matters

The new capital will go toward product acceleration, refining Max’s predictive capabilities, and scaling embedded finance pilots that allow SMEs to take action—such as applying for credit or managing invoices—directly inside the platform.

For many small businesses in MENA, gaps in forecasting, cash-flow planning, and funding access remain key barriers to scaling. Investors believe Metric is moving quickly to solve a deeply rooted SME challenge: turning financial data into practical, day-to-day guidance.

The regional backdrop: Abu Dhabi doubles down on AI

Metric’s progress comes as Abu Dhabi intensifies its AI strategy, with Hub71 expanding its AI-focused cohort and strengthening support for applied AI startups. This environment gives tools like Max immediate pathways into regional sectors where operational efficiency and financial clarity are critical—particularly retail, hospitality, and healthcare.

What to watch next

1. Embedded finance

Metric is working toward a system where SMEs can not only see their financial health but act on it instantly—whether that means unlocking short-term credit or bridging cash-flow gaps.

2. Deeper localization

With strong dual-language support, the startup is expected to roll out GCC-specific benchmarks and workflows tailored for Arabic-first markets.

3. ROI-based outcomes

Metric’s true measure of success will be real-world impact—helping businesses stabilize cash flow, reduce operational friction, and make faster, more confident decisions.

Competitive landscape (and risks)

The SME financial tools market is becoming increasingly competitive, from cloud accounting software to banking-integrated platforms. Metric’s differentiator is its AI co-pilot layer powered by large volumes of real transaction data.

The challenge? Ensuring consistently high data quality and building reliable integrations with banks, PSPs, and POS providers across diverse markets. Scalable impact will depend on how tightly Metric can connect insights to on-the-ground action.

For founders: The playbook behind Metric’s momentum

- Solve a painful, universal problem. The team focused on financial clarity—a priority for every SME.

- Localize early. Arabic support and GCC-tailored benchmarks help adoption in a fragmented region.

- Close the loop. Insights are only useful if they trigger measurable actions inside the product.

Deal snapshot

- Company: Metric (Abu Dhabi)

- Founded: 2022

- Founders: Meenah Tariq, Omar Parvez Khan, Dr. Habiba

- Round: Undisclosed investment

- Lead investor: A-typical Ventures

- Other participants: 500 Global, Hub71, i2i Ventures, Plus VC, Epic Angels, Oqal Angels, Accelerate Prosperity, regional angels

- Product: “Max,” an AI-powered Chief Financial Officer for SMEs

- Reach: 130k+ businesses in 190 countries

- Use of funds: Product acceleration, GCC expansion, embedded finance pilots

Editor’s Note — The Startups MENA Team

At Startups MENA, we focus on the narratives that define how the Middle East builds its next-generation workforce and innovation economy. AI in SME finance is no longer a distant concept—it is rapidly becoming a core operating layer for small and medium businesses.

Metric’s rise signals a shift toward actionable intelligence, where founders gain clarity not in quarterly reviews but in real time. For a region where SMEs drive employment and economic diversification, the ability to make sharper, faster financial decisions could become a defining competitive advantage.

As Abu Dhabi and the wider GCC invest heavily in AI ecosystems, we are watching closely for companies that transform data into better margins, stronger resilience, and scalable growth. The future belongs to tools that empower SMEs not only to understand their numbers—but to act on them with confidence.

— The Startups MENA Editorial Team