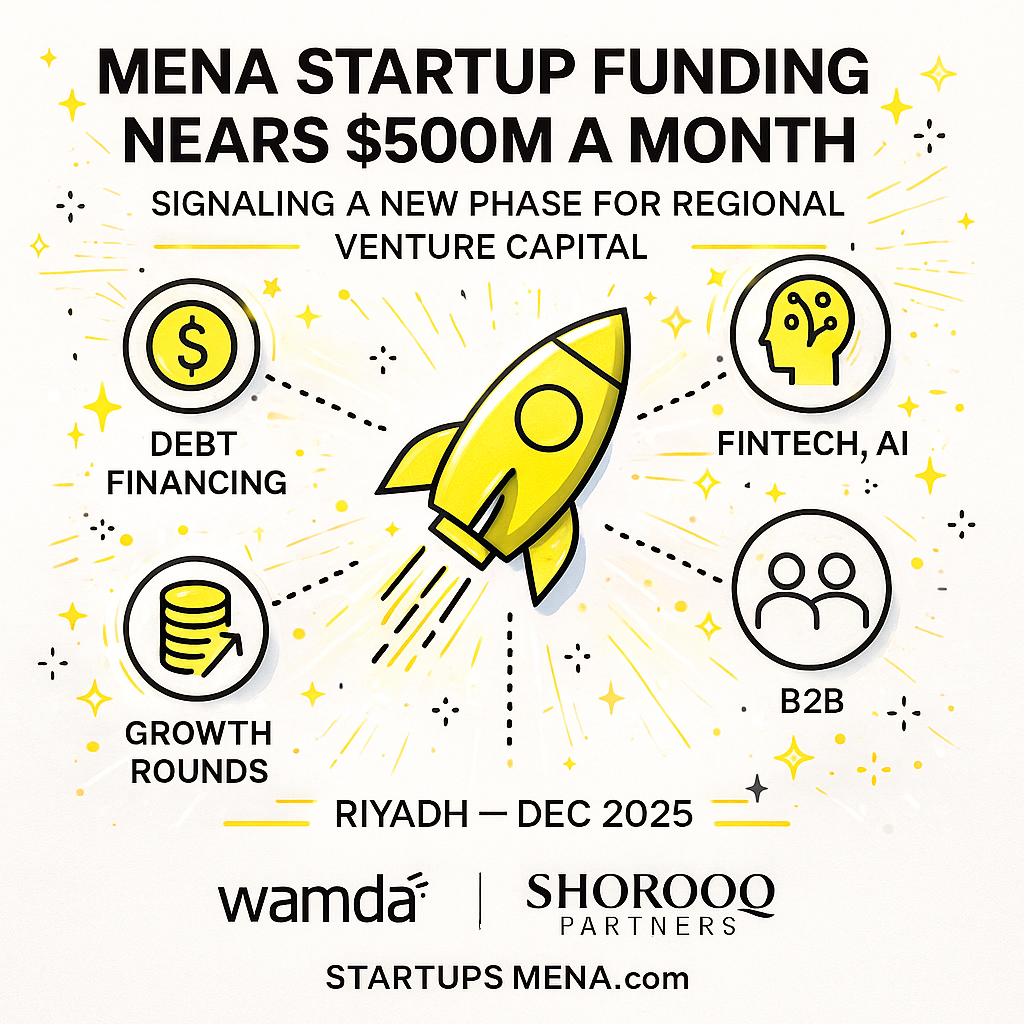

For years, founders in the Middle East and North Africa asked the same question: When will “serious” capital show up consistently in the region? Recent data suggests that moment may finally be here — with monthly startup funding now approaching the $500 million mark in some periods.

A funding rebound powered by debt and growth capital

According to a recent Wamda-tracked report, MENA startups raised roughly $494 million across 58 deals in February alone, nearly five times January’s tally. The spike was driven by one month where debt financing accounted for around 90% of deployed capital, underscoring how non-dilutive structures are becoming a bigger part of the funding mix.

Zoom out, and the picture is even clearer. In the first half of 2025, startups across MENA attracted $2.1 billion across 334 deals — a 134% year-on-year increase — with about $930 million (44%) of that coming from debt. Even excluding debt, equity funding still rose more than 50% year-on-year.

Put differently: it’s no longer unusual for the region to see several hundred million dollars of startup capital deployed in a single month.

Saudi Arabia and the UAE pull ahead — but the pie is growing

The surge is not evenly distributed. In H1 2025:

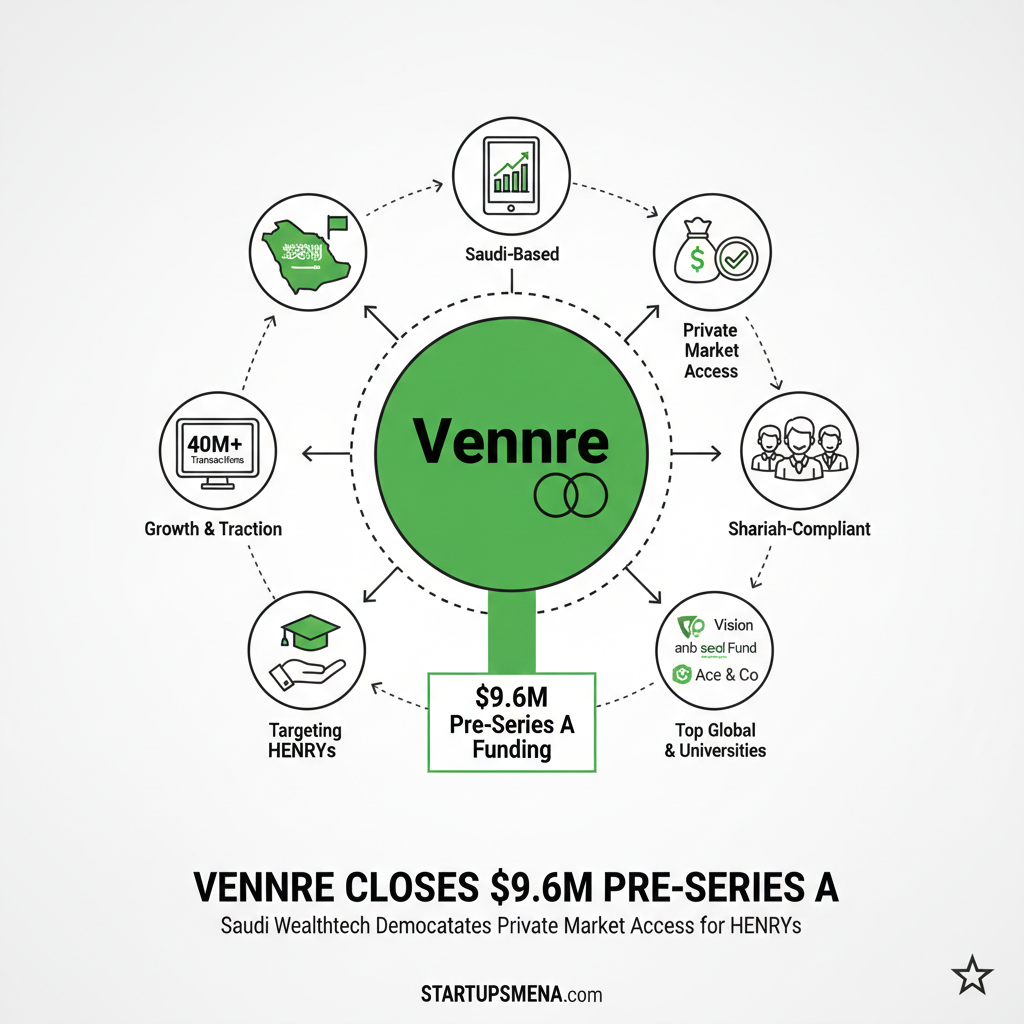

- Saudi Arabia attracted about $1.34 billion, representing 64% of all startup funding in MENA, helped by sovereign-backed programs, strong fintech momentum, and increased global investor participation.

- The UAE drew $541 million across 114 deals, up 18% year-on-year, with fintech, insurtech, and Web3/AI leading the pack.

- Egypt still punched above its macro headwinds, with funding more than doubling to $179 million over 52 deals, driven by fintech, proptech, and e-commerce.

Under the surface, several trends stand out:

- Debt and revenue-based financing are now a mainstream tool, not a novelty.

- Mid-stage (Series A) and growth rounds are increasing in size, suggesting more companies are breaking out of seed purgatory.

- B2B and infrastructure plays — rather than pure consumer apps — are absorbing a large share of capital.

What this means for founders — and for the ecosystem

For founders, a near–$500m-per-month run rate isn’t just a vanity stat. It changes the calculus:

- More instruments to choose from: It’s no longer “equity or nothing.” Debt, venture debt, and structured facilities give startups new ways to extend runway without heavy dilution.

- Deeper late-stage capital: As more regional funds raise larger vehicles — and global investors get comfortable with the region — breakout companies have a clearer path to scaling rather than exiting early.

- Sector specialization: Fintech, AI, logistics, and enterprise SaaS are attracting repeat attention, which tends to produce better support networks, repeat founders, and playbooks.

But the capital boom also brings new pressure: traction, governance, and profitability expectations are rising. The days of “growth at any cost” are unlikely to return; instead, founders are being asked to show disciplined growth, strong unit economics, and a credible path to profitability even as they raise larger rounds.

Editor’s Note — The Startups MENA Team

We’re entering a phase where the story is less about whether capital exists, and more about what kind of capital founders choose. The rise of debt and structured financing — alongside traditional equity — could reshape how MENA startups think about dilution, runway, and risk. Our lens going forward: track not just the size of rounds, but the quality of capital, the terms behind it, and how it ultimately translates into durable companies rather than headline numbers.– By The Startups MENA Editorial Desk