When a founder in Dubai refreshed her inbox on 3 November, the headline was hard to miss: “MENA startup funding drops to $785 million in October, 72% driven by debt.” After September’s euphoria, it sounded like the party was over.

Look closer, though, and October is less a crash and more a reset — one that reveals who gets funded, how, and on what terms.

This piece unpacks what the shift really means for founders, investors, and operators across the region.

From Record-Breaking September to a “Normal” October

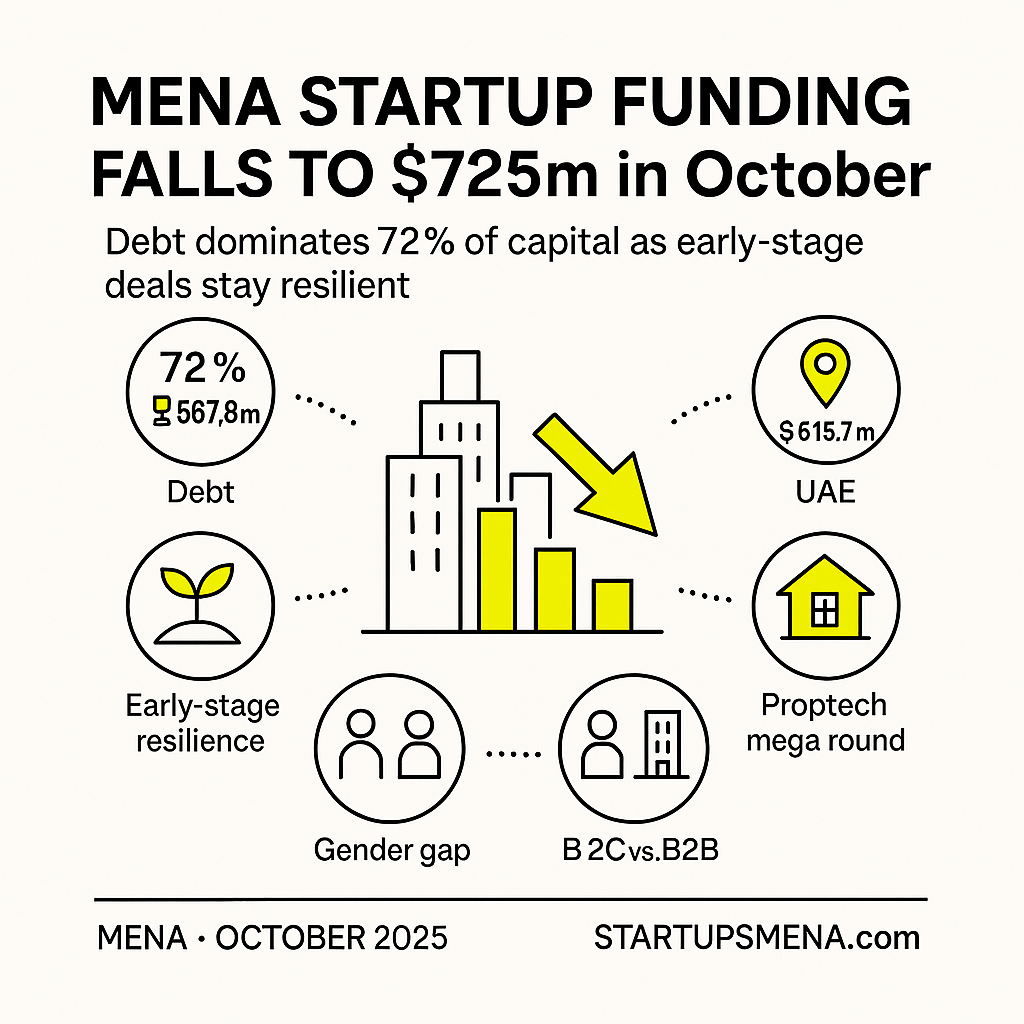

After a record-breaking September, MENA startup funding cooled sharply in October:

- Total October funding: about $784.9 million across 43 deals

- Month-on-month change: roughly down 77% from September’s surge of around $3.5 billion

- Year-on-year change: still up strongly compared to October last year

In other words: compared to September’s megadeal-fuelled spike, October looks like a comedown. Compared to last year, it looks like a booming ecosystem.

September itself was an outlier: multiple large transactions, heavy on debt, pushed quarterly funding to around $4.5 billion — one of the strongest quarters the region has seen.

October, by contrast, shows what the market looks like without multi-billion-dollar rounds distorting the curve. It’s a reminder that founders should benchmark against trendlines, not headlines.

Debt Has Quietly Become the Main Engine of Capital

The most important line in the October data isn’t the total; it’s the composition:

- Debt funding: around $567.8 million across just 4 deals

- Share of total capital: roughly 72%

- Equity and other instruments: about $217 million

Debt is no longer a niche tool reserved for a handful of late-stage companies — it’s shaping the capital structure of the region’s biggest rounds. Property Finder’s roughly $525 million debt raise in the UAE alone defined the month’s narrative and tilted both sector and country rankings.

For founders, this signals three things:

- If you’re asset-heavy or revenue-generating, debt options are expanding.

- If you’re early-stage and pre-revenue, equity is still your main path — but later, you may face a more debt-heavy cap table.

- Investors are looking for capital-efficient growth, using debt to extend runway and finance scale without as much dilution.

The message is clear: understanding venture debt is now part of MENA’s founder toolkit, not a nice-to-have.

UAE Reclaims the Funding Crown as Egypt Rebounds

October reshuffled the regional leaderboard:

- UAE: roughly $615.7 million across 15 deals, driven largely by Property Finder’s debt round

- Saudi Arabia: about $119.3 million across 15 deals

- Egypt: around $33.3 million across 5 deals, beating its entire Q3 total of about $22.3 million across 22 startups

- Morocco: roughly $12.3 million across 3 deals, holding its position for a second consecutive month

A few key reads:

- The UAE is once again the gravitational center of megadeals, especially for capital-intensive verticals like proptech.

- Saudi Arabia remains highly active by deal count, but October’s headline numbers shifted back toward Dubai and Abu Dhabi.

- Egypt’s rebound matters. After a muted Q3, seeing more capital concentrated in fewer but larger rounds suggests investors are selectively re-engaging with the market.

For founders outside the Gulf, particularly in North Africa, October is an encouraging sign that capital hasn’t forgotten them — but expectations are stricter, and stories must be sharper.

Proptech Overtakes Fintech — Thanks to One Mega Round

For months, fintech has dominated the regional funding narrative. October flipped that script:

- Proptech: around $526 million, almost entirely off the back of Property Finder’s debt raise

- SaaS: roughly $60 million

- Gametech: about $41.6 million from a single deal

Fintech, which typically sits at or near the top, fell to ninth place by value with about $12.5 million across seven deals— though it remained the most active sector by deal count.

The takeaway isn’t that

fintech is fading. Instead:

- Single mega-rounds are enough to rewrite sector tables for any given month.

- Proptech is clearly entering its own “scale phase”, especially in markets where real estate, data, and financing intersect.

- Fintech activity is broadening, but with fewer outsized tickets in October.

Founders in both sectors should note: investor appetite is intact, but the bar for large equity cheques in fintech appears to be rising, while proptech is enjoying its moment in the spotlight.

Early-Stage Startups Still Command Investor Attention

Despite the dominance of debt and later-stage capital in headline figures, the underlying deal flow tells a more grassroots story:

- Only one Series B round was recorded in October — at about $50 million.

- Early-stage deals (from grants to Series A) accounted for more than 30 of the 43 transactions, raising roughly $95.2 million.

This shows that:

- Investor interest in seeding new ideas remains strong, even as global markets stay cautious.

- The region is still multiplying the pipeline of future Series B and C candidates, rather than relying only on a handful of giant winners.

If you’re a founder at the pre-seed, seed, or Series A stage, October’s numbers underline a simple truth: the door is open — but you must be disciplined on valuation, unit economics, and clarity of business model.

B2C Models Are Back in Vogue

Recent years have seen a strong tilt toward B2B as “safer” and more predictable. October pushed back on that narrative:

- B2C startups raised around $594.7 million across 9 rounds

- B2B startups raised roughly $166 million across 28 rounds

- 8 startups ran hybrid models, blending consumer and enterprise offerings

The skew toward B2C is partly structural — large consumer platforms can absorb substantial debt and growth capital. But it also reflects:

- Rising digital consumption across the region

- The maturity of consumer-facing categories like proptech, mobility, fintech, and entertainment

- A willingness by investors to back proven consumer behavior at scale

For founders, this doesn’t mean “pivot to B2C.” It means your business model story needs to be precise: who pays, when, and why this model can scale efficiently in MENA’s diverse markets.

The Gender Gap Is Widening — Again

One of the most sobering data points in the October report is gender:

- Male-led startups captured around 93% of total funding

- Female-founded startups raised about $4.5 million across three rounds

- Mixed-gender teams secured roughly $51 million

This is not a one-off fluctuation; it reflects a persistent structural imbalance in where capital flows.

For an ecosystem that aspires to global competitiveness, these numbers are a warning signal:

- Diverse founding teams are still struggling to access later-stage capital.

- Pipeline initiatives alone aren’t enough; fund design, LP expectations, and decision-making tables all matter.

Founders and investors alike will need to treat gender equity not as a CSR talking point, but as a core part of how resilient, innovative ecosystems are built.

What October Really Tells Founders Heading into Q4

It’s tempting to read October as a “cooldown” after an extraordinary September — and it is. But more importantly, it shows what kind of growth the region is rewarding:

- Debt-backed scaling for mature, asset-heavy or cash-generating businesses

- Steady, selective support for early-stage founders with credible paths to product–market fit

- Strong national hubs (UAE, Saudi Arabia) balanced by emerging rebounds in Egypt and steady activity in markets like Morocco

- A sector mix that’s broadening beyond fintech, with proptech, SaaS, and gametech stepping forward

Despite month-to-month volatility, 2025 is shaping up as a landmark year for tech investment in MENA. The overall direction of travel is clear:

This is not a funding winter — it’s a funding market that is more precise, more structured, and more demanding than ever.

The opportunity is real. So is the scrutiny.

Editor’s Note — The Startups MENA Team

At Startups MENA, we don’t look at funding reports as just numbers on a chart. We see them as a live dashboard of how the region is choosing to build its future economy.

October’s $785 million in funding — 72% of it powered by debt — tells us that MENA is maturing from a purely equity-driven, “grow at all costs” phase into a more capital-structured, risk-aware ecosystem. Late-stage companies are learning to scale with less dilution, while early-stage founders continue to attract belief at the idea and product–market fit stages.

But the data also exposes fault lines. The widening gender gap and the concentration of megadeals in a handful of markets show that who gets funded, where, and on what terms is still uneven. If the region is serious about building a resilient innovation economy, these gaps must be treated as strategic risks, not side notes.

As MENA moves toward its various national visions — from Saudi Vision 2030 to the UAE’s Centennial 2071 and beyond — startup capital is becoming more than fuel for individual companies. It is infrastructure for the next generation of jobs, technologies, and industries.

Our editorial commitment is to track not only how much money flows, but how wisely it is deployed — and whose stories are amplified or overlooked along the way.

— The Startups MENA Editorial Team