Egyptian-founded, Saudi-headquartered Intella is betting that Arabic dialects aren’t a “localisation problem” for global AI, but the foundation of a new regional infrastructure play.

A New Milestone for Arabic Speech AI

On a recent e-commerce demo, shoppers didn’t scroll, type, or tap. They simply spoke in colloquial Egyptian Arabic — and an AI “digital human” called Ziila understood, guided them through products, and completed the order.

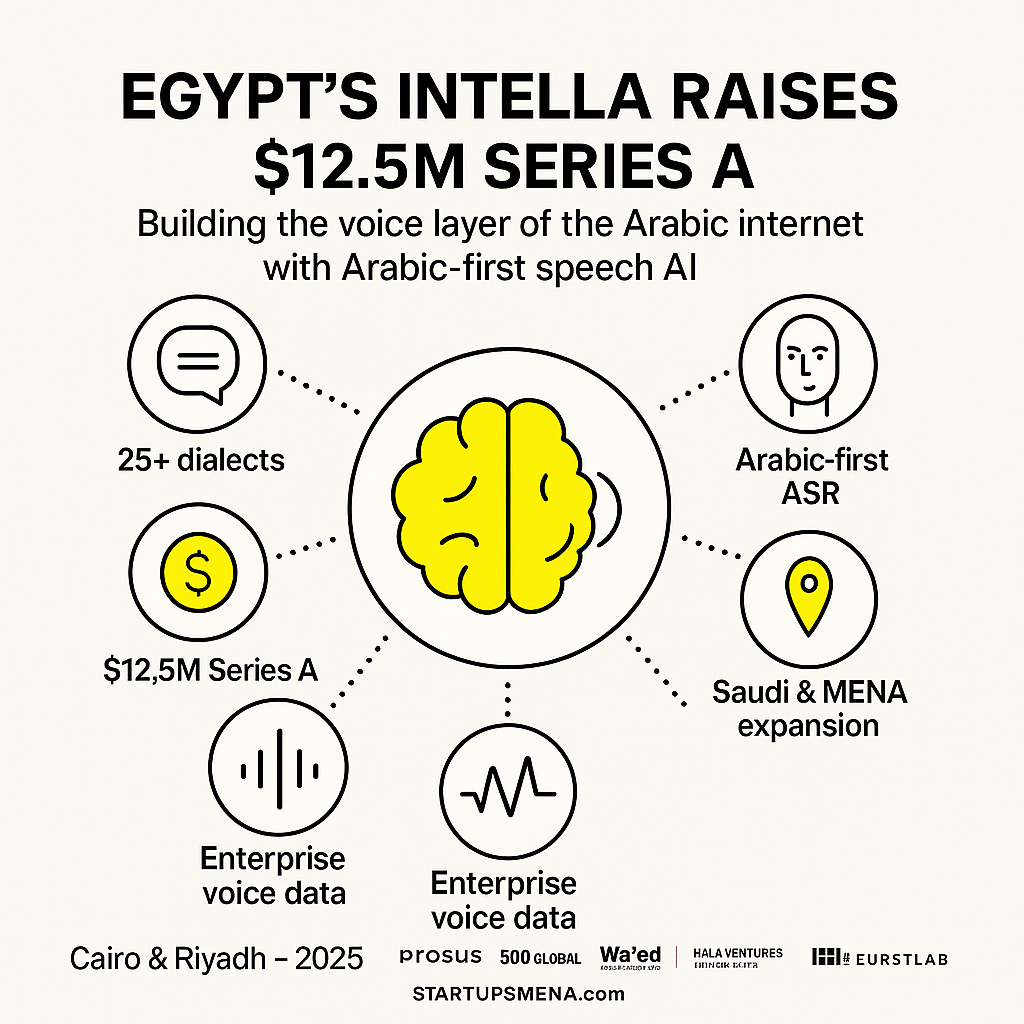

Behind that experience is Intella, an Arabic speech intelligence startup that has closed an oversubscribed $12.5 million Series A round.

The round is led by global tech investor Prosus, with participation from 500 Global, Wa’ed Ventures, Hala Ventures, Idrisi Ventures, and HearstLab, the investment arm of Hearst Corporation.

Founded in 2021 by CEO Nour AlTaher and CTO Omar Mansour, Intella began in Egypt and now operates from Saudi Arabia as it scales across the Middle East and North Africa. Its mission: build Arabic-first AI models that actually understand how people in the region really speak — across different dialects, contexts, and industries.

This new round brings Intella’s total funding to $16.9 million, following a pre-Series A raise and earlier seed capital.

Why Arabic Still Challenges Global AI

Arabic is one of the world’s most widely spoken languages, but most commercial AI systems are still built and tuned primarily for English and a small set of other languages. For Arabic, two structural issues stand out:

- It’s many dialects, not one language

Daily life happens in Egyptian, Gulf, Levantine, Maghrebi, and other dialects, while Modern Standard Arabic is mostly reserved for news, education, and formal communication. Intella’s models are trained on more than 25 Arabic dialects, enabling them to handle real-world conversations instead of just textbook Arabic. - Voice data is still “dark” for most enterprises

Contact centers, banks, telecoms, and government hotlines handle millions of calls every day. But much of that audio is never reliably transcribed or analyzed, because generic tools struggle with dialectal speech. This leaves businesses sitting on huge volumes of customer insight they can’t fully access.

Intella wants to change that by turning spoken Arabic into a structured, searchable, and actionable data layer — transforming calls, voice notes, and media content from dark data into a strategic asset.

Inside Intella’s Arabic-First AI Stack

Intella describes itself as a speech intelligence company rather than a simple transcription service. Its platform brings together several layers that enterprises can mix and match:

- Dialectal Speech Recognition (intella Voice / intellaVX)

Proprietary speech-to-text models tuned for regional Arabic dialects, delivering high accuracy on real-world conversations where global tools typically fail. - Contact Center Intelligence (intellaCX)

A suite that transcribes, scores, and analyzes calls at scale. It tracks key performance indicators, sentiment, agent behavior, and recurring customer issues, helping operations teams move from sample-based QA to full coverage analytics. - Media and Content Transcription (intellaMX)

Tools for batch transcribing and subtitling podcasts, video, and broadcast content in Arabic, with the option to translate into English for cross-border distribution. - Ziila – The Arabic Digital Human

A conversational AI agent built natively for Arabic. Ziila can handle voice-based journeys such as product discovery, order placement, customer support, and FAQs. Its early use cases include voice ordering experiences in Egyptian Arabic for e-commerce.

Together, these products are designed to give enterprises a full loop: listen to customers, understand them at scale, respond in real time, and continuously learn from every interaction.

The Investors Backing Intella’s Bet

The Series A round is as much a signal as it is capital.

Around the table are:

- Prosus Ventures – one of the world’s most active tech investors in emerging markets, with a track record of backing infrastructure-like companies.

- 500 Global – a global early-stage fund with deep experience in MENA and a history of supporting founders building for the region.

- Wa’ed Ventures – the venture arm of Saudi Aramco, reinforcing Intella’s strategic presence in Saudi Arabia.

- Hala Ventures and Idrisi Ventures – regional investors with strong local networks.

- HearstLab – an investor with roots in media and content, relevant to Intella’s transcription and media intelligence products.

For these investors, Intella represents a broader thesis: that Arabic language AI is not a niche feature, but a critical enabler of the region’s digital and AI transformation.

From Cairo Roots to a Regional AI Workforce

Intella’s journey reflects a familiar MENA pattern: start in one market, scale across borders, and then anchor in a regional hub.

Originally founded in Cairo, the company is now Saudi-based while maintaining teams in Egypt and working with customers across the GCC and wider region.

Key growth signals include:

- Deployments across finance, telecom, government, and e-commerce, where contact centers and customer experience teams are under pressure to digitalize.

- Strong year-on-year revenue growth, with expectations of further acceleration as more enterprises shift from pilot projects to production AI systems.

- Strategic partnerships that embed Intella’s technology into broader cloud and AI ecosystems, extending its reach beyond standalone deployments.

With the new capital, Intella plans to expand its R&D, broaden its product suite, and hire across technical and commercial roles to build what it calls a “digital AI workforce” for Arabic-speaking markets — AI agents and tools that can handle frontline tasks in support, sales, and operations.

Why This Round Matters for MENA’s AI Future

Intella’s Series A lands at a time when MENA governments and enterprises are actively defining their AI roadmaps, from national strategies to sector-specific automation.

The raise is significant for several reasons:

- Localization as a Core Problem, Not a Side Task

Intella isn’t waiting for global models to “catch up” on Arabic. It is building Arabic-first models from the ground up, tuned to local speech patterns, slang, and cultural context. That approach moves localization from the margins to the core of the product. - Voice as the Region’s Most Natural Interface

In many markets, voice can be more intuitive than complex interfaces or long forms. Reliable Arabic voice AI could help onboard millions of users to digital services, especially in segments where reading, writing, or navigating apps is a barrier. - From Experimental AI to Operational AI

By anchoring its products in measurable business outcomes — reduced handling time, higher customer satisfaction, better quality assurance — Intella is part of a broader shift from AI proofs-of-concept to mission-critical systems in production. - Owning the Language Layer

Just as payment rails and logistics networks became foundational in earlier waves of digitalization, the language and conversation layer is emerging as a new kind of infrastructure. Intella’s ambition is to be that layer for Arabic.

If it succeeds, Intella could become the default choice for enterprises, platforms, and even global companies that want to operate natively in Arabic — not as an afterthought, but as a first-class citizen in their AI stack.

Editor’s Note — The Startups MENA Team

At Startups MENA, we focus on the technologies and founders that define how this region builds its next-generation innovation economy. Intella’s $12.5 million Series A is more than a funding milestone for one startup; it’s a signal that language itself is becoming strategic infrastructure in MENA.

By building Arabic-first speech and conversational AI, Intella is not just solving a technical challenge. It is encoding dialects, accents, and everyday conversations into a form machines can understand, transforming unstructured voice data into an engine for insight and automation.

As MENA economies move toward ambitious 2030 and 2050 visions, competitiveness will depend on systems that understand people the way they actually live and speak — in Egyptian, Gulf, Levantine, Maghrebi, and beyond. For Arabic speakers, the next leap will come from AI that doesn’t just translate words, but truly grasps context and intent.

This moment marks a defining chapter in the region’s AI journey: one where owning the language layer could be as important as owning the rails of finance, logistics, or energy. Intella’s trajectory will be a key indicator of whether the region can build — and eventually export — that capability at global scale.

— The Startups MENA Editorial Team