On a narrow street in Casablanca, the neighbourhood hanout is quietly becoming more than a place to buy tea and sugar. Customers can top up their phones, pay bills and, increasingly, access financial services — all powered by a startup most people never see: Chari.

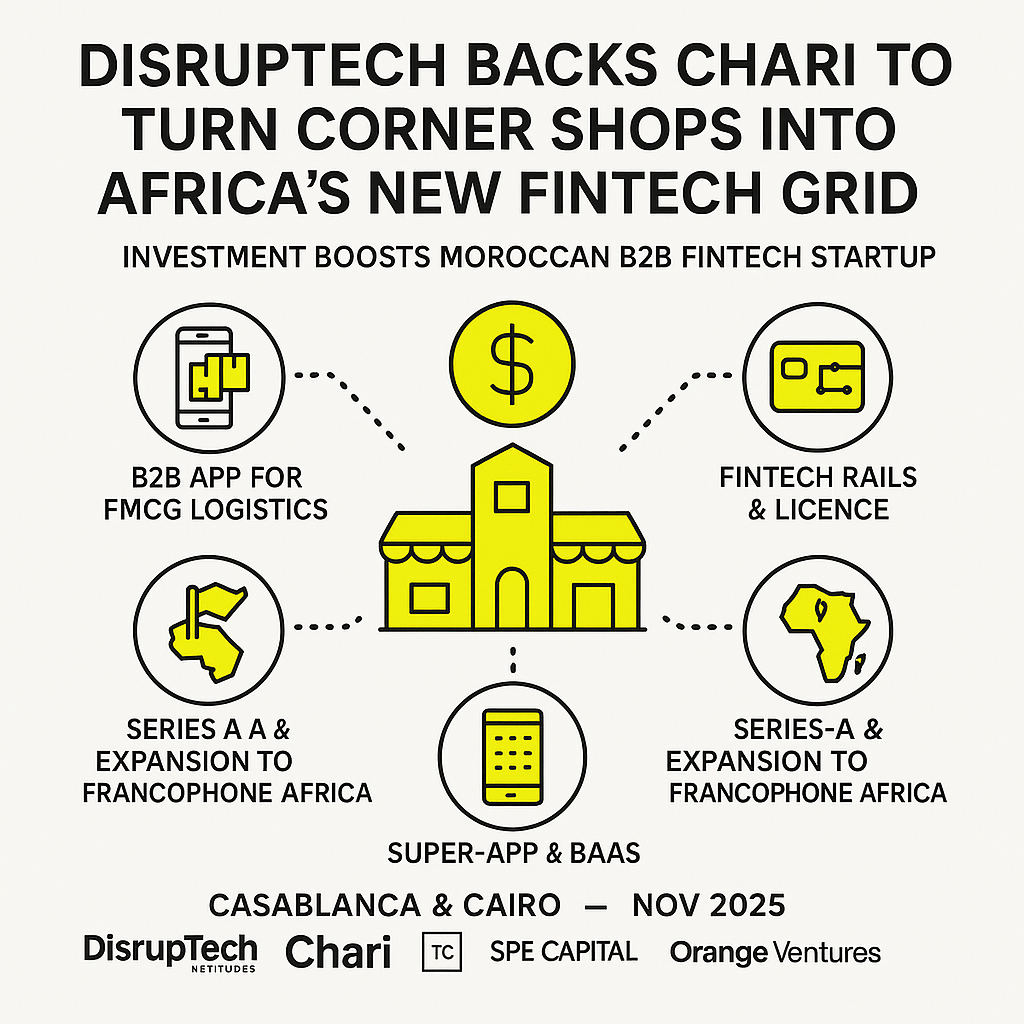

That quiet infrastructure is now getting a cross-border boost. Egypt-based VC firm DisrupTech Ventures has invested in Chari, the YC-backed Moroccan B2B e-commerce and fintech platform, in a deal that marks DisrupTech’s first bet in Morocco and only its second investment in Africa outside Egypt.

Beyond the cheque, DisrupTech is taking a board seat, signalling a hands-on push to scale Chari’s fintech rails and turn thousands of informal retailers into last-mile financial access points across Francophone Africa.

For North Africa’s startup ecosystem, this is more than a funding headline. It’s a glimpse of how homegrown capital, regulation and infrastructure are starting to align around one of the region’s toughest problems: how to bank the informal economy at scale.

From Corner Shops to Financial Access Points

Founded in 2020 by husband-and-wife team Ismael Belkhayat and Sophia Alj, Chari started as a B2B app that lets small retailers order FMCG products and get them delivered in a matter of hours.

Over time, that logistics layer became a bridge into fintech:

- Retailers use the app to stock their shelves from multiple distributors

- Chari’s data shows what sells, where and how often

- That transaction graph becomes the basis for credit scoring and embedded finance

The company now works with tens of thousands of traditional proximity stores, with more than 20,000 retailers already onboarded in Morocco alone.

Crucially, Chari is not only a marketplace. It has secured a payment institution licence from Bank Al-Maghrib, Morocco’s central bank, enabling it to:

- Issue IBANs and debit cards

- Process domestic and cross-border transfers

- Embed bill payments and micro-insurance into the merchant experience

In practice, that turns each shop into a micro-branch for digital financial services — particularly powerful in communities where traditional banks are distant, intimidating or simply absent.

Why DisrupTech Is Crossing Borders for Chari

DisrupTech Ventures is a Cairo-based VC firm built around one thesis: fintech is the fastest way to modernise how money moves in emerging markets. Until recently, that thesis was applied almost exclusively in Egypt.

By backing Chari, DisrupTech is making three strategic moves at once:

- Geography – entering Morocco, one of Africa’s fastest-maturing startup markets, where early-stage capital is still relatively concentrated in a handful of funds.

- Segment – doubling down on informal retail, a sector that handles a majority of consumer spend but remains largely off the grid.

- Infrastructure – betting on a startup that already has regulatory approval and live rails, not just a pitch deck.

Managing Partner Mohamed Okasha has described Chari’s model as a new way to deliver financial services “from the grassroots up” by empowering small shops to become gateways for payments and credit.

The fund’s new board seat means this is not a passive allocation. DisrupTech is positioning itself as a long-term partner in Chari’s transition from B2B marketplace to regional fintech infrastructure provider.

Series A, Super-App Ambitions and BaaS

DisrupTech’s entry comes on the heels of a landmark raise for Morocco.

Less than a month before the new investment, Chari closed a $12 million Series A round, co-led by SPE Capital and Orange Ventures, with participation from regional and global investors. It is widely reported as the largest Series A to date in Morocco’s startup ecosystem, bringing Chari’s total funding to around $17 million.

That capital is earmarked for three big bets:

- Building a super-app for merchants that bundles ordering, inventory, logistics, payments and credit into a single interface

- Scaling a Banking-as-a-Service (BaaS) platform that opens Chari’s licensed rails to third parties — from other startups to corporates needing compliant payments infrastructure

- Expanding its footprint in Francophone Africa, where retail is still dominated by small shops rather than modern trade

Co-founder and CEO Ismael Belkhayat has framed it simply: once Chari’s payment rails were robust enough for its own needs, the logical next step was to open them to others — turning a single startup’s infrastructure into a shared backbone for the ecosystem.

That evolution — from app to infrastructure — is where DisrupTech’s fintech specialisation and board presence are likely to matter most.

A New Axis for African Fintech Inclusion

The DisrupTech–Chari deal illustrates a broader shift in African tech:

- Pan-African capital, not just global VC, is now backing scaling rounds in regulated sectors

- Fintech is moving from consumer apps towards embedded, B2B and infrastructure-level plays

- Informal retail is being recast from “too messy to underwrite” to data-rich and credit-worthy

By digitising orders, payments and cashflows for thousands of shops, Chari is creating visibility where there was previously opacity. For banks, lenders and insurers, that visibility is the missing ingredient to design products for micro- and small businesses at scale.

For Morocco and Egypt, the partnership also tightens a North African fintech corridor:

- Moroccan regulation and market depth

- Egyptian fintech expertise and capital

- A shared focus on financial inclusion as economic policy, not just a startup buzzword

If it works, thousands of corner shops will effectively become on-ramps into Africa’s formal financial system — without losing the trust and familiarity they already hold in their neighbourhoods.

Key Takeaways for Founders and Operators

1. Infrastructure is the real moat

Chari’s advantage is not only its app or brand, but its regulated payment rails, licence and distribution network. Startups that own the rails others build on are better positioned to outlast hype cycles.

2. Informal doesn’t mean unstructured

When digitised, informal retail can generate some of the most predictable, high-frequency data in emerging markets. That data is the foundation for smarter credit, insurance and working capital products.

3. Cross-border founder–investor fit matters

An Egyptian fintech-focused fund and a Moroccan retail-fintech operator are combining lessons from two of Africa’s most sophisticated ecosystems. Expect to see more such cross-border pairings as MENA and Africa’s startup hubs become more interconnected.

Editor’s Note — The Startups MENA Team

At Startups MENA, we track the stories that show how the region is quietly wiring its own financial infrastructure. DisrupTech’s investment in Chari is one such inflection point: a homegrown VC from Egypt backing a licensed fintech in Morocco to turn everyday shops into nodes in Africa’s digital economy.

This is more than a funding extension. By pairing fintech regulation, retail distribution and cross-border capital, Chari’s model reflects where MENA is headed — from isolated markets and cash-heavy transactions to an integrated corridor where small merchants become the backbone of financial inclusion.

As North African ecosystems continue to mature, the narrative is shifting from importing solutions to exporting infrastructure. Deals like this one signal a new chapter in the region’s evolution — where capital, talent and regulation collaborate to build platforms that are not just valuable, but foundational.

— The Startups MENA Editorial Team