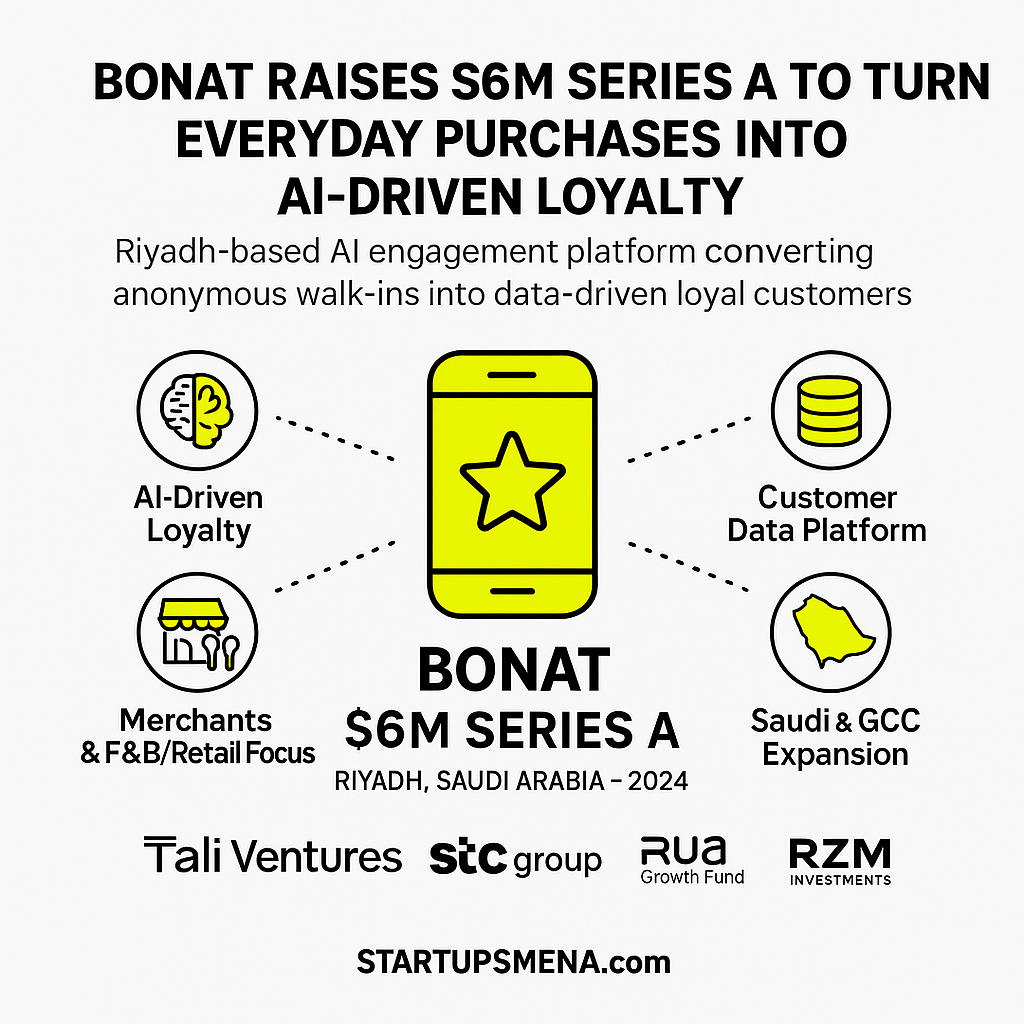

Riyadh-based AI customer engagement platform Bonat has raised a $6 million Series A round led by stc group’s corporate venture arm Tali Ventures, in a bid to help merchants convert anonymous walk-ins into loyal, data-rich customers.

From Anonymous Walk-Ins to Trackable Relationships

For many Saudi retailers and F&B brands, a familiar pattern still defines the day: customers walk in, pay, and leave—without leaving behind much more than a receipt. Little data, no clear picture of who they are, and almost no structured way to bring them back.

Bonat, founded in 2019 by Saud Binsaeed, was built to change that. The platform plugs into merchants’ existing systems and turns everyday transactions into a living customer database. Using AI, it analyses behaviour and triggers personalised campaigns—nudging customers to return, spend more, and stay loyal.

Today, Bonat says it serves thousands of retailers and F&B brands across Saudi Arabia and connects with over six million end users. For a growing slice of the Kingdom’s offline and omnichannel businesses, it is becoming the hidden layer where customer relationships are recorded, understood and activated.

The Round: A Strategic $6 Million Series A

Bonat’s $6 million (SAR 23 million) Series A is led by Tali Ventures, the corporate venture capital arm of stc group. The round also includes anb Seed Fund, Rua Growth Fund, RZM Investments, and a network of angel investors.

For stc and Tali Ventures, the deal extends a strategy of backing AI-native and SaaS infrastructure that sits on top of the group’s connectivity and cloud capabilities. Customer engagement—and the data that powers it—is increasingly seen as part of the digital backbone of the Saudi economy, not just a marketing add-on.

The new capital will focus on three priorities:

- Deepening AI capabilities to make engagement more predictive and automated.

- Scaling personalised campaign automation, so merchants can target customers based on real behaviour rather than broad demographic guesses.

- Expanding across Saudi Arabia and the wider GCC, and beyond F&B into sectors like retail and services that share the same retention challenges.

With this raise, Bonat moves from early product–market fit into a scale-up phase, with both capital and strategic alignment behind it.

Inside Bonat’s Stack: Loyalty, Data and Automation in One Platform

Bonat positions itself as an all-in-one customer engagement and loyalty operating system for merchants. Its core capabilities can be grouped into five layers:

- Loyalty & Rewards

Customisable loyalty programmes, points and rewards that integrate with in-store POS and online channels, replacing stamp cards and fragmented schemes. - Customer Data & Segmentation

A central customer database built from transactions and interactions, enabling segmentation by visit frequency, spend, recency and other behaviours. - Behaviour-Based Marketing Automation

Campaigns triggered automatically—like reminding customers who haven’t visited in a set period, or rewarding high-spend, high-frequency visitors—across SMS, email and other channels. - Digital Wallets, Gift Cards & Subscriptions

Tools for issuing stored-value balances, gift cards and subscription-like offers that create pre-paid revenue and increase customer stickiness. - Analytics & Feedback

Dashboards that show retention, frequency, average ticket size and campaign performance, complemented by customer ratings and feedback to close the loop.

For merchants, the value proposition is straightforward: less guesswork and more repeat revenue, without needing a dedicated data or growth team.

Customer Data Becomes Infrastructure

Bonat’s raise lands at a moment when customer data is shifting from “nice-to-have” insight to core infrastructure in Saudi business.

Research suggests that software spend on customer success and CRM tools in the Kingdom is growing rapidly, as companies move from manual tracking and generic campaigns to structured, data-driven engagement. SMEs and mid-market businesses, which historically relied on intuition and simple promotions, are now under pressure to compete in a cashless, digitised and highly measurable environment.

Bonat sits precisely at this intersection:

- It looks like CRM from a business owner’s perspective: customer profiles, segments and campaigns in a single dashboard.

- It behaves like a customer success platform, obsessed with outcomes such as retention, repeat visits and lifetime value.

For investors, that means Bonat is not just another loyalty app—it is a potential infrastructure layer for how Saudi merchants own and grow their customer relationships over the next decade.

Founder’s Vision: Turning Every Interaction into Revenue

Founder and CEO Saud Binsaeed has framed the Series A as the start of Bonat’s next chapter: scaling faster, advancing AI integration and giving merchants tools to “turn every customer interaction into revenue growth.”

Practically, that vision translates into three shifts:

- From static points to intelligent engagement

Moving beyond simple earn-and-burn schemes towards AI-powered recommendations that decide which offer to send, to whom, and when. - From F&B-only to multi-vertical

Extending the same engagement logic into broader retail and services, especially multi-branch operators that need consistent, cross-location customer strategies. - From siloed tools to integrated journeys

Integrating more deeply with payments and mobile wallets, so the entire customer journey—from first visit to repeat purchase and win-back—is visible and actionable from one place.

If Bonat executes this roadmap, it has a credible shot at becoming the default engagement platform for SMEs across Saudi Arabia and, over time, parts of the wider GCC.

Signals for MENA SaaS Founders

Beyond the headline number, Bonat’s Series A offers several useful cues for founders building B2B SaaS in the region:

- Solve problems close to the till

Bonat doesn’t sell abstract “AI transformation.” It sells higher retention, bigger baskets and more frequent visits—outcomes that show up in a P&L and are easier to justify in SME budgets. - Start vertical and local, then expand

By focusing first on Saudi F&B and retail, Bonat built deep integrations, Arabic-first UX and playbooks tailored to local behaviour—advantages that globally oriented CRMs often lack. - Align with national digital agendas

Positioning as an enabler of Vision 2030’s cashless, digital commerce goals makes it easier to partner with telcos, banks and corporates that are under similar mandates. - Treat AI as both feature and moat

As AI models become more accessible, the differentiator shifts to the data feedback loop. Bonat’s millions of interactions across merchants help it refine recommendations and build defensibility over time.

The Road Ahead

With a strategic lead investor in Tali Ventures and a syndicate aligned around the same thesis, Bonat now has the capital, partners and timing to scale.

The questions that will define its next phase include:

- Can it maintain product simplicity for SMEs while layering in more sophisticated AI capabilities?

- How quickly can it replicate its Saudi traction in other GCC markets with different competitive and regulatory landscapes?

- And, crucially, can it prove consistently that merchants who adopt Bonat see measurable, sustained lifts in revenue and retention?

What is clear is that the race to own customer relationships in MENA’s offline and omnichannel retail is intensifying—and Bonat has just strengthened its position on the grid.

Editor’s Note — From the Gulf Customer Growth Desk

At Startups MENA, we pay close attention to the infrastructure that quietly reshapes how value is created in the region. Bonat’s $6 million Series A is one such moment.

Customer engagement in Saudi Arabia is moving from instinct to instrumentation. When a neighbourhood café or boutique in Riyadh can understand who walks in, how often they return, and what truly keeps them loyal—without adding operational friction—that’s more than a software upgrade. It’s a new operating model for SMEs.

As Vision 2030 accelerates cashless payments, e-commerce and AI adoption, platforms like Bonat illustrate a deeper shift: loyalty is no longer defined by discounts and stamp cards, but by data, insight and personalised experiences. Merchants that treat customer information as a strategic asset—not an afterthought—will be the ones that navigate rising competition and tightening margins.

This funding round is therefore bigger than its cheque size. It signals a region where small and mid-sized businesses are no longer playing catch-up on innovation, but standing at the centre of an AI-powered, data-driven growth story.

— The Startups MENA Editorial Team