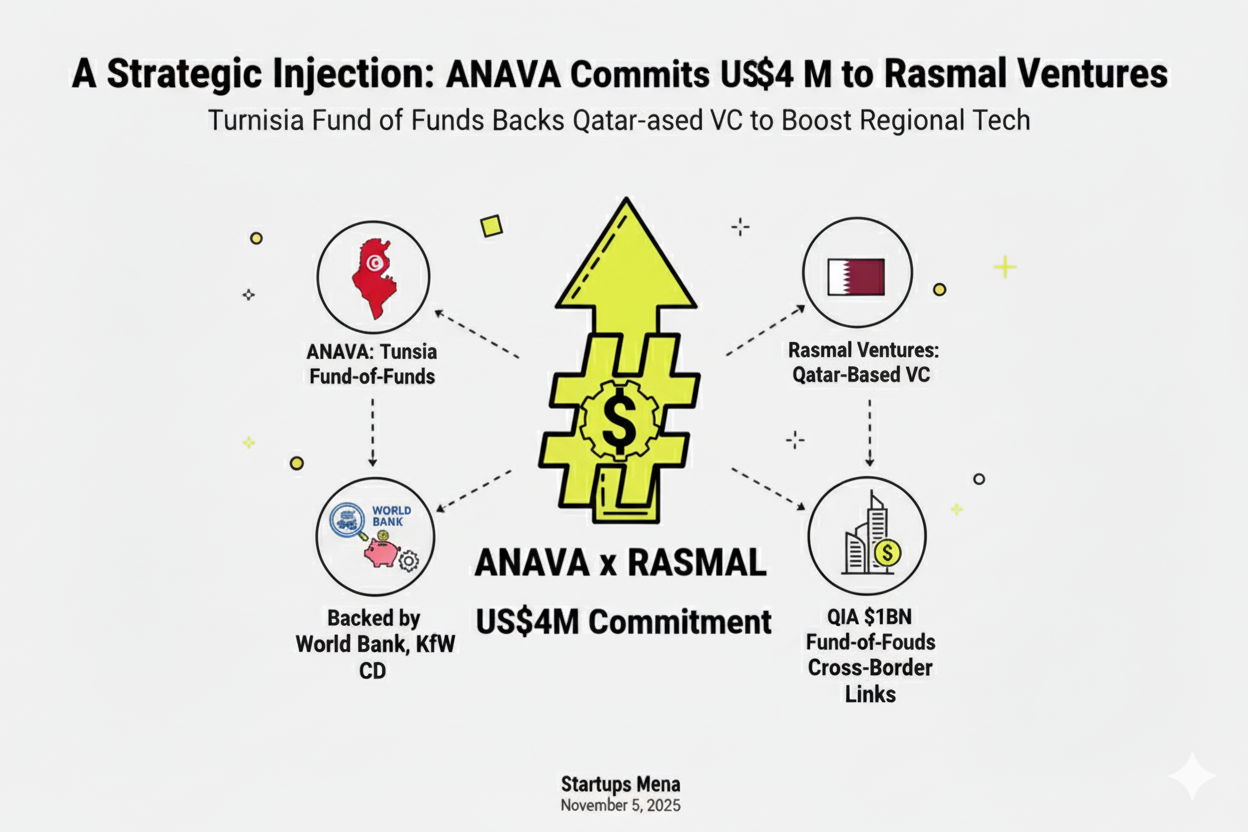

Tunisia’s ANAVA Fund of Funds has made a US$4 million commitment to Rasmal Innovation Fund I, the debut fund of Qatar-based Rasmal Ventures.

This move is designed to channel more international venture capital into Tunisian startups and to strengthen cross-border links between innovation hubs in the Middle East and North Africa (MENA).

Background: ANAVA’s Role & Fund-of-Funds Model

ANAVA operates as a public-private “fund of funds” initiative in Tunisia. Supported by entities such as the World Bank, Germany’s KfW Development Bank, and Tunisia’s Caisse des Dépôts et Consignations (CDC), ANAVA’s remit is to attract international fund managers who will deploy capital into Tunisian startups.

By investing in other VC funds rather than directly in startups, ANAVA leverages domestic public capital to multiply its impact via global VC partners.

Rasmal Innovation Fund I: Ambitions & Structure

Rasmal Innovation Fund I, managed by Rasmal Ventures, was launched in June 2024. It is the first vehicle selected under the Qatar Investment Authority (QIA) $1 billion Fund of Funds programme.

The fund is targeting a final close of ~US$100 million, after an initial $30 million was secured from QIA, corporates and family offices.

Its investment focus spans seed-to-Series B startups across fintech, B2B SaaS, healthtech and logistics—sectors identified as growth drivers in MENA.

What This Means for Tunisia’s Startup Ecosystem

By wiring capital through Rasmal’s MENA-wide platform, ANAVA is effectively opening up Tunisia’s startup ecosystem to broader regional capital flows and networks. The partnership signals international validation of Tunisia’s startup potential.

For Tunisian founders, this means more than money: potential access to regional investors, markets, mentors, and scaling opportunities across the MENA corridor.

Cross-Border VC Collaboration: A Blueprint?

This development illustrates a model of cross-border VC collaboration within the MENA region:

- A domestic platform (ANAVA) leverages public capital to anchor global partnerships.

- A regional fund (Rasmal) channels capital into local and regional startups, including from smaller ecosystems like Tunisia.

Such a blueprint may help smaller innovation hubs plug into larger pools of capital and talent beyond their borders.

Risks & Considerations

This is a promising alignment, but not without caveats:

- The flow of capital into Tunisia is only as strong as local deal flow and startup maturity. If there aren’t enough investable companies, the benefit may remain limited.

- Regional funds must balance focus between local impact (in Tunisia) and broader returns (MENA-wide) — tension may arise.

- Ultimately, the success will depend on whether Tunisian startups actually receive meaningful follow-on investment, scale regionally, and deliver returns.

The Bigger Picture: MENA’s Startup Momentum

The pairing of ANAVA and Rasmal comes at a time when the MENA startup ecosystem is on the move: increasing VC interest, institutional programs (such as QIA’s Fund of Funds), and maturing incubator/accelerator landscapes. By placing Tunisia into this mix, the country may become more visible and competitive as a tech hub.

Looking Ahead: Key Watch-Points

Deployment: Which Tunisian startups will Rasmal fund, and at what stage?

Scaling: Can those startups expand beyond Tunisia into MENA markets, powered by this linkage?

Follow-on Investments: Will this initial capital attract further rounds from other investors?

Ecosystem Strengthening: Will the partnership boost talent, mentorship and infrastructure in Tunisia?

Returns: Will the model deliver financial returns and impact such that it becomes repeatable?

Editor’s Note — From the Startups MENA Team

At Startups MENA, we continue to spotlight the partnerships shaping the future of regional innovation and cross-border collaboration. ANAVA’s US $4 million commitment to Rasmal Ventures’ MENA fund is more than a capital injection — it’s a strategic bridge linking Tunisia’s emerging startup scene with the wider regional venture ecosystem.

This move underscores a growing trend: North Africa’s high-potential founders are no longer operating on the periphery of the MENA innovation map. By channeling institutional backing from Tunisia into a regional fund like Rasmal, ANAVA is helping local talent tap into new markets, mentors, and capital sources — turning geographical borders into launchpads for growth.

As MENA’s investment landscape matures, collaborations like this one highlight how interconnected the region’s startup economies have become. The story isn’t just about funding; it’s about shared ambition — a collective belief that the next wave of transformative companies from the Arab world will scale not in isolation, but in unison.

— The Startups MENA Editorial Team