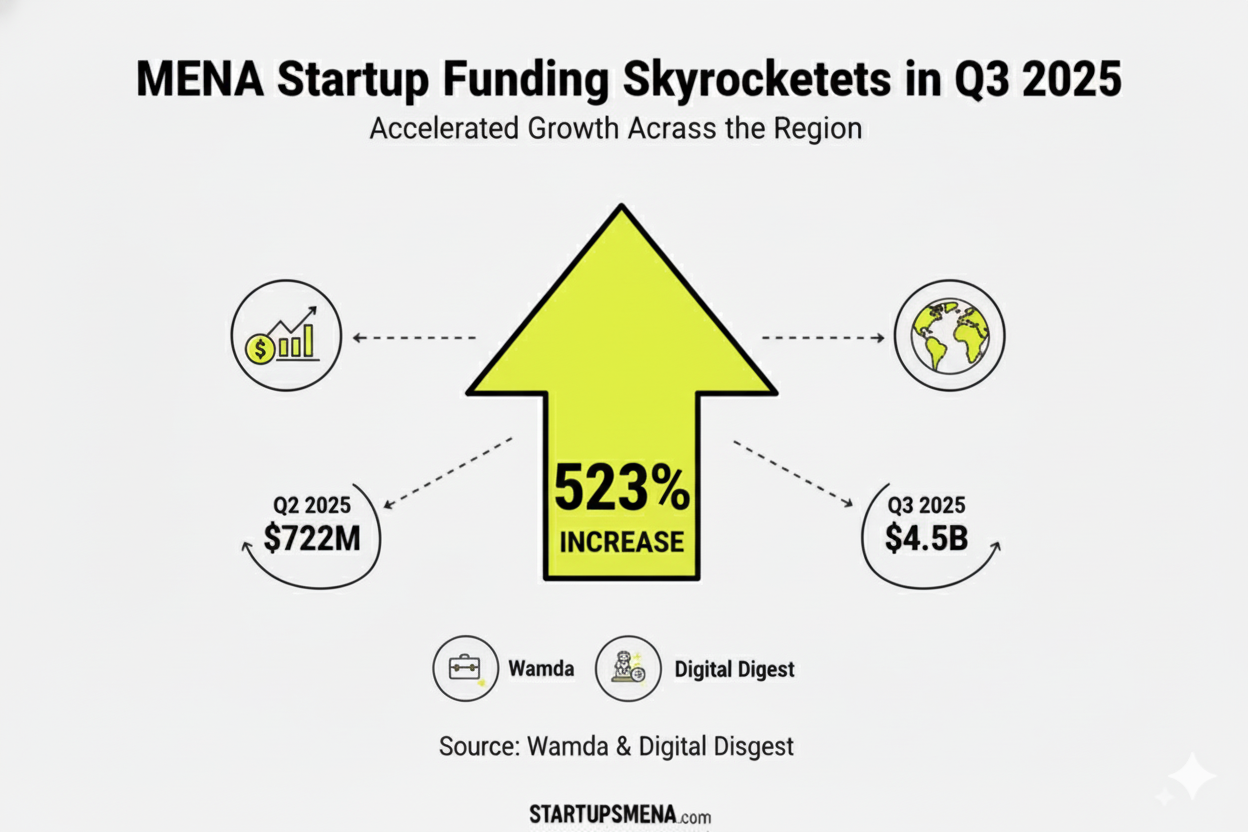

Startup investment across the Middle East and North Africa region soared to US$ 4.5 billion in the third quarter of 2025, marking a 523 % increase quarter-on-quarter, according to data compiled by Wamda and Digital Digest.

September Surge: The Month That Redefined MENA Startup Capital

The surge was largely driven by a record-breaking month of September, which alone accounted for roughly US$ 3.5 billion across 74 deals, up 914 % month-on-month and 1,105 % year-on-year.

Even when excluding around US$ 2.6 billion in debt financing, September remained one of the region’s most active months for startup funding, with equity rounds rising 147 % from August and 194 % versus the previous year.

Saudi Arabia and UAE Dominate MENA’s Startup Capital Landscape

- Saudi Arabia: Dominated the quarter, raising US$ 3.2 billion across 62 deals, with September alone seeing 25 startups secure about US$ 2.7 billion.

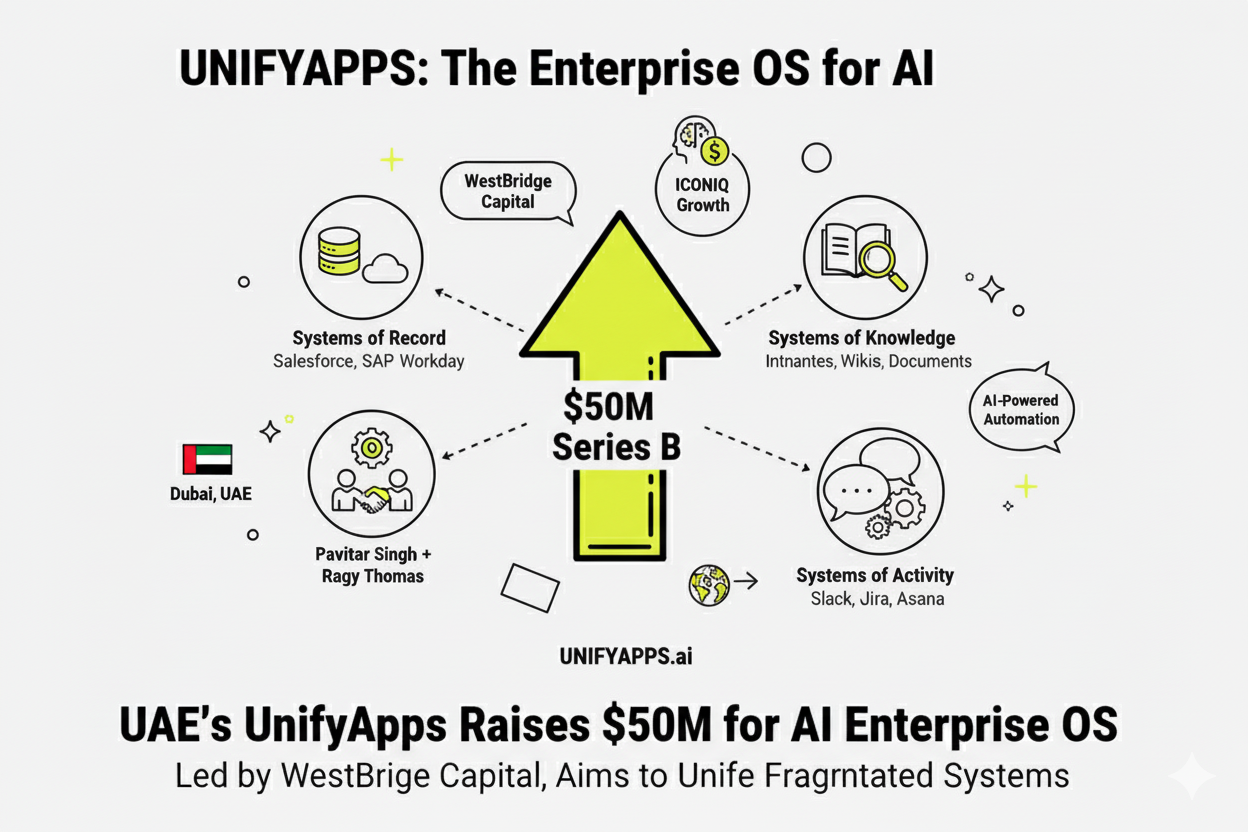

- UAE: The next major ecosystem, with 26 startups raising ~US$ 704.3 million in September, and a total of US$ 1.2 billion across 59 deals in Q3.

- Other markets: Oman recorded around US$ 7.7 million across 3 startups; Morocco raised US$ 6.8 million; Egypt just US$ 3.2 million — highlighting a wide disparity across the region.

Funding Flows by Sector: Fintech Tops, Proptech Gains Ground

- Fintech remained the dominant sector: US$ 2.8 billion raised across 25 deals in September alone (largely in Saudi Arabia).

- Proptech followed with about US$ 684 million in Q3, with one standout round of US$ 525 million (for Property Finder) nearly covering the entire segment.

- E-commerce pulled in around US$ 265 million.

- Later-stage & debt financing: Though early-stage companies led in deal volume (134 deals out of ~180 in Q3), later-stage/scale ventures captured larger individual rounds — US$ 981.3 million across 17 deals.

- Business models: For the first time in the region, B2B2C startups (those combining business-to-business and business-to-consumer models) led fundraising with US$ 2.4 billion across 15 deals. Pure B2C and B2B raised US$ 557.3 million and US$ 456.3 million respectively.

Behind the Numbers: Disparities Persist Despite Record Funding

- Gender disparity: Startups founded by men drew about US$ 3.3 billion, while female-founded ventures raised only US$ 1.1 million across four deals — keeping women-led startups under 5 % of total capital in 2025.

- Uneven geography: Egypt, despite a larger population and historic startup scene, raised minimal funds in Q3 (US$ 3.2 million), reflecting macroeconomic headwinds and currency volatility.

The Bigger Picture: Where MENA’s Startup Ecosystem Is Headed

- The region’s startup ecosystem appears to be entering a new growth phase, with large-scale funds flowing and momentum shifting from early-stage to growth/scale-stage.

- The dominance of Saudi Arabia and UAE underlines their premier position in the MENA startup landscape — meaningful for founders and investors.

- The ascendancy of B2B2C reflects a shift in investor preferences: favouring business models that capture both consumer engagement and enterprise revenue streams.

- Despite encouraging funding numbers, structural issues remain: national/market disparities, gender gaps, and reliance on mega-rounds in fintech and proptech.

- For founders: Timing matters — deep understanding of model, sector, market fit and growth potential is now more critical than ever.

Editor’s Note from the StartupsMENA Team

At Startups MENA, we often highlight the growth of capital and innovation shaping the region’s tech scene. This quarter’s record funding underscores a critical shift: MENA is not just attracting money — it’s building maturity. The surge in fintech, proptech, and B2B2C models points to a new layer of enablement, where startups are creating infrastructure for others to scale.

For founders and investors alike, the takeaway is clear: value in the region is moving from standalone solutions to systems that enable growth. Those who position themselves as ecosystem builders — connecting capital, capability, and community — will define the next phase of MENA’s startup evolution.

— The Startups MENA Editorial Team