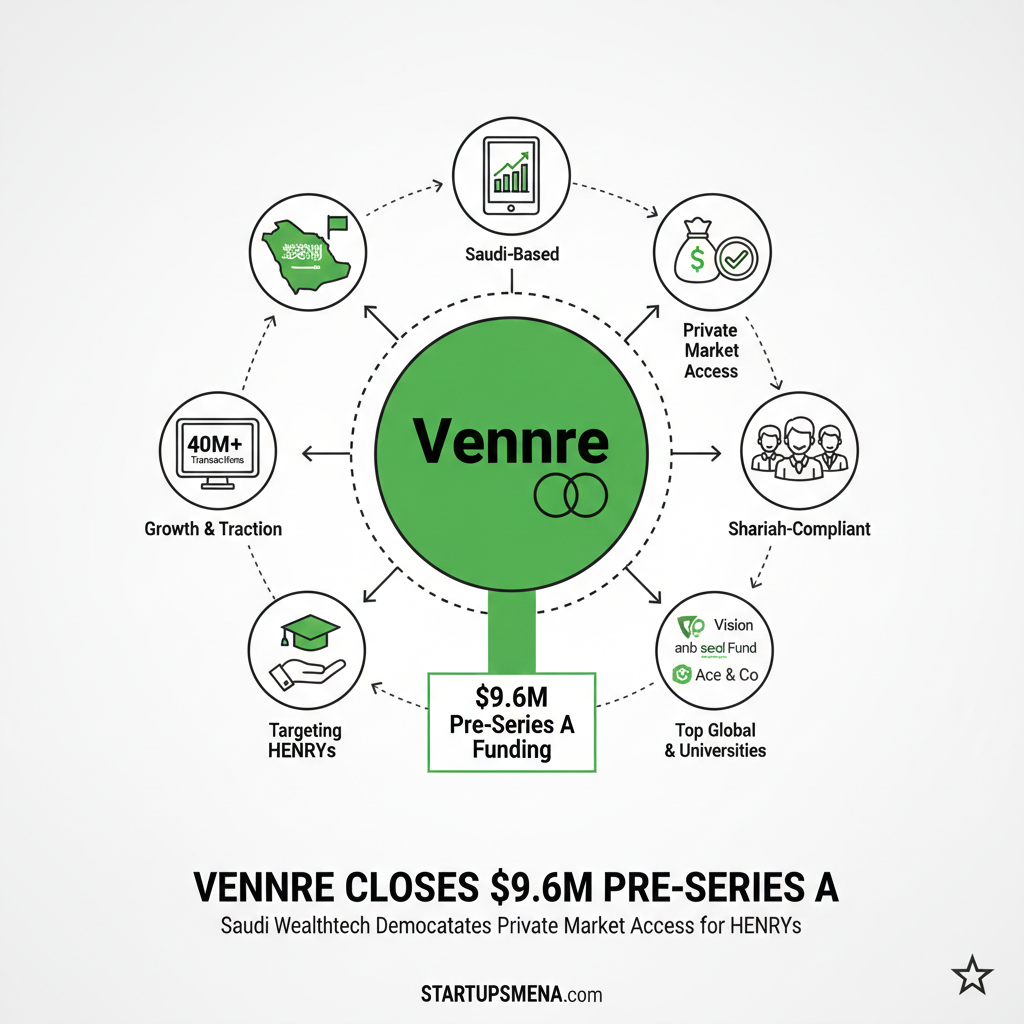

Saudi Wealthtech Vennre Closes $9.6 Million Pre-Series A for Private Market Access

Riyadh, Saudi Arabia – January 27, 2026 – Vennre, a Saudi Arabia-based wealthtech platform focused on democratizing access to private market investments, has successfully closed a $9.6 million (SAR 36 million) Pre-Series A funding round. This substantial investment, structured as a hybrid of equity and debt, was co-led by Vision Ventures and anb seed Fund, with participation from Sanabil 500, Ace & Co, Plus VC, and strategic individual investors from the private banking, technology, and entrepreneurship ecosystems.

Founded in 2021 by Ziad Mabsout, Anas Halabi, and Abdulrahman AlMalik, Vennre targets HENRYs (High Earners, Not Rich Yet), providing them with Shariah-compliant access to curated private market opportunities. The platform aims to bypass traditional gatekeepers, offering a transparent solution previously available only to institutions and ultra-wealthy participants. This investment reflects a growing confidence in Vennre’s mission to address a long-underserved segment of high-income retail investors across the region.

Operational Milestones and Strategic Vision

Vennre has also announced two significant operational milestones: the appointment of Dr. Ibrahim AlMojel as Chairman of its Saudi board, and surpassing $40 million in transaction value across its platform. These achievements provide clear evidence of growing market traction and investor trust in Vennre’s model.

Ziad Mabsout, CEO and Co-Founder of Vennre, articulated the company’s vision, stating, “A generation of ambitious professionals across the region has earned success but has not been given the tools required to compound it. This funding is not just another round — it is a clear endorsement from leading institutions that a large, long-underserved HENRY segment is ready for a better wealth-building experience.” He emphasized Vennre’s commitment to long-term wealth creation, starting with vetted private investment opportunities and expanding into a full wealth journey built on discipline, trust, and alignment.

Driving Financial Sector Development in Saudi Arabia

Khalid S. Alghamdi, CEO of anb capital, highlighted the strategic importance of this investment, noting, “Private markets globally already manage more than USD 14 trillion in assets, yet individual investors account for less than 5% of that exposure. Vennre directly addresses this imbalance by offering Shariah-compliant access to a segment long excluded from these opportunities.” He added that Vennre’s facilitated transactions, exceeding $40 million, prove that high-income Saudis are ready to engage with private markets at scale, fully aligning with Vision 2030’s mandate to broaden capital markets participation.

Kais Al-Essa, Founding Partner and CEO of Vision Ventures, further reinforced this, stating, “Vennre enables access to high-quality investment opportunities in real estate, private equity, venture capital and private credit. These four asset classes were previously available to a select few. Democratising such access is one of our investment goals at Vision Ventures, as it enables generational wealth creation and empowers everyone to access vetted income generating and high-return investments, in line with Saudi Arabia’s financial sector development plan and fintech momentum.”

Future Outlook and Expansion

Looking ahead, Vennre plans to deploy the new capital to significantly grow its client network, launch new platform features, and deepen its presence within the Saudi market. These efforts are in line with the ongoing financial sector liberalization and fintech momentum within the Kingdom, positioning Vennre as a key player in enabling wealth creation for a new generation of investors.

Editor’s Note — The Startups MENA Team

At Startups MENA, we recognize the transformative potential of wealthtech platforms that democratize access to sophisticated financial instruments. Vennre’s $9.6 million Pre-Series A round is a landmark achievement, showcasing Saudi Arabia’s burgeoning fintech ecosystem and its commitment to financial sector development aligned with Vision 2030. This investment not only validates Vennre’s innovative Shariah-compliant approach but also highlights the increasing demand for accessible private market opportunities for high-income individuals in the MENA region.

— The Startups MENA Editorial Team