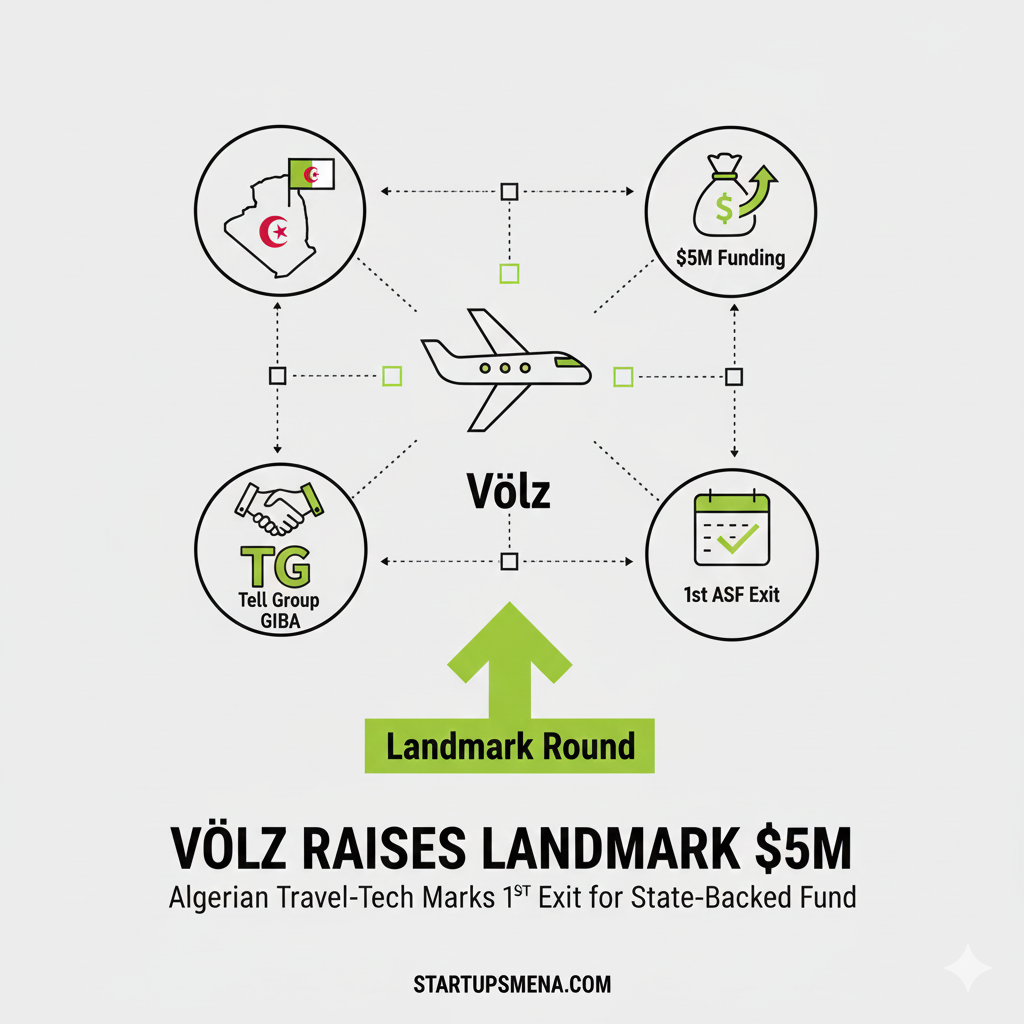

Algerian travel-tech startup Völz has secured approximately USD 5 million in new funding, in a round led by Tell Group alongside Groupe Industriel Babahoum Algérie (GIBA).

The transaction, reported around December 15–16, 2025, represents a significant milestone for Algeria’s emerging startup ecosystem. Beyond the capital injection itself, the round also marks the **first successful exit for the state-backed Algerian Startup Fund (ASF), setting an important precedent for public-backed venture capital in the country.

Founded in Algeria, Völz operates in the travel-tech space, developing digital infrastructure aimed at modernising how travel services are distributed, managed, and accessed in the local and regional market. While Algeria has long been underrepresented in the broader MENA startup narrative, companies like Völz signal a growing shift toward scalable, tech-enabled platforms emerging from North Africa’s less-covered ecosystems.

The participation of established industrial groups such as Tell Group and GIBA highlights increasing interest from traditional Algerian corporates in technology-led growth and digital transformation. Their involvement brings not only capital, but also strategic depth, operational experience, and potential market access—key ingredients for startups looking to scale beyond early traction.

For the Algerian Startup Fund, the Völz transaction represents a validation moment. As the country continues to build formal startup support structures, a realised exit—rather than just paper valuations—sends a strong signal to founders, investors, and policymakers that venture-backed outcomes are achievable within the local market.

As regional investors widen their lens beyond the usual MENA hubs, Algeria’s startup ecosystem appears to be entering a new phase—one defined less by policy ambition and more by executable, capital-backed outcomes.

Editor’s Note

This round is notable not just for its size, but for what it represents structurally. Algeria has invested heavily in building startup frameworks over recent years, yet exits have remained scarce. Völz becoming the first successful exit for the Algerian Startup Fund is a turning point—it shifts the conversation from ecosystem potential to ecosystem proof. If replicated, deals like this could materially change how North African startups are perceived by regional and international capital.