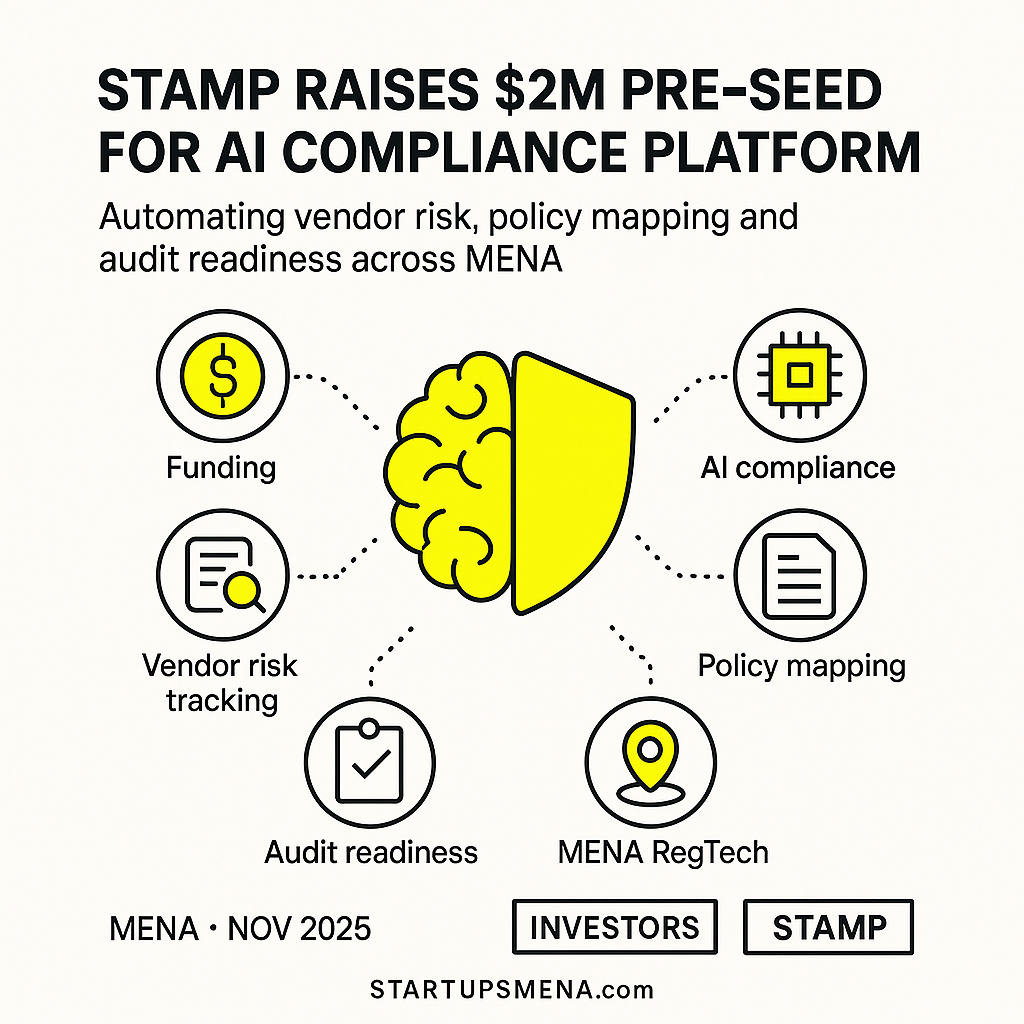

Founders face regulatory pain point with bold AI play

When the founding team of Stamp watched a mid-sized enterprise struggle for weeks to map vendor risk, track policy attachments and respond to audit requests, they concluded: someone needs to bring automation and intelligence to compliance. That insight underpins Stamp’s mission—and the reason investors have now committed US $2 million in pre-seed capital.

Funding round and investor backing

In its first institutional raise, Stamp secured a pre-seed round totalling US $2 million. The investment will fuel product development, hiring and go-to-market efforts as the startup builds its AI-powered compliance platform. (Source: announcing article)

What Stamp does: compliance meets AI

Stamp’s platform is designed for organisations operating in regulated industries—financial services, fintech, insurance and more. It brings together three core functions:

- Automated vendor- and third-party risk tracking (who are you working with? what data do they touch?)

- AI-driven policy and control mapping (understanding language, linking policies to controls, surfacing gaps)

- Real-time readiness for audits, certifications and regulatory requests (less scrambling, more visibility)

By embedding machine-learning models that read contracts, translate risk frameworks and flag anomalies, Stamp aims to reduce the manual drag that compliance teams often face.

The market opportunity: why now?

Regulatory scrutiny is rising across the region and globally. Firms are expected not just to be compliant but to provecompliance—often via certifications, vendor attestations, internal audits and real-time dashboards. Yet many compliance teams remain stuck in spreadsheets, email threads and document chaos.

For Stamp, this means a large addressable market: any company that must monitor risk, maintain controls and respond to audits. The timing is right, particularly in the MENA region where regulatory regimes (on data protection, fintech, outsourcing) are still evolving and many firms are scaling fast.

What makes Stamp’s approach stand out

A few features raise Stamp above simple workflow automation:

- Language and domain modelling: Their AI doesn’t just tag keywords, it maps policy language to controls, frameworks and vendor risk profiles.

- Continuous monitoring: Instead of “once-a-year audit prep”, the system operates in the background, flagging exceptions as they emerge.

- Built for growth markets: The platform is designed to handle multiple jurisdictions, regional regulation nuances and fast-moving firms.

These capabilities should allow Stamp to move past basic compliance tooling into higher-value analytics: Which vendor portfolios are riskiest? Where are we exposed if regulation changes? What certifications are we missing?

Founders, team and early traction

While the public announcement does not disclose full founder bios, the team combines expertise in compliance, software development and AI modelling. Their early go-to-market targets include mid-sized regulated enterprises (insurers, fintechs, large service organisations) where manual compliance burdens are highest and the ROI of automation is clearest.

They have a window of opportunity: firms are beginning to invest seriously in compliance tech, but many platforms remain legacy-oriented. Stamp aims to capture that greenfield.

What comes next: roadmap and risks

With the funding in place, Stamp’s near-term priorities include:

- Expanding the AI model library (covering frameworks, regulations, vendor risk taxonomies)

- Recruiting engineers, compliance architects and business-development talent

- Launching a beta version with early customers, gathering data and refining the value proposition

At the same time, the company must navigate some risks:

- Trust and accuracy: Compliance is high-stakes. Any mis-flag or missed risk could hamper customer confidence.

- Regulatory complexity: Different jurisdictions mean many rules, languages, taxonomies—scaling globally isn’t trivial.

- Go-to-market: Many firms buy tools via established compliance vendors; Stamp must prove value quickly to break into the enterprise stack.

Why this matters for the region

For the broader Middle East and North Africa (MENA) startup ecosystem, Stamp’s raise is an example of a home-grown company tackling regulatory and compliance automation—not just fintech or e-commerce. As regional economies increasingly regulate and digitalise, domestic solutions like Stamp can serve local nuance better than imported tools. The raise also signals that investors are paying attention to RegTech and compliance-tooling, not just headline fintechs.

Key takeaways

- Build a product around a pain point that resonates (manual compliance = high cost + high risk).

- Leverage AI and domain expertise (automation isn’t enough—context matters).

- Target markets where regulation is increasing, and manual processes dominant.

- Prove value early with real metrics (e.g., hours saved, risk exposures reduced) to win enterprise trust.

- Focus on scalability (jurisdictions, languages, frameworks) from day one if global ambitions exist.

Editor’s Note — The Startups MENA Team

At Startups MENA, we focus on the narratives that define how the region builds its next-generation workforce and innovation economy. Stamp’s raise is more than just another funding headline—it’s part of a transition where compliance and regulation become enablers for high-growth companies, rather than obstacles.By applying AI to the invisible but critical domain of risk automation, startups like this are helping the region move from “we need to avoid regulation” to “we can build regulation-aware innovation engines”.

— The Startups MENA Editorial Team