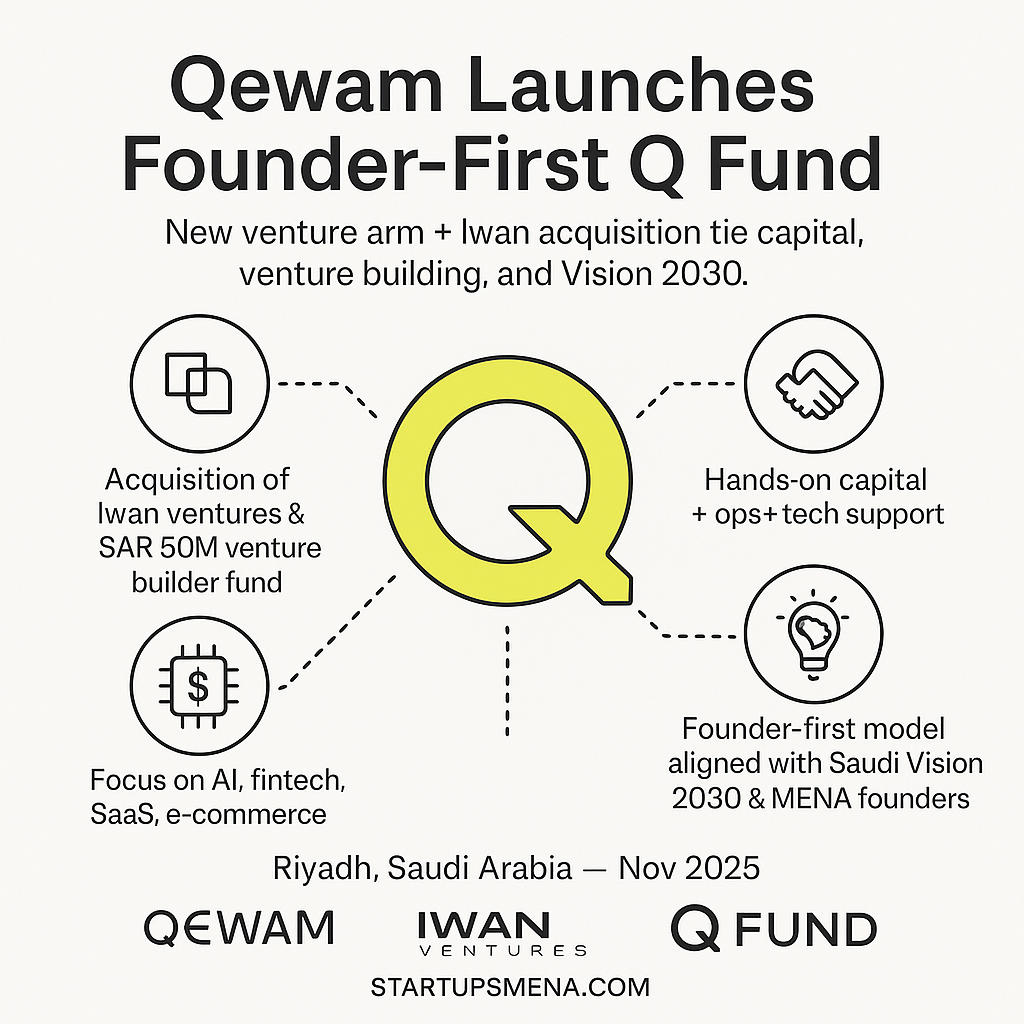

By acquiring Iwan Ventures and launching a dedicated investment arm, Qewam is tightening the link between venture building, capital deployment, and Saudi’s Vision 2030 innovation agenda.

For early-stage founders, the right investor is more than a source of funding—it’s a partner who stands inside the trenches, not on the sidelines. In Saudi Arabia’s rapidly evolving startup economy, this kind of partnership is becoming increasingly essential.

With its acquisition of Iwan Ventures and the launch of Q Fund, Qewam Holding is doubling down on a model where venture building and venture capital work hand-in-hand. The move positions Qewam as a holistic innovation engine—one that supports founders from “day zero,” blends technical and operational resources, and aligns deeply with Saudi’s broader economic transformation.

A Strategic Bet on Early-Stage Venture Building

Founded in 2020, Qewam Holding has grown into a core innovation player supporting thousands of entrepreneurs through digital tools, business development programs, and structured venture-building methodologies.

Iwan Ventures adds a powerful extension to that mission. With a SAR 50 million fund and a venture builder model focused on AI, fintech, e-commerce, and SaaS, Iwan brings:

- A tested venture-building playbook

- Centralized operational support

- Experience launching and scaling high-growth startups

By integrating this engine into Qewam’s broader platform, the combined organization can now offer founders a more seamless and accelerated path from idea to product—and from product to scale.

Inside Q Fund: More Than Just Capital

The acquisition paves the way for Q Fund, an independent investment arm designed to back early-stage technology founders and provide deep operational support.

Led by ecosystem builder Lewa Abukhait, Q Fund will focus on three pillars:

- Capital — early-stage funding for high-potential founders

- Operational Guidance — direct access to Qewam and Iwan’s playbooks, mentors, and team

- Technology Infrastructure — integration with Qewam’s cloud-based and AI-enabled tools for rapid testing, validation, and scaling

This marks a shift from traditional venture capital toward a more hands-on, embedded investment model—one that mirrors the entrepreneurial journeys it aims to support.

The Iwan Ventures Advantage

Iwan has already carved out a presence in Saudi’s early-stage ecosystem, supporting ventures in sectors that demand technical sophistication and regulatory awareness.

Its contribution to the Qewam ecosystem includes:

- A pipeline of validated startup concepts

- Shared resources across tech, operations, marketing, and finance

- A portfolio of active companies in high-growth sectors

In an ecosystem where the first year of a startup can determine its long-term fate, these assets significantly reduce the risk for founders—and increase the likelihood of building something durable.

Alignment With Saudi Vision 2030

Qewam’s leadership has long emphasized its alignment with Vision 2030, and this move strengthens that commitment. The launch of Q Fund places founders at the center of Saudi Arabia’s economic diversification efforts.

The alignment is clear:

- Promoting a knowledge-based economy through technology-driven ventures

- Unlocking value beyond traditional incubators or accelerators

- Expanding Saudi Arabia’s influence as a regional innovation hub

- Turning founders into economic contributors, not just beneficiaries

It signals a future where venture building, technology readiness, and venture capital are fully integrated—accelerating the Kingdom’s shift toward a resilient, innovation-led private sector.

What This Means for Founders Across MENA

For founders in Saudi Arabia and beyond, Qewam’s move unlocks new opportunities:

1. A Clearer Path From Idea to Investment

Founders can now validate ideas inside Qewam’s digital ecosystem and receive early capital via Q Fund without navigating fragmented support systems.

2. Deep Support in High-Complexity Sectors

AI, fintech, SaaS, and regulated industries require more than mentorship—they need expertise and infrastructure. Qewam + Iwan provides both.

3. Regional Expansion Opportunities

With cross-border programs and partnerships already in motion, Q Fund–backed startups gain more than capital—they gain access to an ecosystem that spans the region.

4. A Stronger Signal to the Ecosystem

This acquisition sets a precedent for hybrid models that combine venture building with venture capital—an emerging standard in high-growth markets.

Key Takeaways

- Qewam Holding has acquired Iwan Ventures and launched Q Fund as a dedicated, founder-first investment arm.

- Q Fund blends capital, operational support, and technology infrastructure, creating a unified pathway from idea to scale.

- Iwan Ventures brings a strong venture builder platform and portfolio, strengthening Qewam’s early-stage capabilities.

- The move reinforces Saudi Arabia’s Vision 2030 goals, positioning Qewam as a regional innovation driver.

Editor’s Note — The Startups MENA Team

At Startups MENA, we focus on the narratives that reveal how the region is building a next-generation innovation economy.

Qewam’s acquisition of Iwan Ventures and the launch of Q Fund represents more than an investment announcement—it marks a shift in how Saudi Arabia approaches venture creation. By unifying venture building, talent development, and early-stage capital under one umbrella, this move reflects the Kingdom’s evolving belief that founders are not just participants but architects of economic transformation.

This approach also mirrors a broader regional trend: capital is becoming more embedded, more operational, and more aligned with founders’ day-to-day realities. As Saudi Arabia accelerates toward Vision 2030, integrated systems like Qewam’s will play a central role in shaping a resilient, self-sustaining innovation economy.

We’ll continue to follow this story closely—because the region’s next decade of growth will be defined by how effectively these new hybrid models turn ambition into scalable companies.

— The Startups MENA Editorial Team