Despite a cautious global investment climate, founders across Riyadh, Cairo, Dubai and Tunis continue to secure deals — and the first week of November reveals exactly where investor conviction in MENA is heading.

A Strong Start to November for Regional Startup Activity

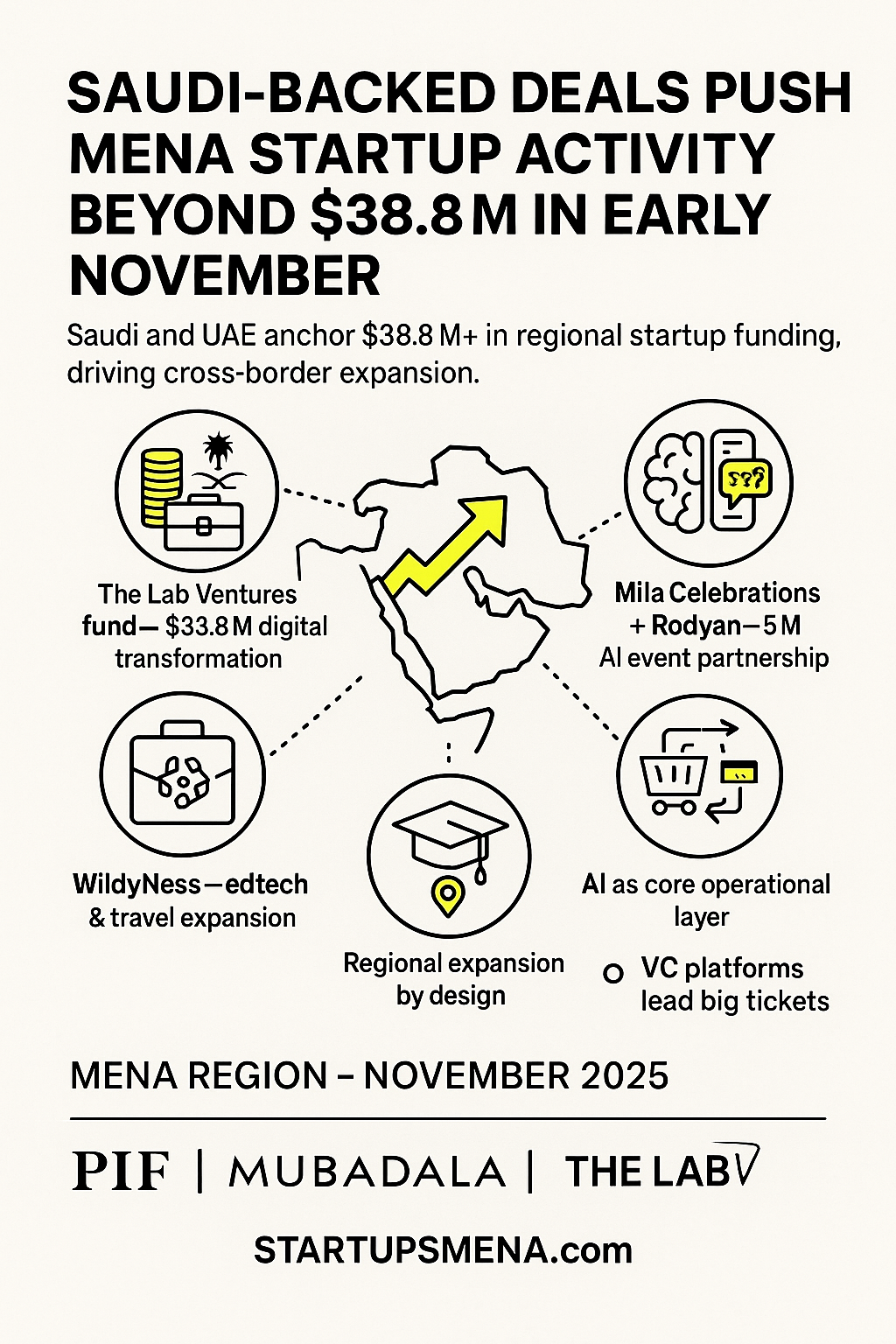

The first week of November 2025 recorded five funding and acquisition deals across the Middle East and North Africa, with $38.8 million in disclosed capital and additional undisclosed deal values bringing total activity above $43.8 million.

The week’s deals spanned four major sectors:

- Digital transformation & enterprise technology

- AI-powered event management

- E-commerce infrastructure

- Education and edtech

Early November’s results reinforce a growing pattern: even when total funding fluctuates month to month, deal momentum continues to shift toward platforms, funds and cross-border strategic plays with regional significance.

Saudi Arabia: The Region’s Capital Engine

Saudi Arabia once again drove the lion’s share of regional deal value.

Two Saudi-linked deals accounted for nearly all of the $38.8 million in disclosed funding, emphasizing the Kingdom’s position as the region’s funding anchor under Vision 2030.

This aligns with wider trends:

Saudi Arabia and the UAE now consistently lead MENA’s startup geography, supported by sovereign-backed funds, maturing VC ecosystems and multi-market ambitions. Even in months when MENA-wide funding dips, Saudi Arabia remains a steady source of large-ticket activity.

Egypt, UAE and Tunisia Hold Their Ground

While Saudi Arabia dominated value, Egypt, the UAE and Tunisia continued to demonstrate resilience and strategic relevance in the regional ecosystem:

- Egypt remains a priority expansion market due to its massive consumer base and rapid digital commerce adoption.

- The UAE continues to serve as the region’s innovation and fund headquarters, home to versatile digital transformation plays and multi-market VC vehicles.

- Tunisia, through startups like WildyNess, underscores how emerging ecosystems can secure regional backing when they build with cross-border potential from day one.

In short, capital is increasingly raised in Saudi and the UAE — then deployed into high-adoption markets like Egypt and frontier ecosystems forming across North Africa.

The Deals That Defined the Week

1. The Lab Ventures: $33.8M Fund to Accelerate Digital Transformation

UAE-based The Lab Ventures closed its second venture fund at $33.8 million, the week’s largest ticket.

The fund aims to back startups driving digital transformation across MENA and Europe, with a focus on technology that upgrades traditional industries.

The message to founders is unmistakable:

Infrastructure-level digital modernization remains a high-conviction investment category, especially when it enables governments and enterprises to scale efficiently.

2. Mila Celebrations & Rodyan: A $5M AI Partnership

Event-tech player Mila Celebrations secured a $5 million strategic partnership with Rodyan to build AI-powered event management solutions.

The collaboration highlights two emerging truths:

- AI is moving from hype to practical deployment in traditionally offline sectors, and

- Partnerships — not just equity rounds — are becoming a preferred model for unlocking both capital and distribution.

3. Zid Acquires Zammit: A Bold Cross-Border E-Commerce Play

Saudi e-commerce infrastructure company Zid expanded into Egypt through its acquisition of Zammit.

The value was undisclosed, but the implications are clear:

- Saudi scale-ups are adopting acquire-to-expand strategies, rather than relying solely on organic growth.

- Egypt remains a gateway market, essential for any player looking to scale across Africa.

This move positions Zid to strengthen its regional footprint and pursue deeper penetration into one of the region’s most active e-commerce economies.

4. WildyNess Raises Pre-Seed to Scale Edtech & Travel Experiences

Tunisian-born WildyNess secured undisclosed pre-seed funding to support its expansion into five Arab markets.

Sitting at the intersection of education and experiential travel, the startup represents a new generation of cross-border models emerging from North Africa.

Its funding illustrates growing investor appetite for niche, experience-driven education models — particularly those that blend digital and real-world components.

Where the Money Went

By Sector:

- Digital Transformation & Enterprise Tech: $33.8M

- AI and Event Management: $5M

- E-commerce Infrastructure: Undisclosed

- Education & Edtech: Undisclosed

By Geography:

- Saudi Arabia: ~100% of disclosed deal value

- Egypt: Key expansion target via acquisition

- UAE: Fund management and tech platforms

- Tunisia: Early-stage innovation with regional reach

The consistent theme:

Big checks are increasingly tied to Saudi- and UAE-based entities, while smaller ecosystems continue to attract early backing for cross-market verticals.

What This Week Signals for the Region

Three strategic takeaways emerge from early November’s activity:

1. AI Is Now a Core Operational Layer

Startups integrating AI into clear business outcomes — reducing cost, improving matchmaking, optimizing logistics — are securing deals and partnerships across the region.

2. Regional Expansion Is the New Baseline

Investors are rewarding founders who design regional distribution into their models early, whether through acquisitions or multi-market rollouts.

3. Professional Capital Vehicles Are Taking Center Stage

Structured VC platforms, not isolated angel checks, are now powering most large tickets — a sign of a maturing investment landscape.

Editor’s Note — The Startups MENA Team

At Startups MENA, we track more than just funding totals. We follow the narratives that illustrate how the region is building its next generation of founders, companies and economic engines.

This week’s $38.8 million-plus in funding and acquisitions is more than a collection of deal announcements — it is another chapter in the story of how Saudi Arabia, the UAE, Egypt and emerging ecosystems like Tunisia are shaping a unified innovation corridor across the Middle East and North Africa.

As long-term national strategies such as Vision 2030 continue to mature, investment flows are increasingly directed toward:

- technologies that digitize legacy industries,

- AI layers that make those industries smarter, and

- cross-border platforms that treat MENA as one integrated market.

For founders, the implications are clear:

Think regionally from day one. Build with AI-enabled efficiency. And plug into the expanding network of funds, operators and strategic partners that now define the region’s startup landscape.This week’s activity is a reminder that MENA’s momentum is structural, not seasonal — built on policy, infrastructure and ambition rather than single funding spikes.

— The Startups MENA Editorial Team