By Startups MENA Staff

When a small business needs capital, waiting weeks for a bank decision can mean lost growth—or lost survival. For thousands of SMEs across the Middle East and Africa, access to fast, flexible funding remains one of the most stubborn bottlenecks in their growth journey.

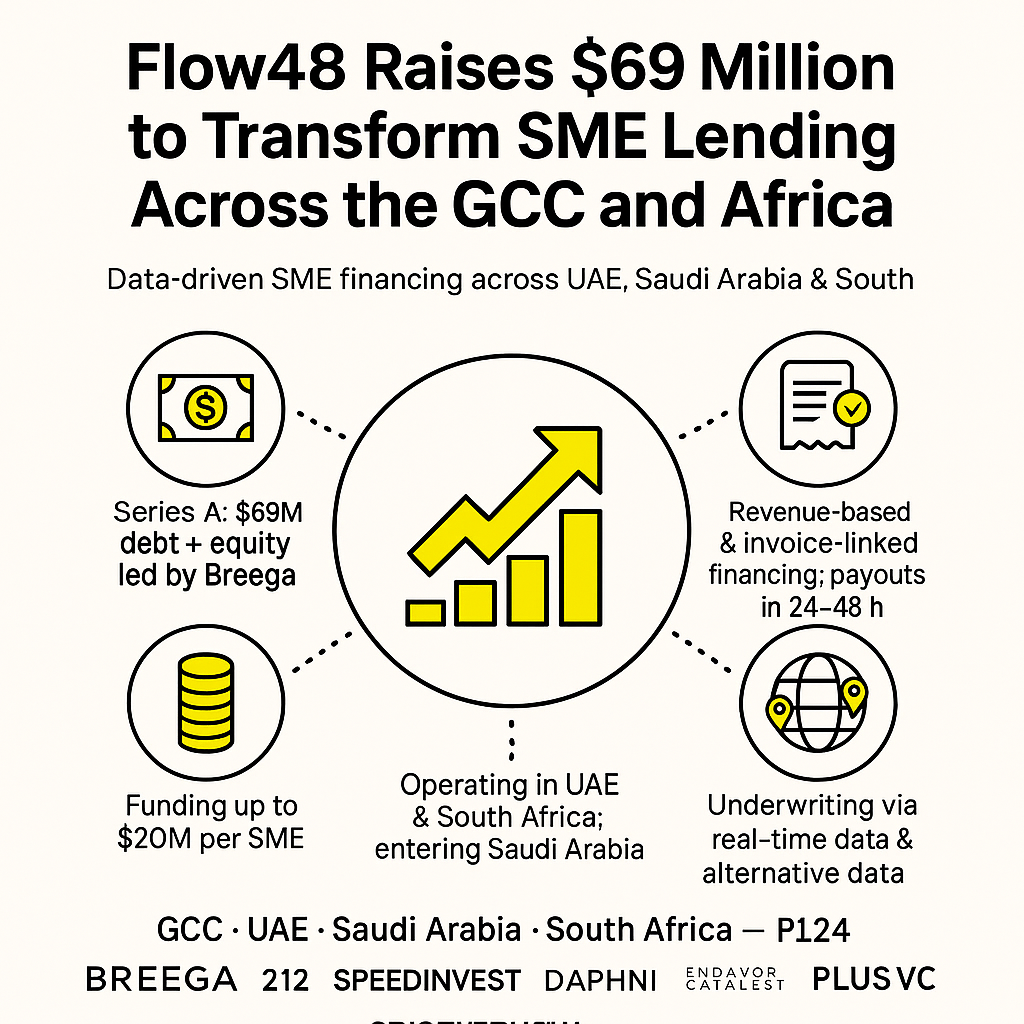

UAE-based fintech Flow48, founded by Idriss Al Rifai, wants to rewrite that story. The company has just raised $69 million in a Series A round—a mix of debt and equity—to scale its data-driven SME lending platform across the UAE, South Africa, and now Saudi Arabia.

From Fetchr to Flow48: A Founder Focused on Fixing the SME Capital Gap

Flow48 was founded in 2022 by Idriss Al Rifai, previously the founder of logistics scale-up Fetchr and an operator with deep experience across last-mile, on-demand delivery, and emerging markets.

After years of working with digital businesses, Al Rifai saw a pattern:

SMEs create the majority of jobs, yet remain chronically under-financed by traditional financial institutions. Banks favor large corporates with collateral and long histories—leaving SMEs to navigate slow processes, strict covenants, or expensive informal lending.

Flow48 was built to flip that script.

“SMEs are the backbone of every economy. They create jobs and drive GDP, yet they remain under-supported. Our mission is to bridge that gap with fast, data-led financing,” says Al Rifai.

Inside the $69 Million Raise

The Series A round is led by Paris-based VC Breega, with participation from:

- 212

- Speedinvest

- Daphni

- Endeavor Catalyst

- Evolution Ventures

- Plus VC

The company did not disclose the exact debt/equity split, but the blended structure mirrors its $25 million pre-Series A round closed in November 2023.

A significant portion of the new capital is earmarked for South Africa, where Flow48 already operates, while the remainder will accelerate UAE expansion and power the company’s entry into Saudi Arabia, one of the fastest-growing SME markets in the region.

How Flow48 Works: Turning Revenue Streams into Instant Capital

Flow48 provides revenue-based and invoice-linked financing, designed specifically for SMEs that are underserved by banks.

Who qualifies

- At least 12 months of operating history

- Minimum $100,000 in annual revenue

- Businesses caught in slow or rigid bank processes

What they offer

- Funding up to $20 million per business

- Payouts in 24–48 hours for eligible SMEs

- Repayments tied to actual cash flow, not fixed monthly schedules

- Fully digital onboarding and automated decisioning

- Underwriting powered by alternative data and real-time transaction insights

In short:

it funds the business you’re actually building today—not the collateral you don’t have.

Why This Matters: SMEs Are Still Locked Out of Traditional Credit

Across the GCC, MENA, and Africa, SME financing gaps run into the hundreds of billions of dollars. Even profitable and fast-growing SMEs often struggle to secure credit due to stringent documentation requirements, risk-averse banking structures, and limited credit history.

A new generation of fintechs—offering non-dilutive, data-driven, and revenue-based financing—is stepping in. Flow48’s raise is one of the strongest signals that institutional investors now believe this category is becoming core financial infrastructure, not a niche alternative.

A Regional Race to Build the Lending Stack

Flow48 joins a fast-expanding group of SME-focused fintech players across the region.

- CredibleX in the UAE recently raised one of the largest seed rounds in regional fintech, powering SME-focused debt and equity financing.

- FlapKap, originally from Egypt and now anchored in Abu Dhabi, is scaling revenue-based financing across e-commerce, retail, and restaurants.

- Erad, based in Saudi Arabia and backed by global accelerators, specializes in non-dilutive capital for digital businesses.

The difference?

Flow48 already operates across multiple continents and aims to become a plug-in infrastructure layer for banks, payment processors, and digital platforms—not just a standalone lender.

What Comes Next for Flow48

The raise sets the stage for an aggressive expansion phase. Key things to watch:

1. Saudi Market Entry

Saudi Arabia is doubling down on SME empowerment. Flow48’s ability to localize products, partnerships, and risk models will determine how quickly it gains traction.

2. Deeper Embedded Financing

The company is exploring integrations with banks, ERPs, and payment service providers to bring financing directly into SME workflows.

3. Product Expansion

Flow48 plans to roll out new SME-focused financing products and expand its alternative data capabilities.

4. Risk Performance at Scale

As markets cycle, the strength of its underwriting engine will become a competitive differentiator—especially across diverse regulatory landscapes.

Flow48’s goal is clear:

to become the default financing partner for the region’s next generation of digitally enabled SMEs.

Editor’s Note — The Startups MENA Team

At Startups MENA, we focus on the narratives that define how the Middle East builds its next-generation workforce and innovation economy. Flow48’s $69 million raise is more than a milestone for fintech; it’s a signal that SME financing is finally being treated as a foundational pillar—not an afterthought—in regional economic strategy.

By converting real-time revenue data into fast, flexible capital, companies like Flow48 are reshaping what is possible for founders. This isn’t only about lending; it’s about enabling SMEs to scale, hire, export, and innovate at the speed demanded by today’s economy.

As the UAE, Saudi Arabia, and South Africa deepen their diversification agendas, the true test will be whether SMEs can access the tools—and the working capital—to participate fully. Revenue-based and embedded financing models are emerging as key enablers of that shift.

This marks a defining chapter in MENA’s economic transformation:

a region where SMEs are no longer sidelined by traditional financial systems, but empowered by new, tech-enabled capital infrastructure.— The Startups MENA Editorial Team