A Milestone Moment for Regional Fintech

When co-founders Esam Alnahdi and Maher Loubieh launched HALA, their mission was simple but ambitious: give micro, small, and medium-sized enterprises (MSMEs) access to modern financial tools that were once reserved for big companies. A few years later, HALA now serves more than 140,000 businesses and powers over $8 billion in annual transactions across Saudi Arabia.

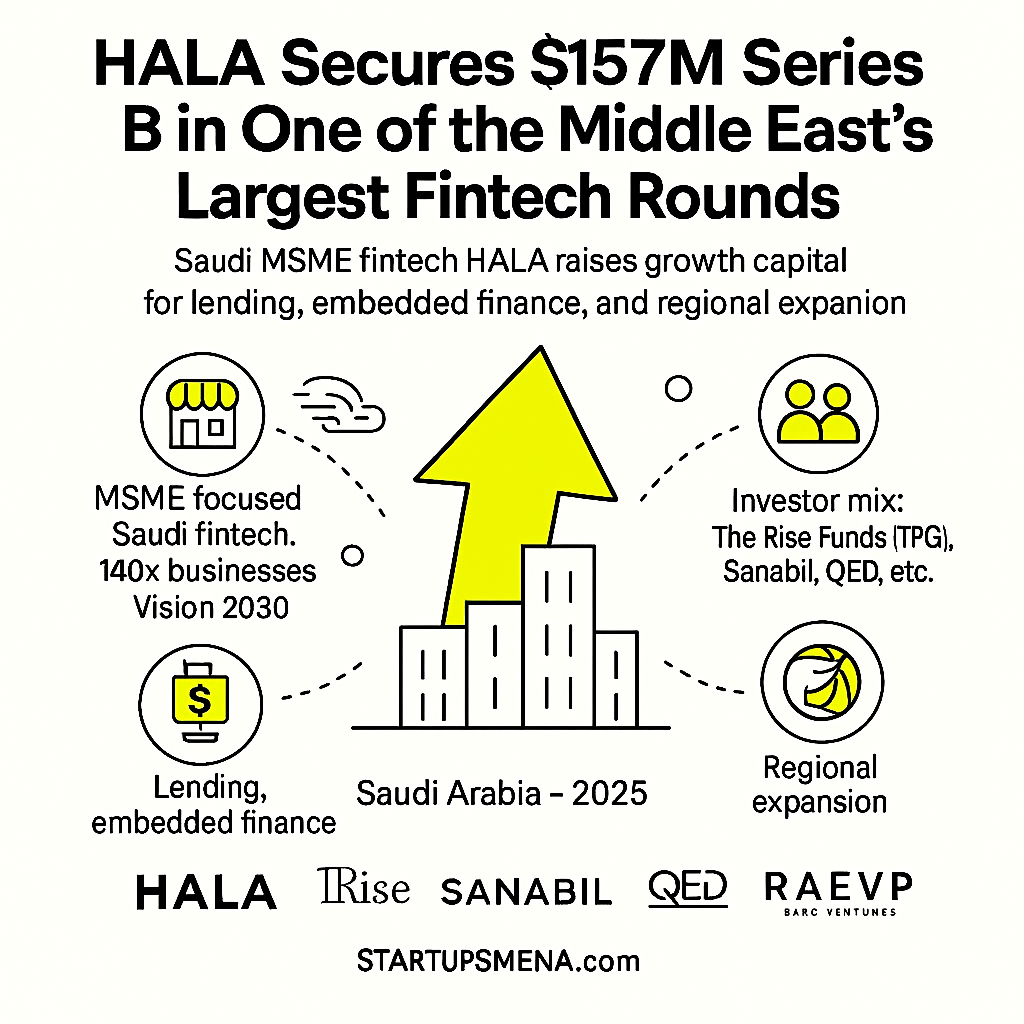

Now, the Saudi fintech has closed a landmark $157 million Series B round, cementing its position among the largest fintech funding rounds in Middle Eastern history. For HALA, the raise represents more than capital—it is a decisive signal that MSME-focused digital finance is entering a new era of scale and adoption.

A Strategic Investor Mix That Speaks Volumes

The round was co-led by The Rise Funds, the impact-investment arm of TPG, and Sanabil Investments, owned by Saudi Arabia’s Public Investment Fund. Additional participation came from QED Ventures, Raed Ventures, MEVP, and other regional and global backers.

This mix tells a bigger story:

- TPG’s first investment in a Middle East fintech highlights growing global conviction in the region’s digital financial infrastructure.

- Sanabil’s backing underscores Saudi Arabia’s push to empower its SME economy through high-growth private sector players.

- A blend of global impact funds and regional VCs validates HALA’s dual promise: commercial scale and socioeconomic impact.

The investor confidence reflects a maturing ecosystem where fintechs serving real business needs—especially MSMEs—are proving both investable and transformative.

Where HALA Is Heading Next

The company plans to deploy the new capital across three growth priorities:

- Deepening Market Leadership in Saudi Arabia

Strengthening product depth, infrastructure and customer support to capture more MSMEs in the Kingdom. - Launching New Embedded Financial Products

Beyond payments and business accounts, HALA is preparing lending solutions for MSMEs and freelancers—one of the region’s largest unmet financial needs. - Accelerating Regional Expansion

The company aims to take its embedded-finance stack across the wider Middle East and North Africa, where millions of small businesses still operate without modern financial tools.

For the region’s MSMEs, this evolution means easier access to credit, faster payments, and end-to-end financial operations that rival those of enterprise-grade systems.

Why This Fundraise Matters for the Region

HALA’s raise arrives at a pivotal moment for the Middle East’s fintech landscape.

- MSMEs are the backbone of Gulf economies, driving employment and innovation—yet remain underserved financially.

- Digital payments and embedded finance are accelerating, driven by regulatory modernization and growing demand.

- Saudi Arabia’s fintech sector is scaling rapidly, supported by Vision 2030, favorable policies, and rising local capital formation.

The size of the round also challenges old assumptions that mega-fintech rounds are only achievable in the U.S., Europe, or China. Capital is increasingly flowing toward the Middle East’s most resilient and scalable digital-first companies.

Execution Will Determine the Next Chapter

With growth comes complexity. HALA’s next phase will require:

- Risk-tuned lending models for MSMEs and freelancers

- Operational discipline across multiple markets

- Continued product differentiation in an increasingly competitive fintech space

- Regulatory navigation across diverse MENA jurisdictions

If HALA succeeds, it will not only transform its own trajectory but elevate the entire MSME-fintech category in the region.

Key Takeaways

- HALA’s $157M Series B is one of the region’s largest fintech raises to date.

- The investor lineup reflects growing global and regional confidence in MSME-focused fintech.

- The company is moving into lending, embedded finance, and regional expansion.

- The raise signals a broader shift: Middle Eastern fintech is now investment-grade at scale.

Editor’s Note — The Startups MENA Team

At Startups MENA, we focus on the narratives that define how the Middle East builds its next-generation workforce and innovation economy. The UAE’s new initiative to train 10,000 youth and create 30,000 jobs is more than a development program—it’s a blueprint for how a nation future-proofs its human capital.

By merging education, entrepreneurship, and digital innovation through StartupEmirates.ae, this campaign moves beyond traditional job creation. It lays the groundwork for an ecosystem where young Emiratis are not just employees, but founders, builders, and contributors to a self-sustaining economy.

As the UAE continues to accelerate toward Vision 2030 and Centennial 2071, the focus is shifting from dependence on opportunity to the creation of opportunity. This marks a defining chapter in the region’s transformation—where youth empowerment is not a policy goal, but the foundation of economic resilience.

— The Startups MENA Editorial Team