When early-stage fintech founders in Casablanca or Kampala sit down with First Circle Capital’s partners, the conversation rarely starts with “How fast can you grow?”

Instead, it starts with a more fundamental question: What piece of Africa’s financial plumbing are you fixing?

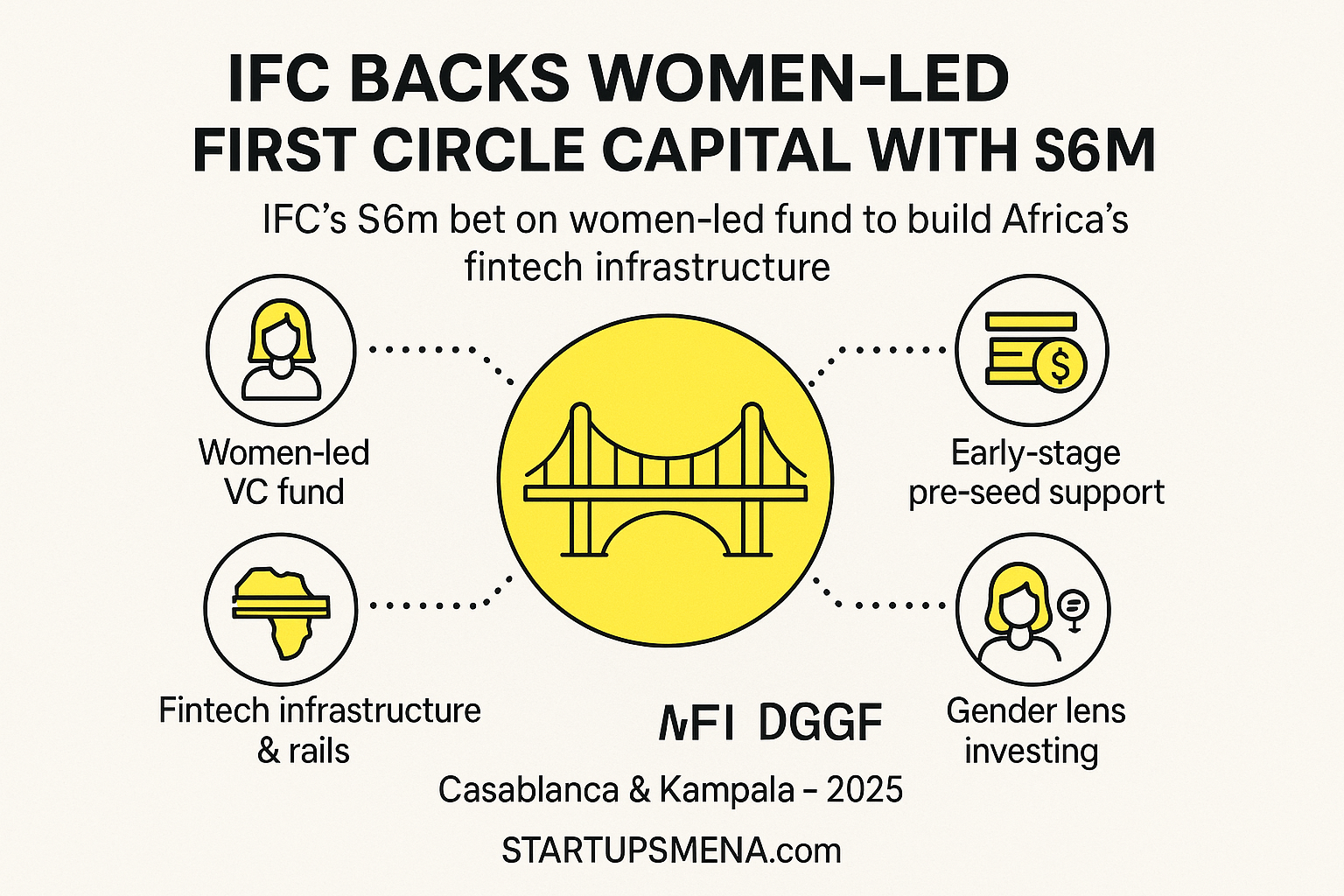

That question is now backed by serious firepower. Morocco- and Uganda-based venture firm First Circle Capital has secured $6 million from the International Finance Corporation (IFC), the private sector arm of the World Bank Group, to double down on early-stage fintech across Africa.

The commitment is part of a targeted fund of up to $30 million, dedicated to pre-seed and seed-stage startups building the next generation of financial infrastructure on the continent.

A Women-Led Fund Built for Africa’s Fintech “Plumbing”

First Circle Capital is run by Selma Ribica and Agnes Aistleitner Kisuule, a women-led partnership operating out of Casablanca (Morocco) and Kampala (Uganda), with the fund vehicle domiciled in Delaware.

Unlike many Africa-focused funds that cluster around payments and consumer-facing apps, First Circle is deliberately thesis-driven. The team focuses on less crowded but mission-critical layers of fintech, including:

- Financial infrastructure and embedded finance

- Insurtech and alternative lending

- Regtech, compliance, and interoperability

- Emerging “climate fintech” use cases, such as financing for green assets

To date, First Circle has invested in 15 startups across eight African markets, with 30% of portfolio companies led or co-founded by women and half operating across multiple countries.

That portfolio concentration is intentional: the fund is targeting around 24 startups in total, preferring deep engagement over broad spray-and-pray exposure.

Plugging a Persistent Gap in Early-Stage Fintech Capital

Africa’s fintech story is often told in headlines about mega-rounds and unicorns. But the reality for founders at the pre-seed and seed stages is more complex.

While overall venture funding into African tech has grown over the past decade, early-stage capital remains patchy and highly concentrated in a handful of markets. Many founders building foundational products still struggle to raise their first institutional round.

First Circle is explicitly designed to attack that gap:

- Ticket sizes tailored for pre-seed and seed, with room for follow-on

- Stage focus on companies still experimenting toward product–market fit, not just scaling

- Hands-on support across operations, business development, and regulatory navigation to get startups “Series A ready”

In other words, the fund is not just wiring money—it’s building a launchpad for the continent’s next wave of financial infrastructure companies.

IFC’s $6m Commitment—and a Bigger Institutional Signal

The $6 million IFC ticket is more than a line item in a fundraise; it is a cornerstone endorsement for a specialist, women-led, Africa-focused fund.

The capital stack around First Circle includes:

- $6m from IFC, including $2m channelled via the Women Entrepreneurs Finance Initiative (We-Fi)

- An approved $3m commitment from the Dutch Good Growth Fund (DGGF)

- Additional backing from FSD Africa, MSMEDA, Axian Group, and a group of global tech entrepreneurs including Jens Hilgers, Tim Schumacher, Peter Steinberger, and Steve Anavi

For IFC, this fits a broader strategy of using fund investments to catalyse early-stage ecosystems, rather than only backing late-stage or infrastructure projects. For First Circle, the IFC commitment does three things at once:

- De-risks the fund in the eyes of other limited partners

- Validates its narrow, thesis-led strategy around fintech infrastructure

- Puts gender-lens investing at the centre, not the margin, of the fund’s design

A Built-In Gender Lens, Not an Afterthought

This is not just another fintech fund that happens to have women GPs. First Circle’s cap table and strategy embed a gender lens by design.

- The presence of We-Fi—a program specifically focused on women entrepreneurs—signals clear expectations on backing women-founded or women-led fintechs.

- The fund has already reached 30% women-led or co-founded portfolio companies, and is positioned to push that share higher as it deploys more capital.

In a landscape where women-led funds and women founders still capture a small fraction of venture capital, this structure matters as much as the ticket size itself.

Institutional capital that flows through gender-smart vehicles tends to influence how other investors allocate, creating a multiplier effect for inclusivity across the ecosystem.

Why This Matters for Founders Across Africa and MENA

For founders, what changes on Monday morning after this deal?

1. More Specialist Capital for Fintech Infrastructure

If you’re building rails, risk engines, KYC infrastructure, alternative credit scoring, or embedded finance layers, there is now a fund whose mandate is precisely your niche—not just generic “fintech”.

2. Deeper Support for Cross-Border Scale

With offices in North and East Africa and a portfolio already spanning eight markets, First Circle is positioned to help founders navigate multi-country licensing, partnerships, and interoperability from very early on.

3. A Bridge Between Africa and MENA Capital

With Casablanca as one of its hubs and backing from pan-regional institutions, First Circle sits at the intersection of North Africa, Sub-Saharan Africa, and the wider MENA investment community—a strategic advantage as GCC and MENA funds further increase their exposure to African tech.

4. A Signal for More Specialist, Women-Led Funds

If First Circle executes well—sourcing strong deals, supporting portfolio companies, and eventually delivering exits—this IFC bet could encourage other institutional investors to back women-led, specialist funds across the continent.

From Fintech Apps to Fintech Infrastructure

The early years of Africa’s fintech boom were dominated by wallets, neobanks, and consumer-facing payments apps. Now, the frontier is shifting.

Today’s most durable opportunities are often in the invisible layers:

- Infrastructure that lets multiple providers plug into the same rails

- Risk and compliance tools that make cross-border payments safer and cheaper

- Financing platforms for farmers, SMEs, and climate-positive assets

- Data and interoperability layers that reduce friction across fragmented markets

First Circle’s strategy is effectively a bet that Africa’s next decade of fintech value will be created behind the scenes—in the pipes and protocols that power everything else. IFC’s $6m commitment is a strong vote of confidence in that thesis, and in the women-led team executing it.

For founders, operators, and investors watching from MENA, it’s also a reminder:

the most transformative opportunities often lie one layer deeper than where the hype is.

Editor’s Note — The Startups MENA Team

At Startups MENA, we track how capital, talent, and technology are re-wiring the broader Middle East and Africa innovation corridor. IFC’s $6 million commitment to First Circle Capital is more than a fund transaction—it’s a signal of how institutional money is beginning to back specialist, women-led vehicles that understand the realities of building in emerging markets.

By focusing on fintech infrastructure rather than just consumer apps, First Circle is investing in the rails that will carry tomorrow’s financial services for millions of people and businesses across Africa. That playbook—thesis-driven, early-stage, and deeply local—is increasingly relevant to founders and fund managers from Casablanca to Cairo, Riyadh, and Dubai.

As MENA capital looks south and African founders look north, deals like this help turn a loose narrative of “Afro-MENA collaboration” into something more concrete: shared infrastructure, shared investors, and shared outcomes. That is where we believe the next generation of breakout companies will emerge—at the intersection of regions, and at the infrastructure layer where resilience is built.

— The Startups MENA Editorial Team