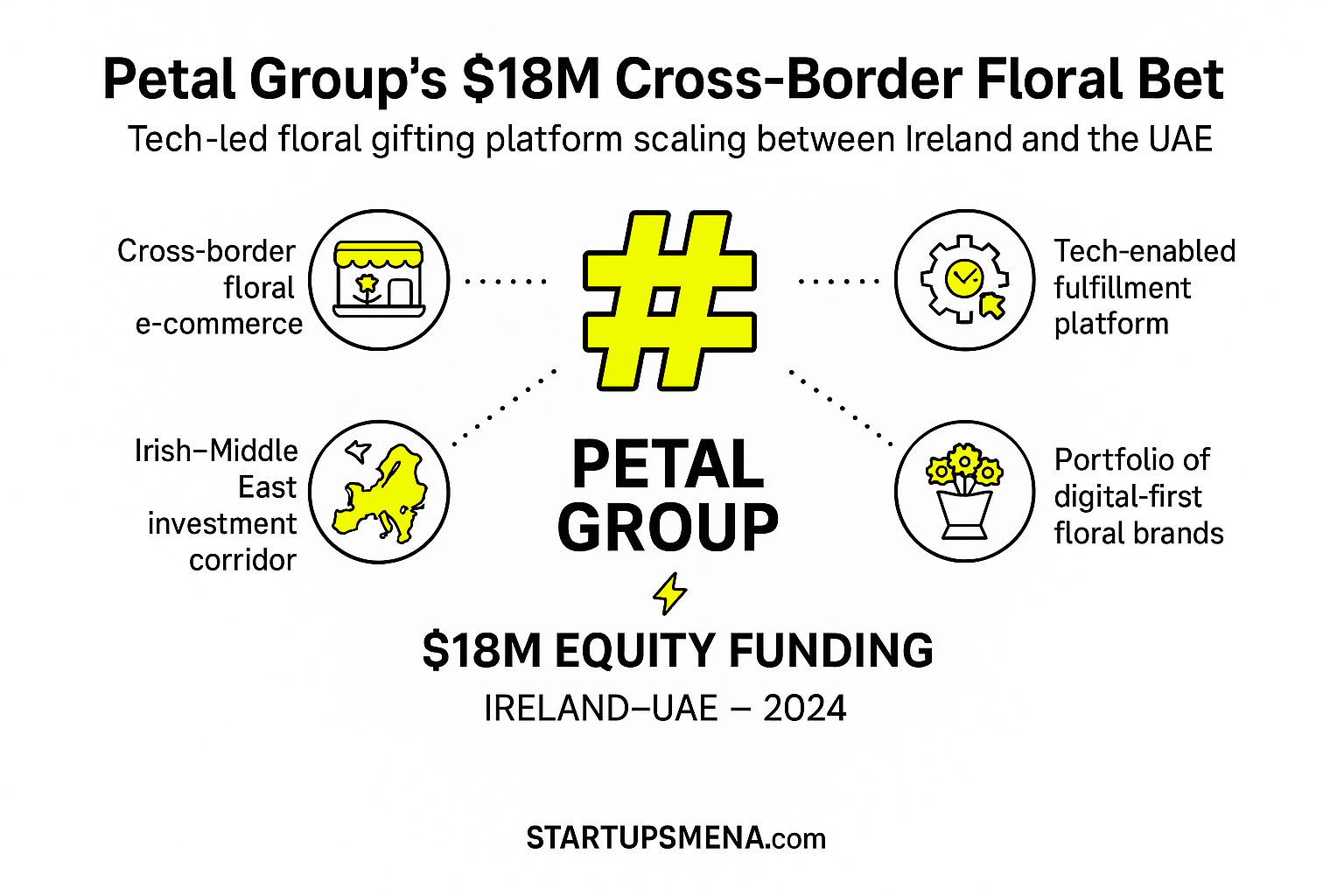

A landmark bet on cross-border floral e-commerce

When entrepreneur and technologist Garreth Knowd started building online flower brands out of Ireland, the vision was never just about bouquets—it was about turning a fragmented, offline-heavy category into a tech-enabled, cross-border gifting platform.

That play has now been validated at scale. UAE-based Quintas Capital has invested $18 million in Petal Group, marking the first-ever deal under its new Managed Equity private equity strategy.

The funding will fuel expansion across the UAE and Ireland, backing Petal Group’s push into new markets and acquisitions along a growing Irish–Middle East investment corridor.

Inside Petal Group: a portfolio of digital-first flower brands

Petal Group isn’t a single website—it’s a portfolio of online florists that together ship thousands of floral gifts every week across Ireland and the UAE.

Its brands include:

- Flowers.ie – a leading online flower delivery platform in Ireland

- FlowersDirect.ie – serving customers across Ireland with curated floral options

- BloomMagic.ie – focused on premium, design-forward arrangements and gifting experiences

- Flowers.ae – targeting the UAE market with high-end floral gifting

What connects these brands is not just flowers, but technology and operations. Petal Group has built a proprietary tech platform that powers fulfilment and customer experience—optimising delivery routes, managing inventory and supporting same-day and next-day delivery for time-sensitive occasions.

That infrastructure is what turns a traditionally local, artisanal business into a scalable e-commerce engine.

Quintas Capital’s first Managed Equity deal

For Quintas Capital, Petal Group is more than another portfolio company—it’s a statement of strategy.

The $18 million investment is the first transaction completed under its Managed Equity division, a deal-by-deal private equity model that allows Quintas to co-invest alongside entrepreneurs, management teams and private investors in high-growth opportunities.

Head of Managed Equity and shareholder Kevin MacSweeny has described Petal Group as a high-growth, scalable, technology-led business with international reach, framing the transaction as a landmark first investment for the strategy. The deal is intended to support Petal Group’s next phase of expansion through acquisitions and new market entries.

The move follows a 2024 reshaping of Quintas’ ownership, when private equity professionals Kevin MacSweeny and UAE-based Fawad Tariq Khan acquired a significant stake in the firm to scale its private market investment activities.

Building the Irish–Middle East investment corridor

This deal is also about geography.

Quintas Capital and Petal Group are leaning into a clear thesis: the Irish–Middle East corridor as a two-way channel for capital, know-how and consumer brands.

Calling the UAE a high-growth economy, Fawad Tariq Khan, Director and shareholder at Quintas, has underscored the significance of making the firm’s first equity investment in the region through Petal Group, and highlighted an active search for further acquisitions and market expansion that fit this cross-border thesis.

With operational roots in both Ireland and the UAE, Petal Group is well positioned to:

- Localise premium floral gifting for distinct cultural and seasonal patterns in each market

- Use its tech platform to replicate operations in additional GCC or European markets

- Act as a proof-of-concept for other vertical e-commerce brands eyeing similar cross-border expansion

In that sense, the deal is not just about flowers—it’s about testing how niche, operations-heavy consumer businessescan scale along newly defined investment corridors.

Founder alignment and value-add capital

Despite bringing in a sizeable institutional investor, Petal Group isn’t a handover story.

Founder Garreth Knowd remains a shareholder and has stressed that the focus of the round was on assembling the right mix of “value-add” investors—including individuals who will work closely with the company at board level, supporting strategy, governance and expansion.

On the other side of the table, Quintas brings more than equity. Its broader platform includes:

- Managed Equity – the private equity arm behind the Petal deal

- An EIIS fund (Employment Investment Incentive Scheme) targeting Irish growth companies

- A Private Credit platform, led by CEO Kevin Canning, offering structured debt solutions

The firm’s overarching mission is to democratise access to private markets, offering professionally managed private investment opportunities that have traditionally been reserved for institutional investors, family offices and high-net-worth individuals.

For Petal Group, that mix of growth capital plus structured expertise could prove crucial as it navigates acquisitions, technology investment and market entry—all while preserving quality and customer experience in a category where trust is everything.

Why this matters for founders and operators

Beyond the headline number, the Petal–Quintas deal underlines a few broader signals for founders in MENA and Europe:

- Vertical e-commerce is still investable

Even in an era dominated by super apps and horizontal marketplaces, specialist vertical players can attract serious capital when they combine brand, operational excellence and technology. - Cross-border stories are getting premium attention

Investors increasingly favour companies that can operate across regions—especially along strategic corridors like Ireland–UAE—rather than being locked into a single domestic market. - Private capital structures are evolving

Models like deal-by-deal Managed Equity, EIIS funds and private credit point to a more flexible, modular private markets landscape, opening up new ways to finance growth-stage companies.

For startups operating in logistics-heavy, time-sensitive verticals—whether flowers, gifting, groceries or specialised retail—Petal Group’s next chapter will be closely watched as a potential playbook.

What’s next for Petal Group?

With $18 million in fresh capital and a long-term partner on board, Petal Group’s roadmap is likely to focus on three big priorities:

- Deepening its presence in core markets

Strengthening operations, technology and brand equity in Ireland and the UAE, where it already has a strong foothold. - Selective acquisitions

Rolling up complementary online flower or gifting businesses to build scale, increase supply-chain leverage and expand product variety. - New market entries

Testing additional GCC and European markets where its model of premium design plus reliable, fast delivery can be replicated.

If executed well, this deal could become a reference case for how category-focused, tech-enabled consumer brandsfrom relatively small home markets can scale into cross-border platforms—with both regional and global investors paying close attention.

Editor’s Note — From the Gulf Innovation Desk

At Startups MENA, we track not only how capital flows into the region, but where it chooses to build bridges. The Petal Group–Quintas Capital deal is a clear signal that the Irish–Middle East corridor is maturing from a loosely defined relationship into a deliberate investment thesis.

By backing a tech-enabled, operations-heavy consumer business that already spans Ireland and the UAE, this investment shows that cross-border scale doesn’t have to come from fintech or heavy infrastructure alone. Sometimes, it comes from reimagining everyday categories—like flowers—through software, logistics and brand.

As the UAE and the wider Gulf continue positioning themselves as gateways between Europe, Africa and Asia, stories like Petal Group’s highlight a deeper shift: from exporting capital to co-building companies that live natively in more than one market. That shift matters for founders across the region who are designing their businesses for multi-market expansion from day one, not as an afterthought.

For us, this is more than a funding headline; it’s another data point in a broader transformation—where the Middle East is not just a destination for global brands, but a co-author of cross-border, tech-led growth stories.

— The Startups MENA Editorial Team