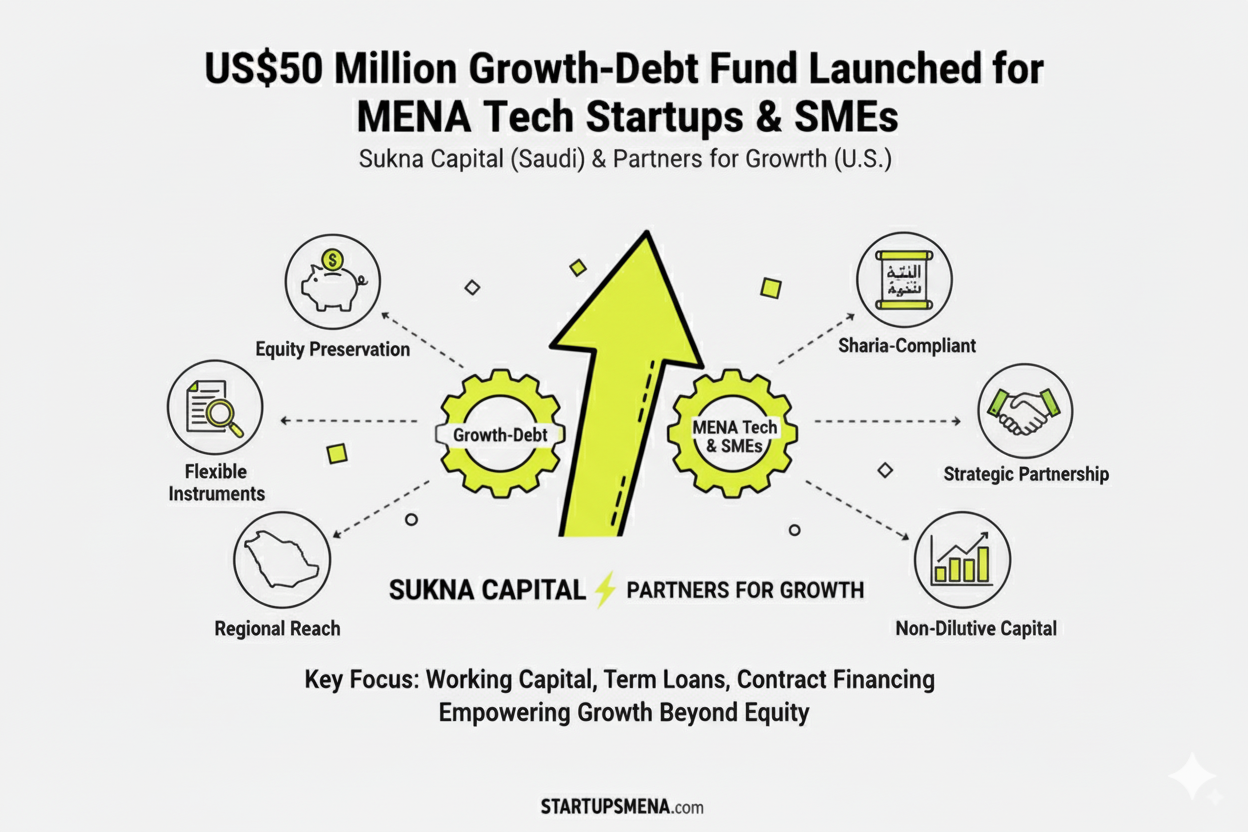

A new funding vehicle has been launched by Sukna Capital (Saudi Arabia) in partnership with U.S. growth‐debt specialist Partners for Growth (PFG). The mechanism: deploy up to US$50 million to support high-potential technology companies and small‐medium enterprises (SMEs) across the MENA region.

Key features include:

- Providing working-capital lines, contract financing, term loans, and other tailored debt structures—not equity.

- Aiming for “institutional‐quality credit” to allow founders to scale without giving up control.

- The fund is structured via a Saudi regulated, Sharia-compliant lending vehicle managed by Sukna.

A Strategic Shift in the MENA Funding Landscape

This move is significant for several reasons:

- Until now, much of MENA’s tech financing has been concentrated in venture equity rounds. The introduction of growth debt marks a diversification of financing instruments.

- For example, in the first half of 2025, VC funding in Saudi Arabia alone reached approximately US$860 million, more than doubling year-on-year.

- Founders scaling past seed/Series A often face a “valley of death” if they don’t want to dilute ownership—growth debt helps fill that gap.

- The regional ecosystem is signalling maturity: local players embracing debt‐based capital, alongside global partners bringing experience and product structures.

Why This Fund Matters for Founders & SMEs

For tech entrepreneurs and SME operators in the region, this fund opens new opportunities:

- Equity preservation: Access to capital without giving up equity means founders can retain strategic control and upside.

- Flexible instruments: Tailored term loans or working capital lines fit different growth trajectories—from early scaling to contract fulfilment.

- Regional reach: The fund is aimed at across MENA (not just Gulf-States), offering breadth for growth-oriented firms.

- Sharia-compliance: The lending vehicle is designed to comply with Sharia standards, which matters in many regional jurisdictions.

Implications for the Ecosystem: Risks and Opportunities

Opportunities

- Acceleration of proven business models: Debt funding allows companies with scale potential to accelerate sooner, rather than waiting for the next equity round.

- Maturation of capital markets: Growth debt signals that the ecosystem is becoming more nuanced—venture capital, debt, hybrid instruments all co-existing.

- Increased investor confidence: With larger institutional players deploying credit, it may drive more rigorous underwriting, stronger governance, improved outcomes.

Risks & Considerations

- Debt service burden: Growth debt requires repayment—companies must have predictable cash flow or contract structure to service the debt.

- Risk of default: In nascent markets, the risk of SME or startup failure remains high—credit investors must be disciplined.

- Market concentration: If the fund focuses too heavily on one geography or sector, it could lead to over-exposure.

What This Suggests for the Coming 12–24 Months

- We can expect more debt-based vehicles entering the MENA market, driven by global investors seeing risk‐adjusted returns.

- Startups that have moved past seed rounds and are near revenue scaling will increasingly opt for debt rather than equity to maintain control.

- Regional governments and regulatory bodies may more actively support such instruments (e.g., through guarantees or enabling frameworks) to deepen the capital pool.

- Strategic sectors—fintech, deep tech, healthtech, enterprise SaaS—will likely be early beneficiaries of this fund and similar products.

- Founders should prepare: demonstrate predictable revenue streams, contract backlogs, clear unit economics and a plan for servicing debt.

Key Facts Table

| Item | Detail |

|---|---|

| Fund Size | Up to US$50 million deployment planned. |

| Investors | Sukna Capital (Saudi) + Partners for Growth (U.S.) |

| Target | High-potential tech companies + SMEs across MENA, particularly in innovation/technology sectors. |

| Instrument Type | Working capital lines, contract financing, term loans, tailored financing (not equity). |

| Regional Context | Saudi’s VC funding in H1 2025 roughly US$860 million; 56 % of all MENA VC deals in that period went through Saudi. |

Editor’s Note

At Startups MENA, we are committed to showcasing strategic capital flows and structural shifts shaping the region’s innovation ecosystem. The launch of this new growth-debt facility is not just another fund—it signals a maturation of financing options that allows technology companies in the Middle East and North Africa to scale without diluting equity. In partnering with a Saudi openended lender and a U.S. venture‐debt specialist, the initiative underscores a defining theme: the next era of MENA tech will be built on tailored credit as much as venture equity.

— The Startups MENA Editorial Team